MyFXspot.com Trade Ideas

- EUR/USD: buy at 1.1310, take profit at 1.1520, stop-loss 1.1200

- EUR/JPY: long at 126.00, take profit at 129.00, stop-loss 124.50

- XAU/USD: long at 1300.00, take profit at 1360, stop-loss 1270.00

Market Overview

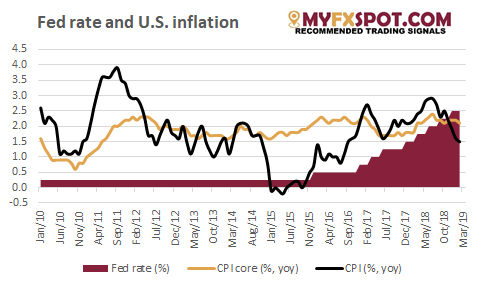

The U.S. Federal Reserve is expected to hold interest rates steady today, cut the number of hikes projected for the rest of the year, and release long-awaited details of a plan to end the monthly reduction of its massive balance sheet.

The U.S. central bank since early this year has signaled a "patient" approach to increasing borrowing costs, drawing an end to a gradual, three-year cycle of monetary tightening marked by nine rate hikes, including seven during the 2017-2018 period.

Investors now put a 75% probability on the likelihood the Fed won't raise its overnight benchmark interest rate, or federal funds rate, any more this year.

New quarterly economic and rate projections to be released with the latest Fed policy statement will show how closely policymakers align with that view. The Fed's December projection called for two hikes this year, but that is widely expected to be cut to a single increase at the conclusion of the two-day policy meeting on Wednesday.

It would take a downward move by seven policymakers to bring the median expected number of hikes to zero for the year, a full half-percentage-point change that has happened only once since the Fed began making its "dot plot" of projections public in 2012.

The more intense focus among investors may be on the balance sheet, and the Fed's plans to stop reducing its holdings of Treasury bonds and mortgage-backed securities each month by as much as USD 50 billion.

Details of that plan are also expected to be released on Wednesday, providing investors with a sense of how much longer the drawdown will continue, and what will likely be left in the Fed's portfolio of assets when it stops.

EUR/USD bulls look set to test the key 1.1374 Fibonacci level, a 50% retrace of the 1.1570 to 1.1177 2018 slide, after spot registered the biggest one-week rise since November 2018. We are looking to get long on dips to 1.1310.

Economic research and trade ideas by MyFXspot.com