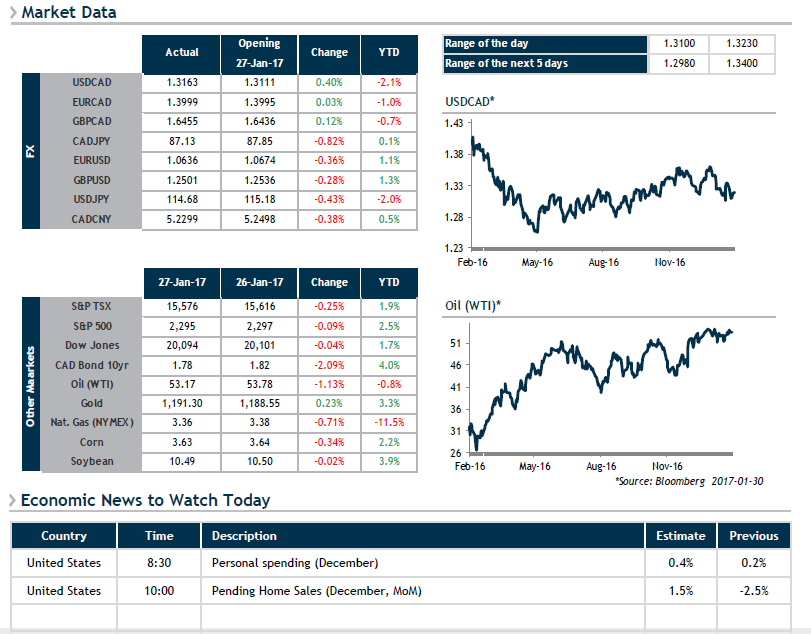

that the new U.S. administration appears to want to reassure Canada regarding the renegotiation of NAFTA and customs tariffs in general. The Canadian dollar reacted well, but we have no further details at present. The strength of our currency remains surprising, however, in a context where monetary policy is diverging between Canada and the United States. It should also be noted that Bank of Canada Governor Stephen Poloz has indicated that the loonie was too strong as it approached the 1.3000 mark.

Meanwhile, crude oil (WTI) is consolidating its gains, trading between $50 and $54 since December. This week, we can expect specific data on the real level of production cuts further to the agreement reached between OPEC members and non-member nations.

In Europe, the European Central Bank informed us this morning that reducing the monetary easing currently underway will not be discussed in March and that a strong U.S. dollar is favourable to Europe; comments that will give a bit of strength back to the greenback this Monday morning.

The main news item this week will be the monetary policy decision by the U.S. Federal Reserve on Wednesday and U.S. jobs figures on Friday.