Summary:

- FedEx Corporation (NYSE:FDX) sank by 10% on Wednesday, after the company posted earnings that missed Wall Street expectations.

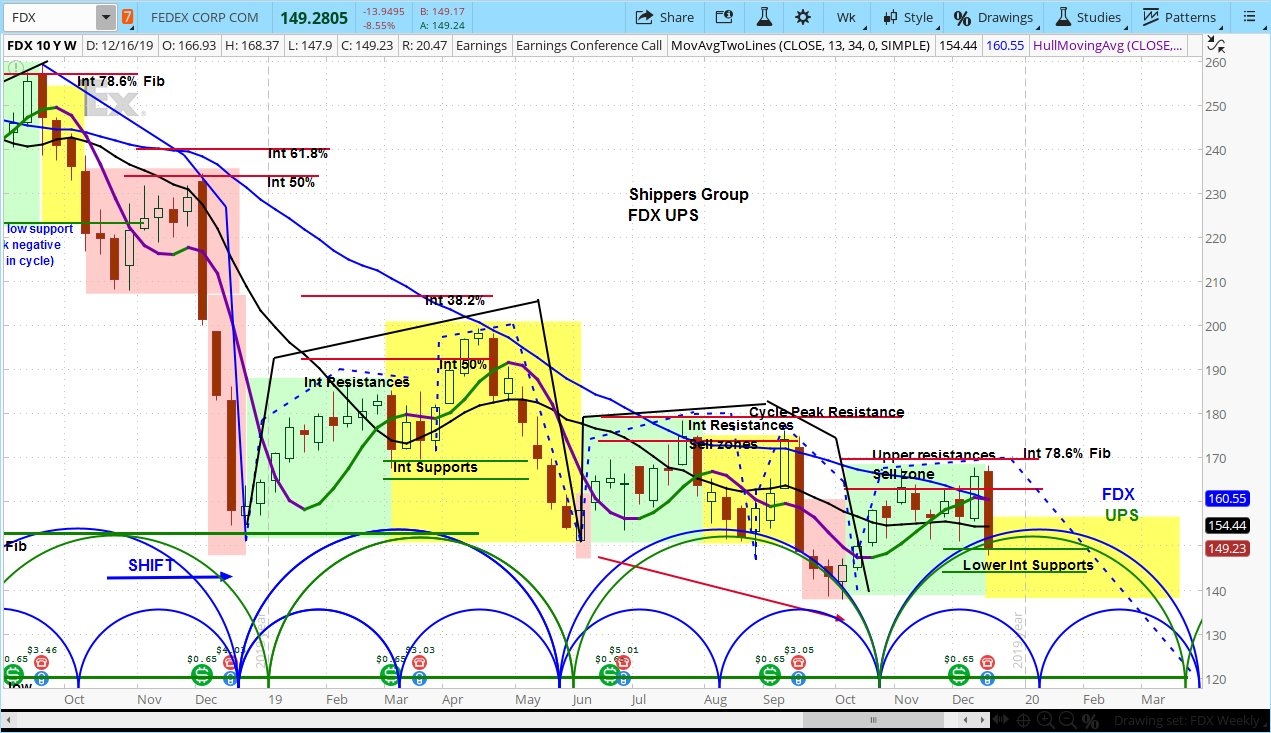

- Based on its market cycles, we believe the stock is headed lower in the coming months.

FedEx reported earnings per share of $2.51 and total revenue of $17.3 billion, compared to analyst estimates of $2.82 and $17.6 billion. Looking forward, management lowered its estimate for earnings to between $10.25 and $11.50 per share, compared to expectations of $12.03.

CFO Alan Graf explained that, “Our revised guidance reflects lower-than-expected revenue at each of our transportation segments and higher-than-expected expenses driven by continued mix shift to residential delivery services.”

Our approach to stock analysis uses market cycles to project price action. Our analysis is that FDX has begun the corrective phase for its minor cycle. We believe that by March, the stock may drop to as low as $120.

For the “Best and Worst Stocks of the Week” check out the askSlim Market Week show every Friday on our YouTube channel.