Market movers today

- The ongoing ‘Fed Listens’ conference remains the centre of attention, with any interviews/speeches scrutinised for policy hints following the recent days’ remarks, see below.

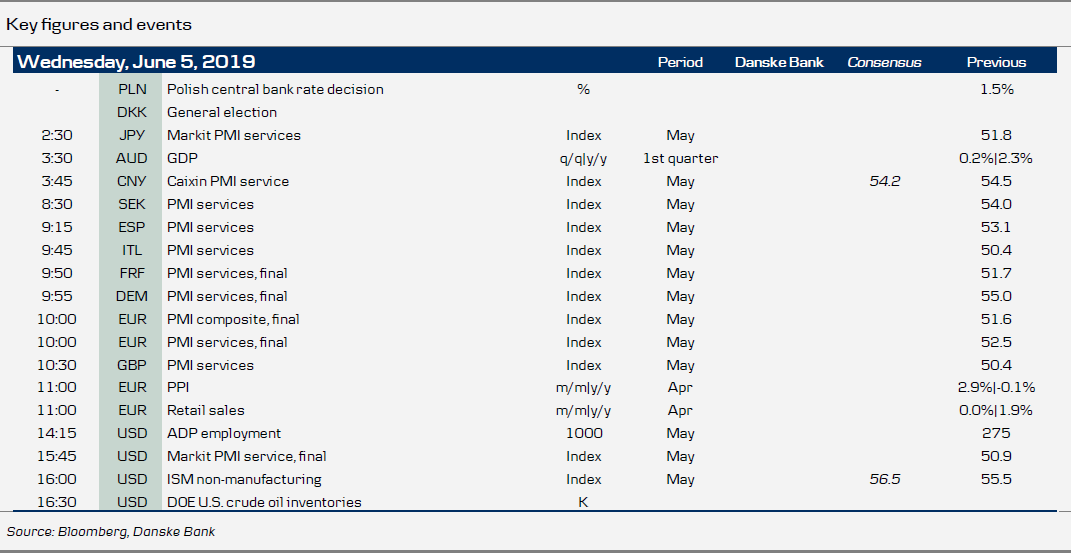

- Otherwise, the market is primarily awaiting the ECB meeting tomorrow and the US labour market report on Friday. Today’s ADP (NASDAQ:ADP) report could give an indication of what to expect on the latter even if the predictive power has been mediocre recently. We also get US ISM non-manufacturing, which will receive more attention than usual given the disappointing US flash Markit Service PMI two weeks ago; we get the final Markit print 15 minutes prior to the ISM today. A series of Markit Service PMIs will also be released across Europe.

- The weekly US crude inventory report could prove interesting in the current weak macro environment and in light of the recent oil sell-off. The story since mid-April has been a rise in US crude stocks, which has raised concerns about weakening US demand.

- In the Scandies, focus turns to the general election in Denmark and Real Estate Norway house prices in Norway. Neither of these should trigger any significant market reaction.

Selected market news

This morning, most Asian equity indices are trading in green following yesterday’s equity rally driven by Fed Chair Powell (see below) and encouraging remarks on both Mexican and Chinese trade negotiations. US market inflation expectations have rebounded from their lowest levels since January while US 10Y treasury yields have moved above 2.10% again. USD FX moved modestly lower overnight while both oil and gold are little changed.

At the ‘Fed Listens’ conference, Fed Chair Powell showed a willingness to cut interest rates. He initiated his opening speech with an odd one out paragraph on the current policy situation, on which he stated the Fed “will act as appropriate to sustain the expansion” amid “trade negotiations and other matters”. In our view, this supports our call for a rate cut signal at the June FOMC meeting and a subsequent rate cut at the July or September meeting, see here.

The big question now is whether the ECB will also make a new dovish turn tomorrow. In that respect, remember the ECB is already on an ‘easing bias’ but inflation markets are clearly doubting the ECB’s ability to react. This was illustrated yesterday following Euro area inflation that came in on the low side with 5y5y Euro area inflation expectations dropping close to a historical low, see chart. For more, see our ECB cheat sheet here and our ECB preview here.

FX reserves data in Denmark published yesterday showed that Danmarks Nationalbank (DN) opted to see through the rise in EUR/DKK to the highest level this year. In our view, it signals patience from DN with respect to the weak DKK.

Scandi markets

- In Denmark, polls indicate there will be a change of government after the general election today, but regardless of the result, we do not expect any market reaction. There is broad agreement on the overall framework for economic policy, and neither Denmark’s EU membership nor staying out of the euro are at stake. Exit polls will be out shortly after 20.00 CEST, and a reliable result is expected around 23.00 CEST. Note also that the Danish market is closed today (Constitution Day).

- In Norway, May Real Estate Norway house prices are set to be published. After rising since November, housing prices levelled off in April. The market seems well balanced and as interest rates have risen, prices are unlikely to move much more strongly than wages. We expect roughly stable prices in May, although the OBOS figures published last week imply some upside risk.

Fixed income markets

Today, for the first time we have Finland tapping the RFGB 06/29 10Y benchmark bond for EUR1bn. Given the current ‘hunt for yield’ in the EGB market, we expect a strong auction. Finland will have fulfilled EUR5bn of its EUR9bn issuance target after the auction.The new Finnish government yesterday announced a EUR4bn stimulus plan. Despite the government saying the plan would be funded by tax hikes and the sale of state assets, the new plan has likely postponed Finland’s potential return to the triple A camp of the rating agencies.

ESFS will also be in the market tapping up to EUR1.0bn in the 01/23 bond.

Norges Bank will also be in the market tapping the NGB ’21 bond. NGB spreads vs Germany have tightened and NGB asw spreads have widened this week. We still hold the view that Norges Bank will hike rates on 20 June despite the drop in global yields. We also hold a positive view on the NOK. For more see Fixed Income Research - Norges Bank to sell NOK2bn in NGB NST474, 3.75%, ’21, 4 June.

FX markets

Two days of hints from Fed officials that policy easing might be warranted has started to weigh on the broad USD. In our view, the Fed has started to blink and the market will discuss using the signal to reverse long USD positions, as the Fed could choose to cut rates in H2 (including repricing EUR/USD higher).

Near term, a bit more might be warranted from the Fed for risk sentiment to turn more sustainably. We still have some lingering doubts as to the credibility of rates actually being cut enough to move the global macro in a positive direction. In markets, this is seen in inflation expectations and a still more muted reaction from credit and commodities (particularly versus equities). We expect USD/JPY to continue lower until a more pronounced movement in inflation expectations and its corresponding drivers is seen.

For the Scandies, both the SEK and NOK continue to trade on the external environment, with little reaction on domestic data releases. In light of the recent Fed policy signals, we have decided to take profit on both our long USD/SEK and USD/NOK positions, see here.