Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The U.S. Federal Reserve (the Fed) stayed very cautious yesterday in its monetary policy statement. Nevertheless, indicators are flashing green in the United States. Private sector job creation in January (ADP) came in well above the consensus (246,000 vs. 168,000). This lack of optimism, which goes against expectations, leaves one to think that the Fed is puzzled regarding the political changes in Washington. They must want to know exactly what’s in store with the remainder of Mr. Trump’s economic program (tax cuts, etc.) before making a move.

Turning to the Canadian dollar (CAD), Bank of Canada Governor Stephen Poloz still appears uncomfortable with its recent rise, noting the following points in a speech at the University of Alberta on Tuesday:

• The strength of the CAD is hindering exports

• Inflation remains weak

• Observers shouldn’t expect Canada to follow U.S. monetary policy (interest rate hikes)

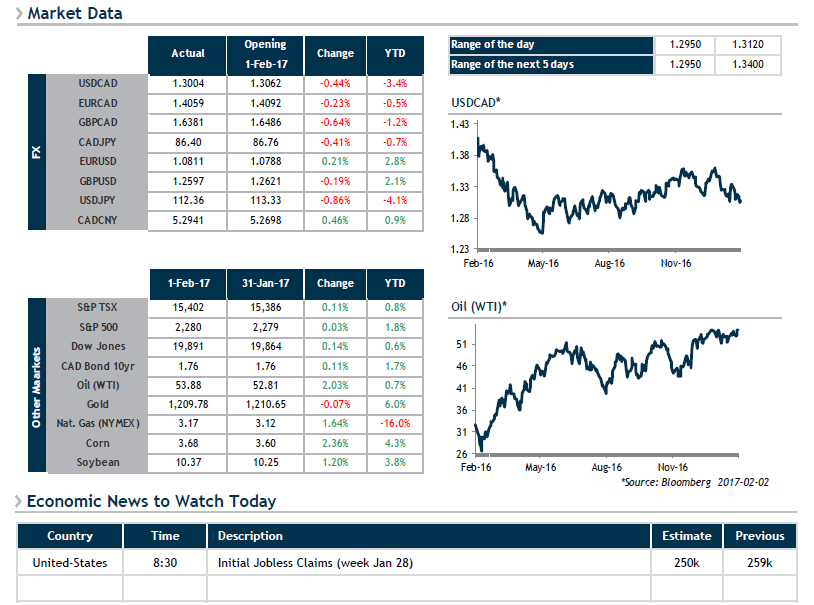

As of yet, his comments have had no effect. Perhaps he has fewer Twitter followers than Mr. Trump? The USD/CAD pair therefore remains toward the bottom of the 1.3000-1.4000 range and we believe that buyers should continue to take advantage of it.

Little economic news of importance is on the agenda today. Friday will bring U.S. job numbers.