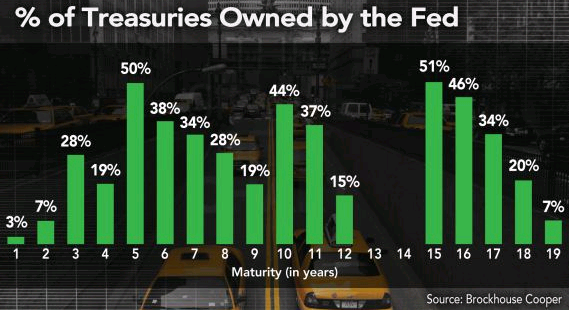

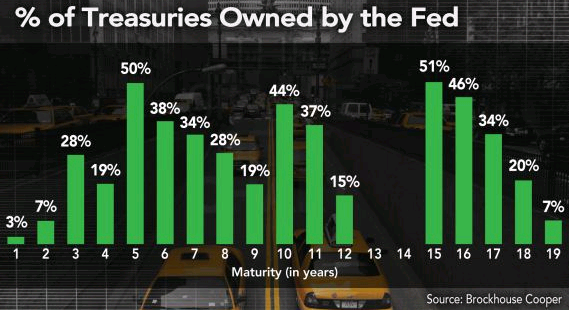

An end result of the Federal Reserve's quantitative easing programs, including Operation Twist, is the Fed's balance sheet has swelled with the growth in U.S. Treasury holdings. In 2011, the Fed purchased over 60% of all the Treasuries issued by the government. A recent Bloomberg comment notes the Fed now owns over 37% of all Treasuries with maturities greater than 5-years.

This is certainly a path that is unsustainable before reaching a tipping point. In order to continue down this path, the dollar printing press will need to run at full speed with an end result a further weakening of the U.S dollar and consequent higher inflation.

This is certainly a path that is unsustainable before reaching a tipping point. In order to continue down this path, the dollar printing press will need to run at full speed with an end result a further weakening of the U.S dollar and consequent higher inflation.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI