The FOMC’s decision to wind down its QE program by the end of the year is lifting the greenback not only because it’s signalling to investors an end to the Fed’s currency depreciation strategies, but also due to the fear/uncertainty such a decision creates, particularly in emerging markets. At this point, the Fed doesn’t seem all too bothered by the recent stress in emerging markets, but that could change, considering the importance of those economies which account for over 50% of global GDP according to the IMF. Regardless, expect the Fed’s actions to continue to foster an environment of heightened financial market volatility.

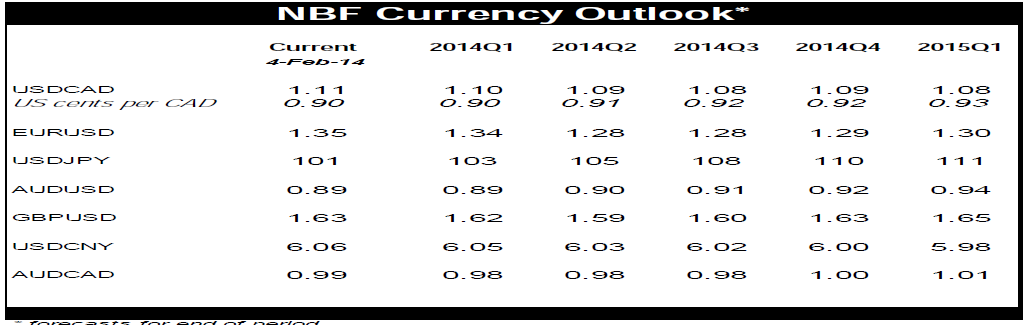

Considering the European Central Bank’s surprising lack of urgency in tackling deflation at its January meeting, we’ve pushed by one quarter (to end-Q2) the timeline for when we see the euro dropping to 1.28 versus the US dollar. But the longer it waits, the more aggressive the ECB will have to get later on to tackle the threat of deflation. We continue to believe that monetary policy is about to get even looser this year in the zone, something that’s likely to weigh on the common currency.

The Canadian dollar was the worst performing major currency in January, losing over 4% in the month and depreciating past our 1.10 end-of-Q1 target versus the US dollar. But we’re in no rush to make room for further depreciation. In our view, market expectations for Bank of Canada rate cuts this year are exaggerated. Moreover, if as we expect foreign investors eventually reacquaint themselves with Canada’s AAA rated securities and superior fiscal standing, portfolio inflows will bounce back, something which together with the unwinding of massive speculative short CAD positions, could be enough to keep the loonie near current levels even as the Fed tapers its QE program.

To Read the Entire Report Please Click on the pdf File Below