Shipping name FedEx Corporation (NYSE:FDX) is up 1.6% at $180.91 in afternoon trading, despite earlier receiving a pre-earnings price-target cut to $230 from $235 at Raymond James. The company's fiscal third-quarter earnings report is due out after the market closes this Tuesday, March 19 -- and ahead of the event, the options market is pricing in an ambitious post-earnings move for FDX stock.

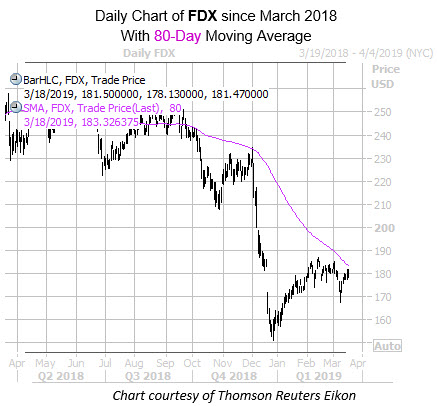

FedEx shares have been on a long-term downtrend, and staged a bear gap last month following a surprise executive departure. The shares have struggled to find purchase above the $180 mark, and they're now staring up at their descending 80-day moving average -- which has been stiff resistance since late September.

Moving onto FDX's earnings history, the stock has traded lower the day after its quarterly report in each of the past four quarters. Over the past two years, the shares have swung an average of 3.9% the day after earnings, regardless of direction. This time around, the options market is pricing in an 8.5% move for Wednesday's trading -- more than double the normal post-earnings move for FDX.

And options traders seem to be betting on another downside move for FedEx after this week's results. FDX holds a Schaeffer's put/call open interest ratio (SOIR) of 0.90, which ranks in the 75th percentile of its annual range. In other words, near-term options traders have rarely been more put-biased in the past year. In fact, total put open interest on FDX stands at 85,772 contracts, per Trade-Alert -- in the 94th annual percentile.

But circling back to analyst sentiment, the majority of brokerage firms covering FDX still sport "buy" or "strong buy" ratings. Plus, the average 12-month price target of $221.40 comes in at a 21% premium to current levels. This split sentiment configuration sets the stage for another potentially dramatic earnings reaction out of the stock.