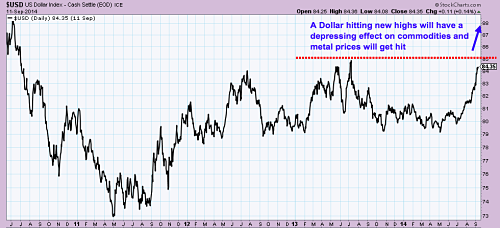

As the signs mount that the Federal Reserve is moving towards a more normal monetary policy, the expectation is that the US dollar will start to appreciate, that may be good news for some commodity producers who have seen the price of their products decline this year, but it could be a problem for emerging market debt if it is priced into the currency.

In an FT article this week Raghuram Rajan, India’s highly respected central bank governor, said he was worried about the levels of emerging market dollar denominated debt, and that leverage has increased markedly on the back of easy money policies by the world’s central banks in the post-financial crisis era.

Nowhere is this phenomenon more pronounced than on his home turf in India. India’s corporate debt, the article states, is roughly $900 billion or 50% of GDP. India’s 10 most-indebted conglomerates are household names such as Adani Enterprises Ltd. (NSE:ADEL), Essar Oil Ltd. (NSE:ESRO)and Vedanta (LONDON:VED), which owe more than $100 billion.

Meanwhile, the proportion of non-performing and restructured debt at Indian banks has spiked as well, reaching roughly a tenth of the loans made last year. Now, before we rush to predict the imminent collapse of the Indian financial system, let us remind you that domestic loans are generally through the state banking sector and the government is unlikely to let any of them fail.

Additionally, the wave of optimism that has resulted from the election of Narendra Modi in May has resulted in a surge on the Mumbai stock exchange and a healthy appetite for public offerings. Heavily indebted Reliance Communications raised $800 million back in July, a move that would have been unthinkable back at the beginning of the year, but which allowed it to keep its creditors at bay in the improved sentiment of the Indian market. Reliance is far from alone. Essar, for instance, Was cited as having net debts of about $14 billion back in 2013, the last year for which it provided figures. Since then, its fortunes in sectors such as power and steel are said to have scarcely improved. Yet its borrowing has almost certainly grown.

This year, it took on a $1.2 billion loan facility from Russia’s VTB, partly to fund the delisting of its beleaguered Essar Energy (LONDON: ESSR) subsidiary in London. This highlights the shift towards dollar-denominated debt and how it will expose the company to sharply increased debt repayments next year if, as expected, the dollar appreciates and interest rates (and hence borrowing costs) rise.

The FT states that equity fundraising can refinance only a tiny portion of corporate India’s outstanding debts. Swapping rupee debt for dollars is storing up a problem that at some stage over the next 18-24 months will come to haunt the economy, just as it seems to be recovering from a prolonged period of decline.