- Market reassess Fed outlook after dovish minutes

- US data needs to be convincing over coming weeks

- Forex volatility confined to tight ranges for now

- Market focus now shifts to August job report

Investors were hoping for guidance on rate liftoff timing from the Fed yesterday, but that was not to be the case. The Fed did not send an obvious signal in the July minutes about whether a rate increase is on the cards for September. But they did acknowledge that the timing for liftoff is getting closer. Members “judged that the conditions for policy firming had not been achieved, but were getting to that point.” Labor market progress was mentioned, but the minutes also raised concerns on the inflation front. “Members agreed that additional information on the outlook would be necessary before deciding to implement an increase in the target range.”

If anything, the July’s FOMC minutes have reduced expectations for a September liftoff. Before the release the odds were +50% that the Fed would begin its rate nominalization policy in a few weeks, now Fed fund futures are trading close to +34%. If the Fed is to raise rates in September, economic data since the July 29 policy announcement needs to win over at least a majority of the voting members – “most” still feel that conditions have not been met. Data since the last policy announcement has been mixed, including disappointing reports on manufacturing and consumer sentiment, while July non-farm payroll (NFP) came in as expected.

US inflation remains a tad soft

Even yesterday’s tame U.S inflation report fell short of expectations and declined slightly from June (CPI +0.1% m/m). But is the report actually weak enough to prevent U.S policy makers from raising rates? Yesterday’s minutes should also be considered a tad outdated, as Fed member opinions have to be reframed by the surprise Chinese Yuan devaluation last week and its potential impact on the U.S. economy. There is a month of data left before the September announcement, and while the onus has been on the data to disappoint and therefore delay a rate hike, yesterday’s minutes suggest that U.S data needs to convince most Fed members that immediate tightening is required. Any rate skeptics should now be looking to next month’s U.S August jobs report release to potentially stand in the Fed’s way – the responsibility has always been on U.S fundamental data to build a case against a tighter Fed policy.

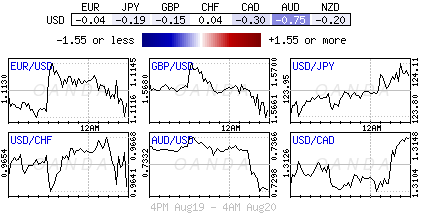

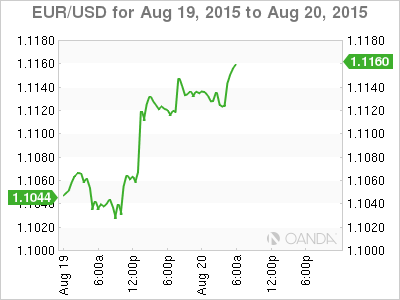

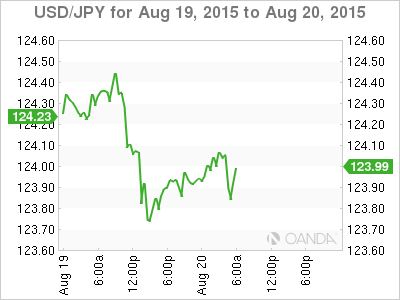

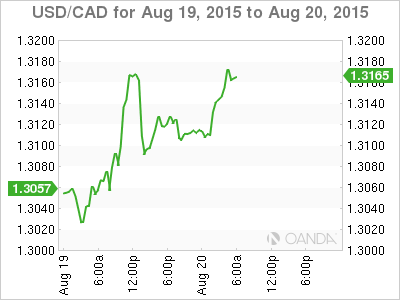

Forex volatility is consistent, but range bound

There is forex volatility, but it’s confined to relatively tight trading ranges. Why? Most likely because investors have been paring back on their long-dollar bets looking for clearer signals that the Fed will begin their rate normalization policy. Many sense that much of the Fed’s rate increase hike has already been priced in, particularly against the EUR (€1.1160), Yen (¥123.86) and some commodity based currencies. For now, most dollar bulls prefer being ‘long’ against the commodity bloc (CAD, AUD, NZD), and any vulnerable Emerging Market currency pairs (ZAR, TRY, MXN, BRL).

On a global perspective, there are a lot of things that investors have to worry about, and it’s not surprising that risk appetite appears fragile. Investors sometimes need to look beyond the obvious global hotspots to see the “next” week’s headlines.

More variables will reduce risk appetite

It has been rather quite, but tensions have been rising again in the Ukraine. Russia is feeling the pain of the collapse in oil and the RUB. They now see crude prices hitting $30-35 dollars a barrel and Putin needs a distraction. Africa is feeling the pain of China’s slowdown and yuan weakness. Chinese demand for hard commodities and energy that Africa produces will be tested (in 2015 it was worth approximately $250b to the continent). The ZAR is trading at a 14-year low (12.96) and the world is beginning to question China’s “real” growth potential, especially since the PBoC has been tinkering with its own currency valuation. Chinese authorities will also be slightly miffed that the yuan has been passed over by the IMF as a reserve unit for at least another year yesterday.

The combination of significant weakness in commodity prices and ongoing concerns about emerging markets has been weighing heavily on most equity markets and should not get any easier next month. With history tending to repeat itself, the month of September is historically the worst month of the year for equities. Investors will need to be alert and ready now that the market is focusing intently on the U.S August job report for rate guidance.