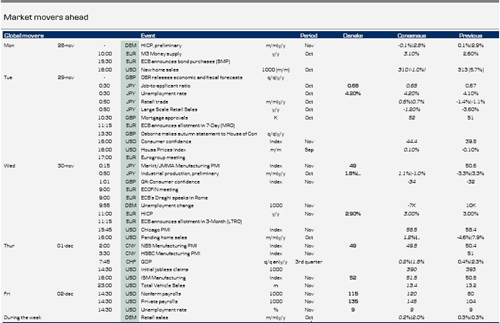

- Big week coming up in the US with both ISM and non-farm payrolls. ISM manufacturing is expected to rise slightly to 52 in November (consensus 51.5) from 50.8 in October. ISM has been lagging hard data on industrial production this year and we expect it to catch up with the improvement we have already seen in the hard data. GDP growth expected at 2.5-3% in Q4 also points to a higher ISM reading.

- Non-farm payrolls is expected to continue to show decent increases as employment indicators have pointed to improvement recently (ISM manufacturing and service, jobless claims). We look for a rise in total payrolls of 115k (consensus 120k) and in private payrolls of 135k (consensus 145k). The unemployment rate is likely to stay unchanged at 9.0% after falling in October to 9.0% from 9.1%.

- Other indicators of interest next week will be new home sales, house prices, Chicago PMI and vehicle sales.

- Next week‟s main political event in the euro area is the Eurogroup meeting on Tuesday. The euro area‟s ministers of finance have promised to finalise the work on the two options to increase the firepower of the EFSF (i.e. the first loss insurance model and the SPV-model). Possible treaty changes are likely to be touched upon as well as the presented Green book on the different options for creating euro bonds. Despite the fact that euro bonds might help to restore confidence, it does not seem to be a feasible solution in the short term. At the ECOFIN meeting on Wednesday the recapitalisation of banks will be on the agenda. We should not expect any solution from the euro area leaders in the coming week, as confidence in the sovereign bond markets has been damaged severely. It seems increasingly likely that the ECB eventually will be forced to step up its purchases.

- On the release front we have a dense calendar. Euro area CPI is expected to start to decrease and we expect a reading of 2.9%. Despite headline inflation remaining high the ECB has softened its tone considerably and we expect at least a 25bp rate cut in December possibly combined with extending the fixed rate full allotment to 24 months. The ECB will also release M3 data. We expect an unchanged reading of euro area unemployment but the increasing pattern will continue over the coming months. In Germany data for unemployment, CPI and retail sales are worth keeping an eye on.

- Focus in the UK next week will be on Chancellor George Osborne‟s Autumn Statement to the House of Commons and the Office for Budget Responsibility‟s updated economic and fiscal forecasts. It is clear that the Government‟s deficit-reduction plan is not on track but the Chancellor said earlier this week that “Plan B is to do Plan A a little longer”. We think the Chancellor will announce some new measures aimed at small and medium-sized businesses. The problem is that he has not got any money so he has to be extremely creative! The OBR will have to bite the bullet and make substantial revisions to its optimistic forecasts from March like the BoE did in the Inflation Report last week. We pointed out in early September that the OBR would cut growth forecasts substantially, see “How long can the UK maintain its AAA rating?”. The market reaction is likely to be muted as a downbeat statement and forecasts adjusted lower are expected in the markets. Data for consumer spending like the CNI reported sales, GfK consumer confidence and mortgage approvals could also attract attention.

- In Switzerland, Q3 GDP data are likely to show a deceleration of growth, but no decline in production. KOF's leading indicator will also be published, along with November's PMI, and the coming week will thus provide some answers to how steep the growth slowdown has been into Q4 - a quarter where most of Europe most likely entered recession.

- In Japan most activity indicators for October will be released next week. We expect the overall message to be that growth in Q4 is poised to slow markedly after the strong recovery in Q3 in the wake of the earthquake. Production plans suggest that industrial production will expand a solid 1.8% m/m in October. However, this largely reflects a reversal of a very weak September reading. The drop in exports in October suggests that industrial production will only show a modest gain in the coming months. For that reason we expect the Markit/JMMA manufacturing PMI to decline to 49.0 in November from 50.6 in October. We could see a substantial impact from the flooding in Thailand, because many major Japanese companies have substantial operations in Thailand. Resilient import and auto sales in October suggest that retail sales improved again in October after a couple of weak months. Finally, the unemployment rate probably edged slightly higher to 4.2% from 4.1%, largely reflecting an unusually large decline in the unemployment rate in the previous months. Overall the labour market remains resilient supported by reconstruction in the wake of the earthquake and the job-to-applicant ratio, a better measure of the strength of the labour market in Japan, probably continued to improve in October.

- In China we have a relatively light calendar next week. Main focus will the release of the NBS manufacturing PMI for November and the final estimate for the HSBC manufacturing PMI. Together with other manufacturing PMIs released across Asia it will gives us an idea whether the unexpected large decline in the flash HSBC manufacturing PMI for November was just a “blip” or is a sign of renewed weakness in the Chinese economy. The weak HSBC manufacturing PMI suggests that NBS manufacturing PMI will decline to 49.0 from 50.4 in October.