Federated Investors, Inc. (NYSE:FII) delivered a positive earnings surprise of around 6% for second-quarter 2017, marking the ninth straight quarter of earnings beat. Earnings per share of 53 cents beat the Zacks Consensus Estimate of 50 cents and improved 3.9% year over year.

The results were driven by lower expenses and considerable improvement in non-operating income. However, decline in revenues and assets under management (AUM) were the undermining factors.

Net income for the quarter came in at $53.5 million, up 1% year over year.

Revenues and Costs Decline

Total revenue for the second quarter declined 5% year over year to $272.8 million. Further, the figure missed the Zacks Consensus Estimate of $277.4 million.

The decline in revenues can mainly be attributed to decreased revenues from lower average money market assets and a reduction in revenue resulting from a change in a customer relationship. It was partially offset by reduced voluntary fee waivers related to money market funds and increased revenues from higher average equity assets.

In addition, net service fees increased 19% year over year to $47.4 million. However, administrative service fees were down 14% to $45.6 million. Also, net investment advisory fees declined 7% to $179.3 million.

During the reported quarter, Federated derived 40% of its revenues from money market assets and the remaining 60% from equity and fixed-income assets.

Further, supported by a 256% rise in net investment income to $3.9 million, the company recorded a spectacular improvement in non-operating income from the year ago quarter.

Total operating expenses declined 5% year over year to $188.6 million. Less expenses primarily exhibit a decrease in compensation and related expenses, resulting from lower incentive compensation and a decrease in distribution expenses.

Assets and AUM

Federated witnessed equity assets of $65.8 billion, up 6% year over year. Additionally, fixed-income assets grew 4% year over year to $52.5 billion.

As of Jun 30, 2017, total AUM was $360.4 billion, down 2% year over year. Average managed assets were $360 billion, down slightly from the prior-year quarter.

Money market assets decreased 4% year over year to $245.1 billion. Moreover, money market mutual fund assets came in at $173.3 billion, down 20.5% year over year.

As of Jun 30, 2017, cash and other investments were $282.8 million and long-term debt totaled $178.5 million compared with $301.1 million and $165.8 million, respectively, as of Dec 31, 2016.

Our Viewpoint

Federated displays substantial growth potential on the back of its diverse asset and product mix. Furthermore, strategic acquisitions are expected to be favorable for the company. Additionally, with rising interest rates, lower fee waivers will continue to aid the company’s top-line performance.

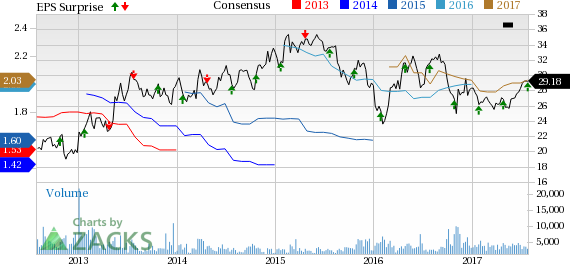

Federated Investors, Inc. Price, Consensus and EPS Surprise

Currently, Federated carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Managers

Eaton Vance Corp. (NYSE:EV) reported second-quarter fiscal 2017 (ended Apr 30) adjusted earnings of 62 cents per share, outpacing the Zacks Consensus Estimate of 60 cents. Also, earnings were 29% higher than the prior-year quarter.

BlackRock, Inc. (NYSE:BLK) reported second-quarter 2017 adjusted earnings of 64 cents per share, surpassing the Zacks Consensus Estimate of 61 cents. Also, the bottom line came in 14.3% higher than the prior-year quarter.

Ameriprise Financial Inc.’s (NYSE:AMP) second-quarter 2017 operating earnings per share of $2.80 comfortably surpassed the Zacks Consensus Estimate of $2.62. Also, the figure represents a year-over-year increase of 26%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Eaton Vance Corporation (EV): Free Stock Analysis Report

Original post