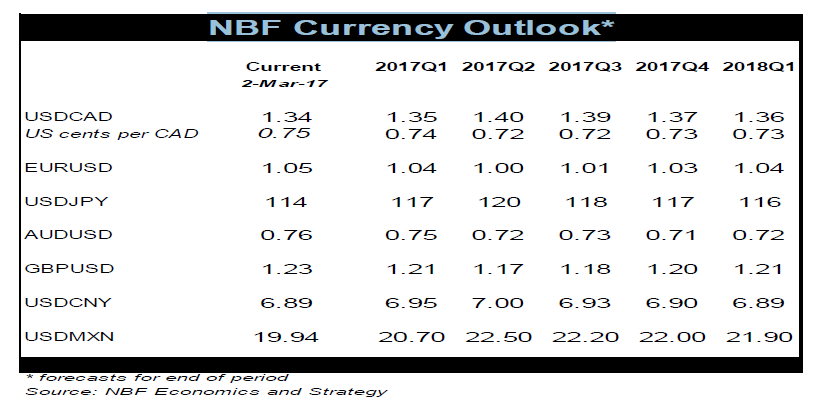

- After a difficult start to the year, the U.S. dollar seems to be regaining traction. Hawkish signals from several Fed Governors, including Chair Janet Yellen, prompted investors to adjust their views about the possibility of an interest rate hike as early as this month. A March hike is still not fully priced in by markets, suggesting a move by the Fed this month could push up the U.S. dollar further.

- The euro has room to depreciate more, possibly testing parity with the greenback later this year. There’s more than just diverging monetary policy weighing on the euro. Political developments on the old continent are getting markets to once again question the viability of the Eurozone.

- The Canadian dollar is once again under pressure. Oil prices have stagnated as output cuts from OPEC have been offset by higher North American production, while the combination of a more hawkish Fed and a cautious Bank of Canada is causing U.S.-Canada interest rate spreads to widen. The large current account deficit does not bode well for the loonie, more so considering it is being financed entirely by short term foreign capital flows which can reverse on a whim. We continue to expect USDCAD to head towards 1.40 over the coming months.

To read the entire report Please click on the pdf File Below