Summary:

- FedEx Corporation (NYSE:FDX) sank by 3% on Wednesday, after the delivery company posted earnings and guidance that missed Wall Street expectations.

- We see more downside risk, as there is ample time left in the declining phase of the current market cycle.

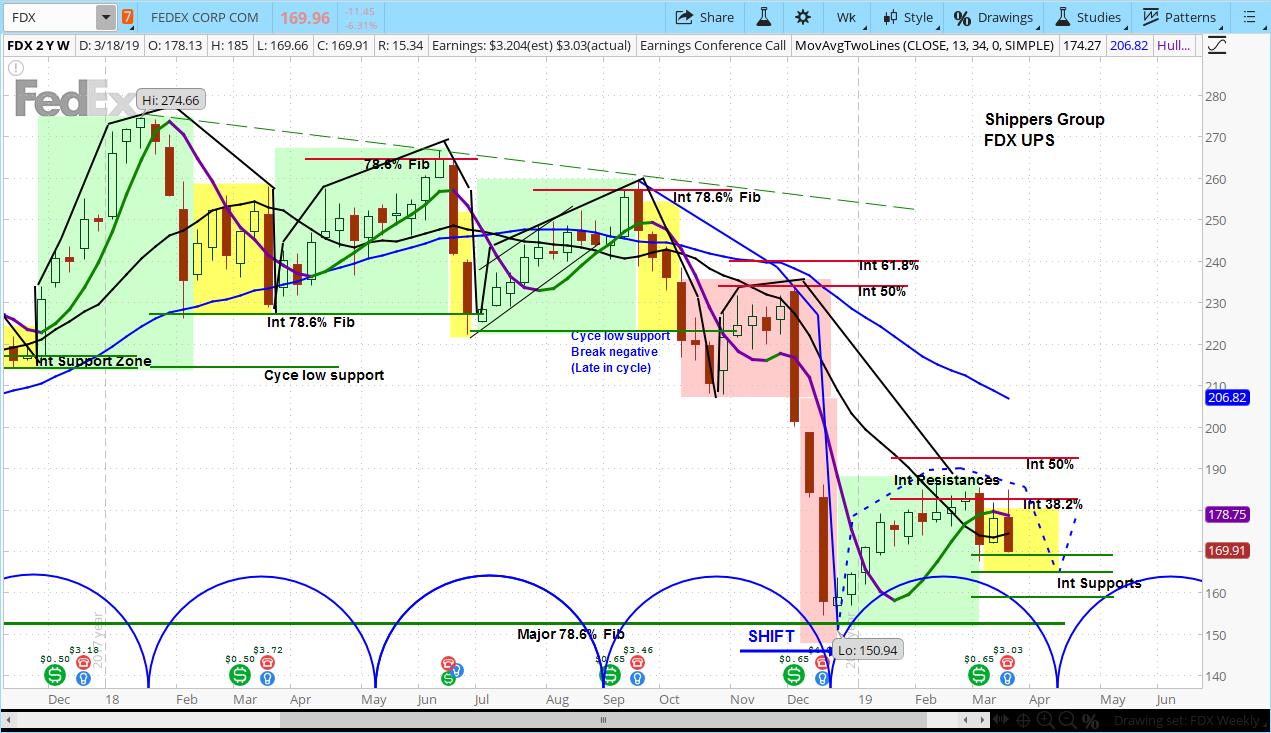

FedEx Corporation (FDX) Stock Weekly Chart

The company reported earnings per share of $3.03 and total revenue of $17.0 billion, compared to analyst estimates of $3.14 and $17.6 billion. For the fiscal year, the company expects earnings in the range of $15.10-15.90 per share, below the average forecast of $15.97.

CEO Fred Smith admitted that “This was a challenging quarter.” He pointed out that the reason they missed was, “mostly due to lower economic growth in international regions.” The company also identified “weaker global trade growth trends” as a contributing factor.

In analyzing the market cycles for FDX, we now appear to be in the declining phase of the current cycle. With a few weeks remaining, we appear to have more room for downside risk. Our near- term targets are between $167-158.