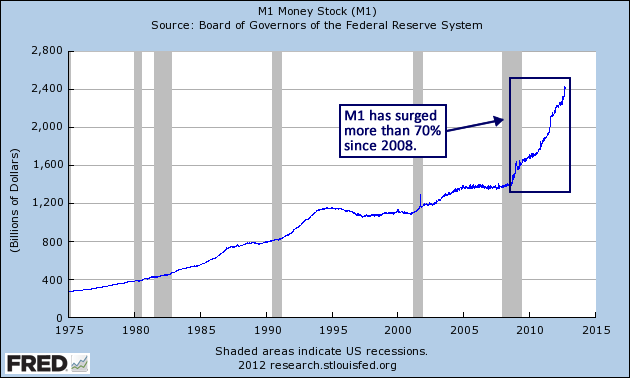

At its latest meeting, the US Federal Reserve announced that it would continue the current liquidity operation intended to support economic recovery, committing to holding short-term rates at effectively zero until at least 2015. Since the recession in 2008, M1 money supply has surged 70 percent, topping the $2.4 trillion level in September with no end in sight to the extreme move higher.

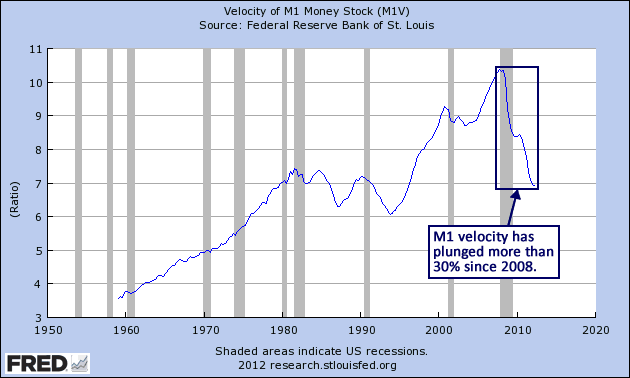

However, during that time, the velocity of M1 money has plunged from a high of 10.37 in late 2007 to 6.93 in 2012.

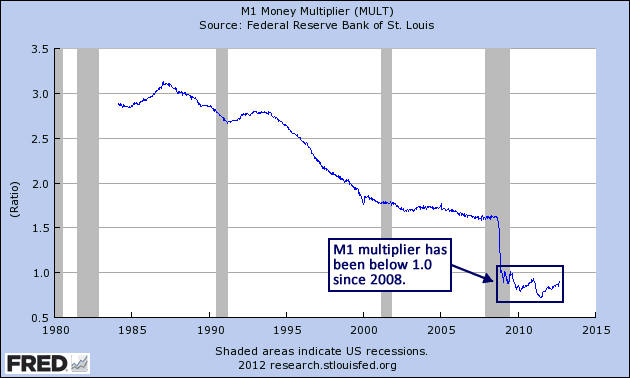

Essentially, velocity measures how fast money changes hands, providing a gauge of economic activity. In basic terms, when velocity declines sharply even as supply is being introduced at an unprecedented rate, the implication is that the added liquidity is not engendering economic activity. This is what “pushing on a string” looks like. Accordingly, the M1 money multiplier has remained well below the 1.0 level during the last four years.

The Federal Reserve can attempt to spur economic activity by introducing monetary stimuli, but it cannot force banks to increase their loan and investment activity. The velocity and multiplier data trends clearly demonstrate that the newly introduced M1 supply is simply remaining idle in places like bank reserves. Federal Reserve Chairman Bernanke understands the dilemma, but he would prefer to deal with any problem except deflation, so he has committed to flooding the system with liquidity for the foreseeable future and worrying about the consequences later.

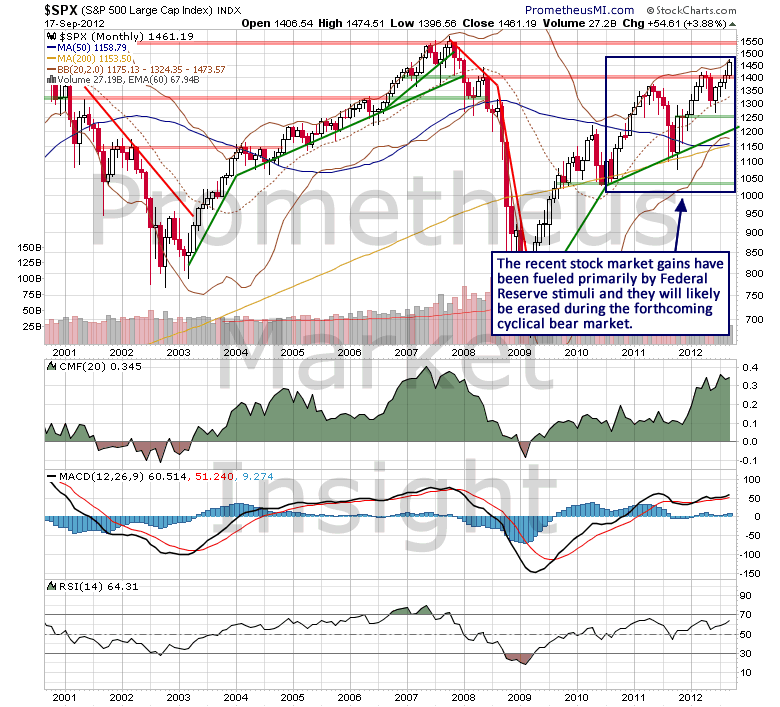

When the second quantitative easing program was introduced in late 2010, Chairman Bernanke stated in no uncertain terms that one of the primary goals of the program was to inflate the stock market. There is no question that the measures taken by the Federal Reserve during the last three years have fueled appreciation in the stock market, so, from that perspective, the programs have been successful.

However, it must be noted that equity gains fueled primarily by government stimuli during periods of structural economic weakness are typically not durable and they can be erased as quickly as they are created.

The liquidity operations that have produced the huge spike in M1 since 2008 have created massive structural imbalances that will continue to drive violent moves both higher and lower as the system attempts to return to a state of equilibrium. More importantly, there is absolutely no evidence to support the assertion that higher stock prices meaningfully support economic recovery.

Historically, a 1.0 percent increase in the S&P 500 index has been accompanied by GDP growth of approximately 0.04 percent during the same year, 0.04 percent growth during the next year, and it has a negative correlation during subsequent years. However, for better or for worse, the Federal Reserve appears to be locked into this course of action for the foreseeable future. The recent announcement that interest rates would remain “excessively” low until at least 2015 suggests that Bernanke believes he has the tools and expertise required to prevent these unprecedented structural imbalances from engendering massive economic disruptions when they are purged from the system some years from now. Seeing as no central bank in history has been able to accomplish that feat, we have our doubts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Federal Reserve Continues Pushing On A String

Published 09/24/2012, 01:14 AM

Updated 07/09/2023, 06:31 AM

Federal Reserve Continues Pushing On A String

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.