- Fed raises interest rates and signals another six hikes this year

- Despite hawkish message, Wall Street powers higher, dollar retreats

- Bank of England coming up next as sterling bounces back

Fed gets the ball rolling

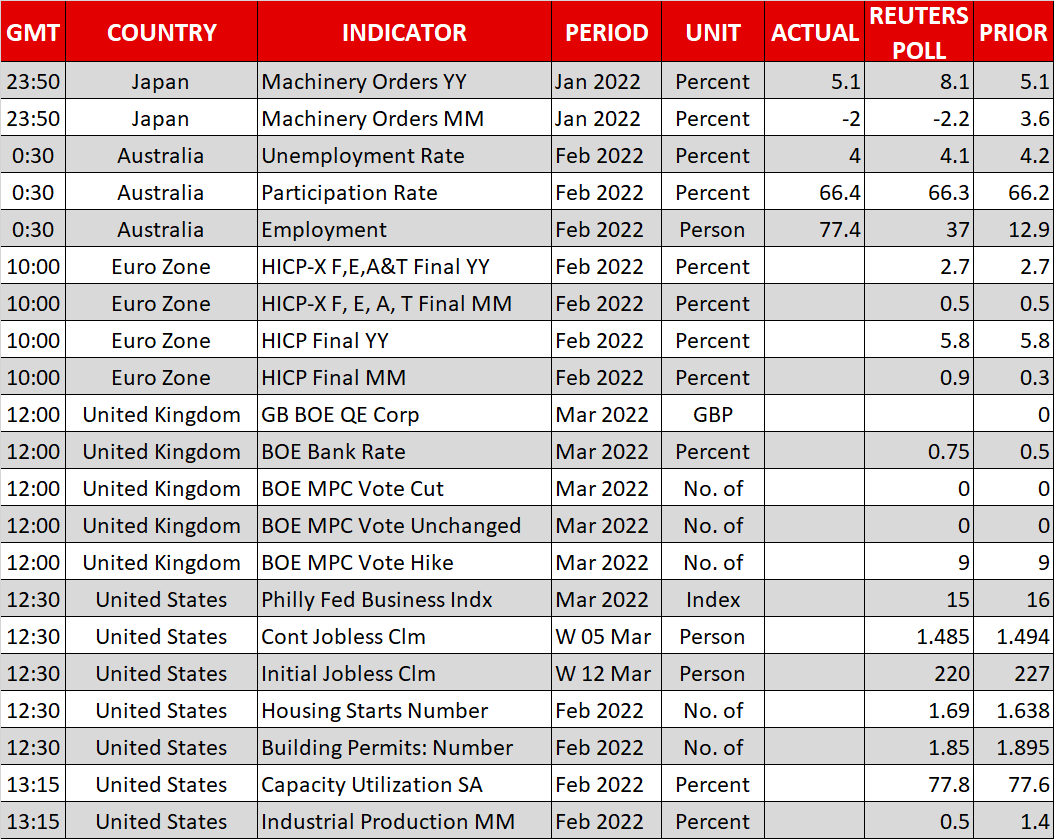

The Federal Reserve officially kicked off its tightening cycle yesterday, raising interest rates by a quarter point. Although the rate hike itself was fully baked into money markets, the central bank still delivered a hawkish twist by signaling another six rate increases for this year through its ‘dot plot’ projections.

That was exactly in line with market pricing heading into the event but exceeded even the wildest forecasts among economists, who expected a slower approach. Chairman Powell spent most of his press conference emphasizing how strong the US economy is, arguing that it can absorb tighter monetary policy without tipping into recession.

Overall, the takeaway was that the Fed is serious about combating inflation. There is a sense that they waited too long to get the normalization ball rolling and the latest commodity shock added fuel to this urgency, as it implies inflation will peak at a higher rate and take even longer to do so.

Markets defy hawkish message

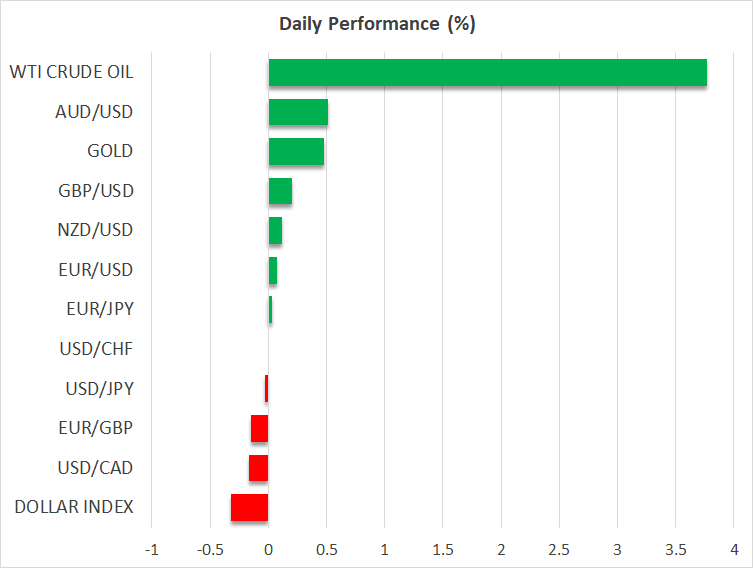

Even though the Fed made it crystal clear that it wants to tighten financial conditions, market participants did not play along. Shares on Wall Street closed the session with stunning gains while the US dollar fell almost across the board, which is striking considering the overall hawkish message.

There are a couple of factors that might explain this strange reaction - for example Powell didn’t seem very comfortable with raising rates in 50 basis point increments and there weren’t any new revelations around the balance sheet reduction process. However, these arguments don't seem very convincing.

Instead, this may have been a classic case of ‘sell the rumor, buy the fact’ for equity markets. Many big players were likely flush with protective hedges like put options heading into the Fed decision, which they unloaded once the event passed and volatility cooled, sparking a relief rally. The uncertainty of traveling is often more painful than the arrival for the markets.

Bank of England next

In the broader market, there’s been a feel-good atmosphere for most of the week as traders scramble to price in the prospect of a peace accord in Ukraine. The latest reports suggest negotiators have made significant progress on a ceasefire, with Moscow willing to withdraw if Kyiv pledges to remain neutral and accepts caps on its military forces.

Optimism that these talks will bear fruit has seen the euro stage a meaningful recovery, mostly to the detriment of the Japanese yen. The British pound has also been a beneficiary of the peace bets, outperforming even the war-stricken euro in recent sessions.

The Bank of England will conclude its own meeting today. A quarter point rate increase is fully priced in and markets imply a one-in-three chance for a half point move. Hence, the initial reaction in sterling will depend on the size of the hike. Admittedly, while inflationary pressures have strengthened, this is hardly the time for the BoE to raise rates with reckless abandon, as the economy is already headed for a slowdown.

Finally, the Bank of Japan will also meet early on Friday but with the economy having barely escaped deflation, it is unlikely to signal an exit from decades of easy money policies. The yen remains at the mercy of risk appetite and the actions of foreign central banks, until the BoJ executes its own U-turn.