FedEx Reports Earnings After The Close On Tuesday, June 19

It's near the end of earnings season, but delivery giant FedEx Corporation (NYSE:FDX) is slated to unveil its fiscal fourth-quarter results after tomorrow's close. Ahead of the event, FDX stock is seeing a rare pop in options volume, with calls and puts crossing at around two times what's typically seen at this point in the day.

Specifically, 4,392 calls and 3,462 puts have changed hands on FDX so far. Most active is the July 270 call, where the majority of the contracts have crossed at the ask price. With implied volatility higher, this would suggest new positions are being purchased here, but considering a number of July 270 calls have been sold to open in recent months -- per data from the major options exchanges and Trade-Alert -- speculators may be buying to close the positions ahead of earnings.

More broadly, FedEx's options pits have been relatively quiet. Just 49,118 calls and 45,465 puts are currently open on the stock, with total open interest ranking in the 4th percentile of its annual range. That July 270 call is home to peak open interest, followed by the July 260 and 250 calls. Data points to buy-to-open activity at the 260 strike and sell-to-open action at the 250 strike, meaning it's possible some traders were initiating a long call spread ahead of earnings.

Whatever the reason, FDX call options are currently pricing in much higher volatility expectations than their put counterparts. This is based on the stock's 30-day implied volatility skew of 6.4%, which ranks in the 10th annual percentile.

Historically speaking, FedEx stock tends to perform well after earnings, with the shares closing higher in the session subsequent to the company's results in five of the last eight quarters. On average, the stock has swung 3.2% the day after earnings looking back two years, regardless of direction. This time around, the options market is pricing in a larger 5.6% swing.

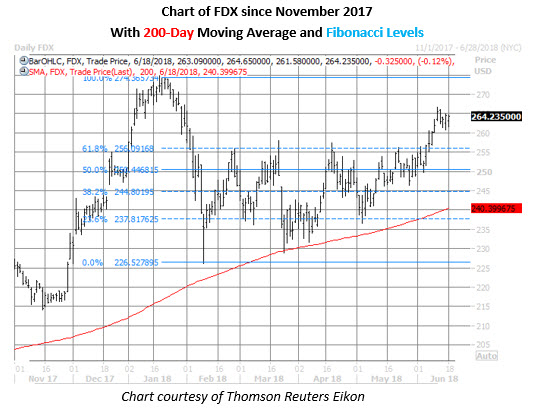

Looking at the charts, FedEx shares have been climbing higher since taking a familiar bounce off its 200-day moving average in late March -- up more than 15% at $264.24. This trendline was perched near $230 at the time, a region that caught the stock's pullback from its Jan. 18 record high of $274.66, and coincides with FDX's late-November bull gap. Plus, the equity is now trading above a short-term ceiling around $256, which is a 61.8% Fibonacci retracement of that early 2018 sell-off.