Not a lot happened in markets yesterday with a quiet data calendar and investors not wanting to commit too much to the game before tonight’s Federal Reserve meeting. The belief that the world economy has dodged a bullet with the Greek debt swap and the belief that further liquidity injections are forthcoming from the worlds’ central banks has allowed equities and commodities to remain close to recent highs.

The recent improvement in the US labour market has caused analysts to reassess their expectations of whether further quantitative easing is warranted by the Federal Reserve. Non-Farm payrolls has published numbers above 200k for the past 3 months and initial jobless claims, people signing up to claim unemployment benefits, is at a multi-year low so why does the economy need further funding? Looking at those numbers it is very true however that the majority of those new jobs being created are part-time work and for the minimum wage whilst those who have managed to remain in the labour market have seen benefits and wages cut through past years whilst also dealing with higher than targeted inflation.

So will Ben Bernanke and the Fed do anything tonight? My money is on no. Much like the Bank of England have tended to do I would expect the FOMC to wait for next month’s meeting as it coincides with the April economic statement on the state of the US economy and would be a perfect checkpoint on the road to recovery.

GBPEUR was one of the biggest movers on the day yesterday with very little reason attached. Euro demand was strong from local corporates it seems while some are blaming it on noises from a Eurozone finance ministers’ meet in Brussels surrounding further protection and firewalls around the periphery.

Away from the Fed, the news will likely focus on Spain today following calls for it to reduce its deficit further after the Spanish parliament voted to ignore the new fiscal pact. I personally believe this is a non-event. Spain knew they were going to breach the fiscal compact when they signed up for it but have promised to get it under control before the next deadline. These measures are for the longer-term benefit of the EU even though they have been stuck in the depths of a crisis. Missing the targets at the front end is not a problem as long as the trend remains one of improvement.

Data before the Fed will be watched but is unlikely to cause any massive price swings as traders wait for news from Washington. The UK publishes its latest trade balance numbers at 09.30. Last month’s figures showed recent record levels of exports although we expect this to have moderated following movements in energy markets. We also receive the German ZEW economic sentiment survey; analysts expect it to improve for the 4th month in a row.

The euro crisis – are you protected? World First has teamed up with Charles Russell and haysmacintyre to host a unique event for business leaders. The seminar will feature a series of short presentations taking a closer look at the Eurozone crisis and how this will affect your business in 2012, before exploring some of the ways you can protect yourself from any potential fallout. Register for our free seminar on 29 March or ask for a copy of our whitepaper here

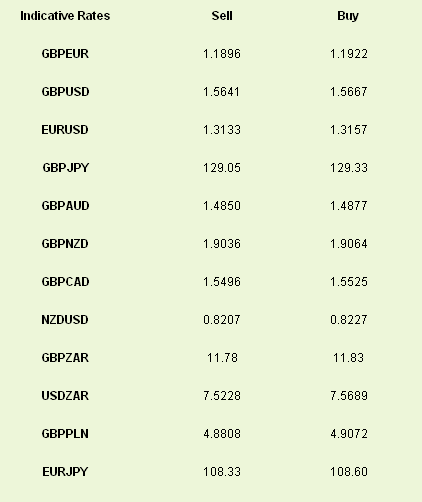

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Federal Reserve Meeting Hopes Buoy Risk

Published 03/13/2012, 07:54 AM

Updated 07/09/2023, 06:31 AM

Federal Reserve Meeting Hopes Buoy Risk

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.