Investors expected a rate hike by the US Fed after the announcement of an emergency meeting. As soon as the news broke last Thursday, the US dollar started to strengthen. So, the event is partially responsible for a rise in the greenback. Given that the regulator changed interest rates at previous closed meetings, there seemed to be no doubt that a rate hike would be announced this time.

However, the outcome of yesterday’s meeting turned out to be somewhat unexpected. The US central bank made the meeting closed and just issued a press release without giving any comments or statements. Nevertheless, the press release contains answers to many questions. The regulator mentioned a decrease in the percentage of non-pass loans and hinted that an increase in the interest rate would be inevitable.

Perhaps this way, the Fed is preparing markets for a 0.50% rate hike. If so, the interest rate will be immediately raised to 0.75% versus 0.25%. In any case, the meeting outcome came as a surprise, so the market ended up being flat.

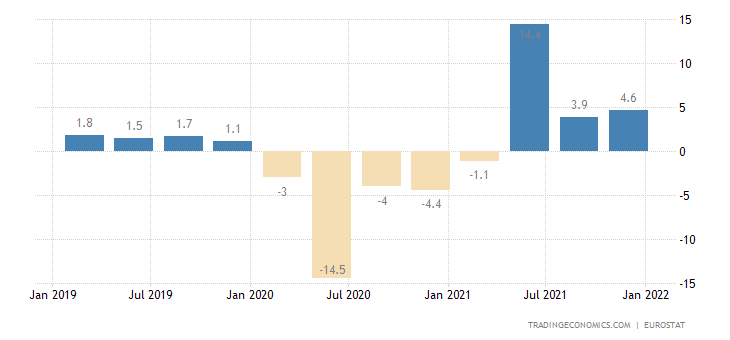

Today, the market is likely to trade sideways, judging from the scheduled releases. In the eurozone, the second estimate of Q4 GDP came in line with the first one, showing a rise in economic growth to 4.6% from 3.6%. The market showed no reaction to the data.

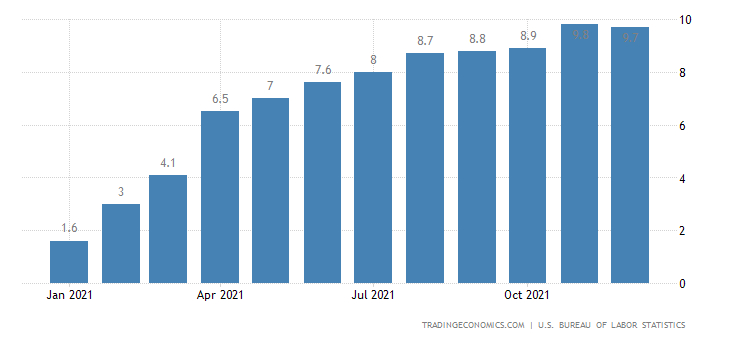

The United States will present its PPI report. The figure is forecast to accelerate to 10.0% versus 9.7%. Anyway, the results will unlikely somehow affect the market because a rate hike seems to have already been settled. Therefore, the PPI data will not have any influence on the market.

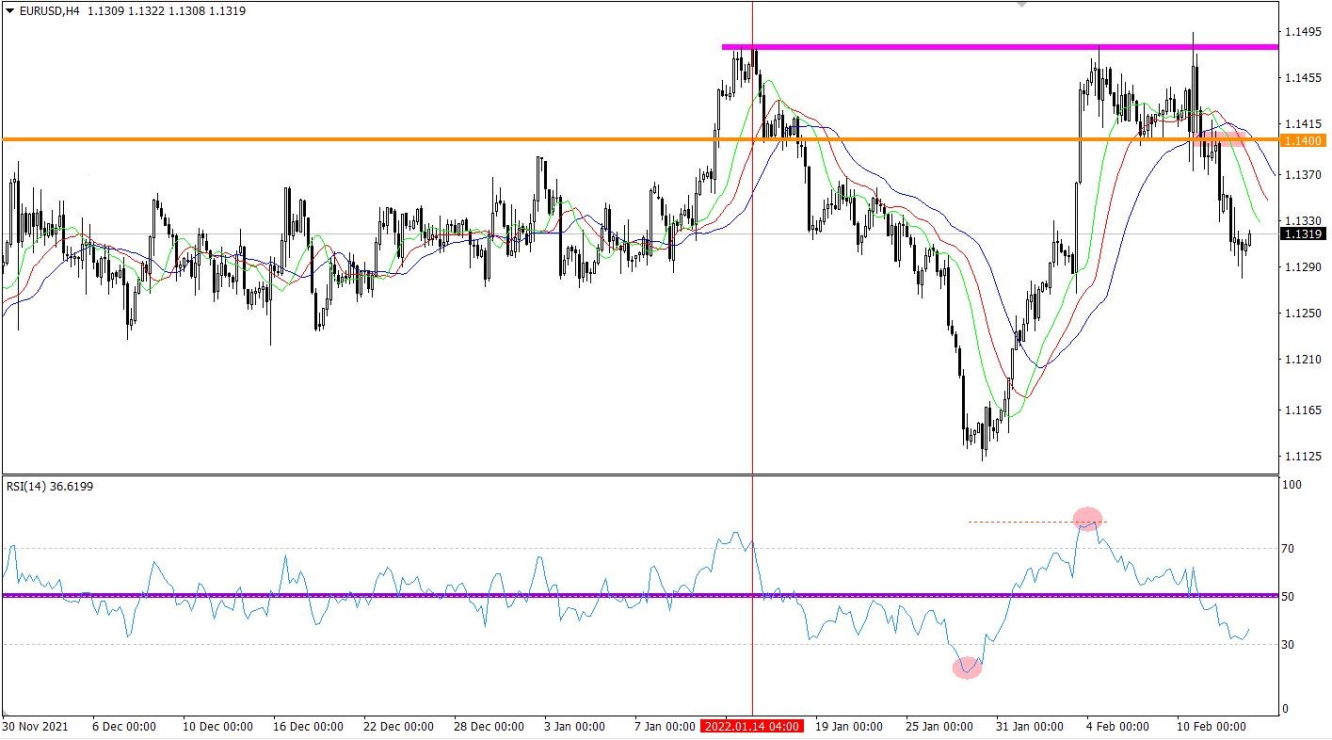

The EUR/USD pair lost 200 pips in the past three days. As a result, the greenback recovered more than 50% after the recent corrective move. The RSI indicator moves within the overbought zone on the 4-hour chart, indicating bearish sentiment. There is no crossover at line 30.

The Alligator indicator is signaling the emerging downward reversal on the 4-hour chart. On the daily chart, the moving averages of the indicator are intertwined, producing the first signal of the end of the upward cycle.

Outlook

The market is flat due to the quote’s almost oversold status. This may lead to a rebound and a shift in market sentiment. The subsequent increase in the volume of short positions may occur in case of consolidation below 1.1260 in the 4-hour time frame.

As for complex indicator analysis, there is a signal to buy the pair in the short term due to a minor pullback and a signal to sell the instrument intraday and in the medium term amid the recovery after the recent corrective move.