Federal Realty Investment Trust (NYSE:FRT) posted second-quarter 2017 funds from operations (“FFO”) per share of $1.49, beating the Zacks Consensus Estimate of $1.46. The figure also came in higher than the prior-year quarter tally of $1.42.

Results were backed by growth in revenues. Also, the company raised its guidance for full-year 2017 and recently announced a hike in dividend.

Total revenue for the quarter grew 5.1% year over year to $208.0 million. In addition, the top line surpassed the Zacks Consensus Estimate of $207.0 million.

During the reported quarter, Federal Realty signed 111 lease deals for 432,164 square feet of retail space. As of Jun 30, 2017, the company’s overall portfolio was 94.5% leased, unchanged year over year.

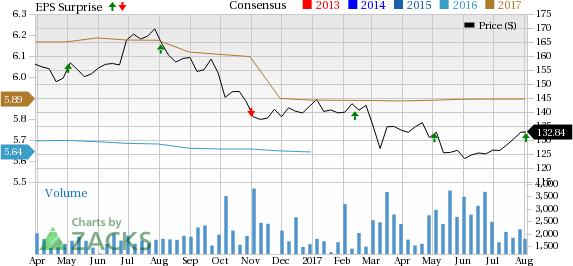

Note: The EPS numbers presented in the above chart represent funds from operations (“FFO”) per share.

Quarter in Details

On a comparable-space basis (spaces for which a former tenant was there), Federal Realty leased 397,555 square feet, at an average cash-basis contractual rent escalation of 13%. Rent increases (on a straight-line basis) for comparable retail space averaged 27% for second-quarter 2017.

Same-center property operating income (including redevelopments) improved 3.9% year over year. However, excluding such properties, same-center property operating income edged down 0.7%. As of Jun 30, 2017, Federal Realty’s same-center portfolio was 95.9% leased, unchanged year over year.

Federal Realty exited the second quarter with cash and cash equivalents of approximately $96.3 million, up from $23.4 at the end of 2016.

Outlook 2017

For 2017, Federal Realty raised its FFO per share guidance to $5.86–$5.94 from the previous guidance of $5.85–$5.93. The Zacks Consensus Estimate for the same is currently pegged at $5.90, which lies within the company’s guided range.

Dividend Update

On Jul 31, 2017, Federal Realty announced a quarterly cash dividend of $1.00 per share, marking a hike of 2% from the prior dividend payout. Also, it marks the 50th consecutive year of common dividend increases by the company. The dividend will be paid on Oct 16 to shareholders on record as of Sep 22, 2017. Notably, the company’s compound annual growth rate of the dividend increases over the 50 years is above 7%.

Our Take

We are encouraged with the better-than-expected performance of Federal Realty in the reported quarter. The company’s portfolio of premium retail assets – mainly situated in the major coastal markets from Washington, D.C. to Boston, San Francisco and Los Angeles – along with a diverse tenant base, positions it well for decent growth.

Nevertheless, mall traffic continues to dwindle amid a rapid shift in customers’ shopping preferences, with non-store sales rising significantly. This has become a pressing concern for retail REITs like Federal Realty. Furthermore, though the anchor-repositioning strategies are a strategic fit for the long term, the short-term impacts on earnings cannot be bypassed.

Currently, Federal Realty carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let us now look forward to the earnings releases of Condor Hospitality Trust Inc. (NYSE:CDOR) , FelCor Lodging Trust Incorporated (NYSE:FCH) and Hospitality Properties Trust (NASDAQ:HPT) , all of which are expected to report their quarterly figures in the upcoming days.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Federal Realty Investment Trust (FRT): Free Stock Analysis Report

FelCor Lodging Trust Incorporated (FCH): Free Stock Analysis Report

Hospitality Properties Trust (HPT): Free Stock Analysis Report

Condor Hospitality Trust, Inc. (CDOR): Free Stock Analysis Report

Original post

Zacks Investment Research