From time to time, you will read that the Federal Reserve is trying to “thread the needle” on rates. That is, they don’t want to keep rates too high for too long, lest they sink the economy, nor lower them too soon or too far, lest they reignite (or merely fail to finish off) inflation.

To me, that is a very odd use of the phrase. “Threading the needle” tends to describe a delicate operation that must be conducted with deft precision, since a small error represents a failure. Not to put too fine a point on it (Ha! Ha! Needle pun), but that seems as wholly unlike the problem the Fed is confronting, and the characteristics of the error function.

Let’s think way, way back to 2022 when the Fed began hiking rates aggressively.

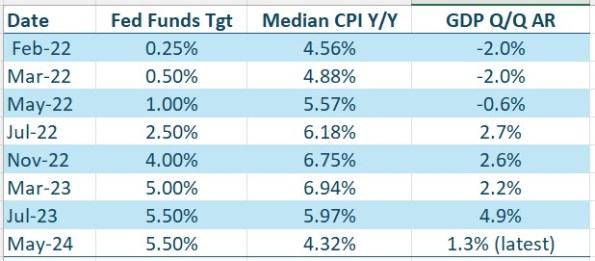

The Fed’s first 475bps of rate hikes corresponded with a rise in median inflation from 4.56% to 6.94%, over a period of more than a year, along with accelerating economic growth. The next 50bps must have been the magic number, because Median CPI has dropped 2.6% since March of 2023 and growth has slowed a bit.

Some of this – if you believe that changes in overnight interest rates have an important impact on inflation – might be written off to lags. But historically, the correlation of changes in interest rates with changes in core inflation 12 months later is approximately zero (as I illustrated in this nifty article almost exactly a year ago: Enough With Interest Rates Already).

How is it reasonable to worry about ‘threading the needle’ when the economy does not evidently respond to 50bps, 100bps, or 200bps of rate hikes? Methinks that this is not an apt metaphor.

Part of the problem is that the FOMC doesn’t really know what the target looks like that it is trying to hit. If you fervently believe that interest rates matter, but you don’t know what the lags are or the significance to the economy of 25bps, then how can you be confident that you have the precise control implied by ‘threading the needle?’ Fed speakers have admitted, although they don’t phrase it this way, that they don’t have much control over any of the variables that determine whether or not the target is hit. They’ve specifically noted that monetary policy is not efficacious in bringing down energy prices or moderating food prices, and some have opined that the rapid rate increases might have artificially increased shelter inflation by restricting the supply of homes on offer thanks to trapped mortgagees. Did the Fed rate hikes cause Used Car prices – one of the largest sources of the disinflation to date – to drop precipitously? It seems unlikely.

To thread a needle, you need fine motor control and the Fed doesn’t have it. It was difficult to even get inflation headed in the right direction, and it didn’t happen because of what the Fed did. If monetary policy makers looked at their record objectively, they would have to admit that microadjustments in a policy rate that directly affects very little of the economy do not seem to have much efficacy. If that is true, then the correct policy response is to do nothing unless you are absolutely certain that the direction you need to move policy is unambiguous, and the magnitude you need to adjust policy is substantial. Otherwise, you’re just adding unnecessary volatility to markets.

One thing you learn as a trader is that most of your money is made on very few trades, and so if you are trading frequently the majority of your trading is just noise. Similarly, for most investors it is more important to get the position scaled for proper risk rather than to choose the ‘right’ securities. The odds that you have chosen the best-performing stocks, if you choose just (say) three, are vanishingly small. Market prices may not be completely efficient, but they’re too efficient for most people to beat on a regular basis. Similarly, the Fed ought to make few moves. Most of its activity is just noise…at best. The market is pretty good at moving interest rates to where supply and demand balance, when it is left alone, and market interest rates have a better forecasting record than the Fed by quite a lot. Stop trying to thread the needle.