Every year since the financial crisis the Federal Reserve creates a simulated crisis to see which banks are healthy enough to survive in the event of an emergency.

The tests were particularly difficult this year because the economy is doing well, but it does seem that a few U.S. banks passed by the skin of their teeth.

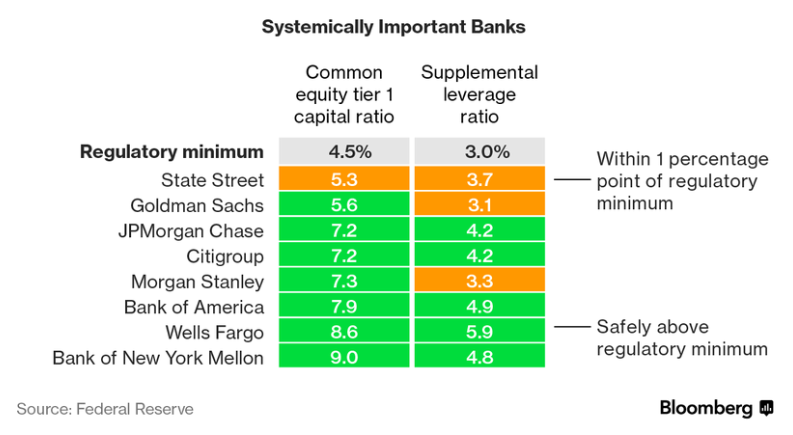

Here we can see the results for some of the top banks.

It's important to note that this simulation is not indicative of a real world situation. Next week the Fed will perform a few more tests that should give us a better understanding of the situation.

Today's Highlights

Greek Debt Deal

Win for Mom & Pop

Fed Adds Ethereum

Please note: All data, figures & graphs are valid as of June 22nd. All trading carries risk. Only risk capital you can afford to lose.

Greek Debt Deal

The negotiations have been going on for far too long and have brought the markets to their knees several times already. Today the crisis has finally been declared over.

Though the Greeks didn't get anything close to the deal that Prime Minister Alexis Tsipras advocated in his famous 2015 election campaign, they did win a number of concessions from the European Union that will make it easier to operate the country and start borrowing money from the public again.

Much of the €96 billion owed will be pushed back by 10 years, which should allow the country to breathe and grow the economy in the meantime.

The Euro is gaining a bit of ground this morning on the news (purple circle), although hasn't quite recovered from Draghi's announcement last Thursday.

Win for Mom & Pop

A landmark case has now passed the US Supreme Court that could have an impact on your portfolio going forward.

Until now, online stores in the United States were exempt from local sales taxes in states where they do not have a physical presence.

Bricks and mortar stores claim that they have been disadvantaged by this for the last 25 years. Some even say that this has been a major contributing factor to the retail apocalypse of the last decade.

Going forward, online retailers will be subject to the same taxes that everyone else is, which should level the playing field a bit, but won't necessarily reverse the online shopping trend.

The clear winners here are the state governments because they're about to get billions more in tax revenues. This may be a good time to look at the stocks you're holding as bottom lines for both online and offline retailers will be affected by this.

Fed adds Crypto

While many old school financial institutions see cryptocurrencies as a threat, the Federal Reserve Bank of St. Louis is extremely supportive of them.

They have already released a significant amount of research detailing how the introduction of a new form of decentralized money can have a stabilizing effect on the global economy.

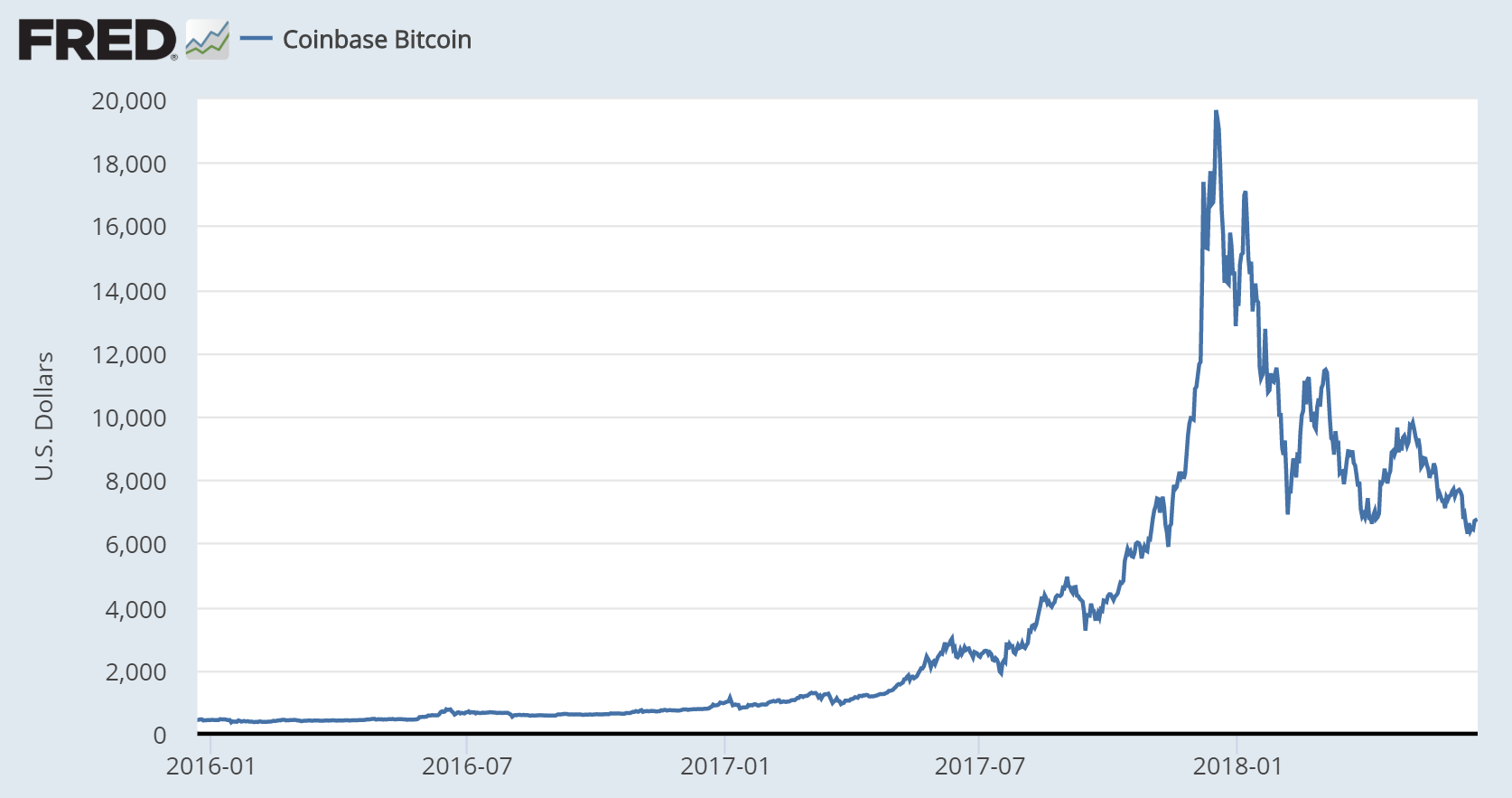

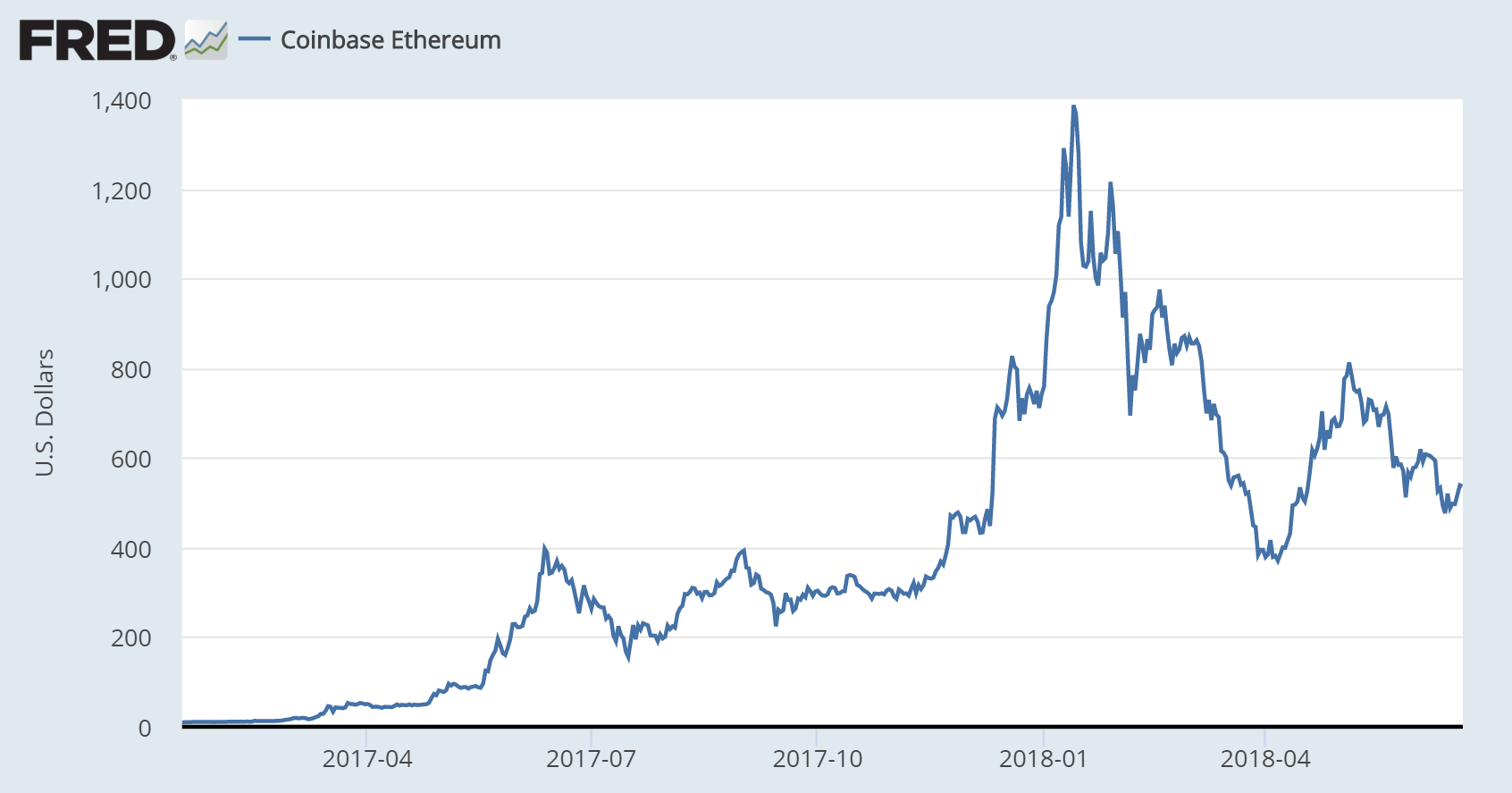

This week, the Federal Reserve Economic Data (FRED) website, run by the St. Louis Fed, has taken a massive step towards legitimizing cryptocurrencies in the eyes of the financial world by adding price tracking graphs for Bitcoin, Bitcoin Cash, and Ethereum, and Litecoin.

Here's Bitcoin on FRED...

...and Ethereum...

Though the United States has been more skeptical about ICOs lately, they're certainly looking a lot more friendly towards the more established cryptocurrencies.

What Else?

Remember that today is the much anticipated OPEC meeting. Watch for volatility in crude oil throughout the day.

Also, the Turkish elections will be held on Sunday. A month ago this looked to be a clear win for Erdogan the incumbent. Today, the scales have tipped just a little showing a slightly more favorable outlook for the opposition. Don't get your hopes up too much though. Just keep an eye on the USD/TRY.

Wishing you and yours an outstanding weekend ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.