The US dollar slid after the FOMC decision yesterday, perhaps as the Committee kept the view that the surge in inflation may prove to be transitory, as well as due to Powell’s comments that they can stay patient on interest rates.

As for today, the central bank torch will be passed to the BoE, and with the UK OIS pointing to an 80% chance of a rate rise, it will be interesting to see whether British officials will indeed push the hike button.

US Dollar Slides As Fed Keeps 'Transitory' Language And Powell Signals Patience

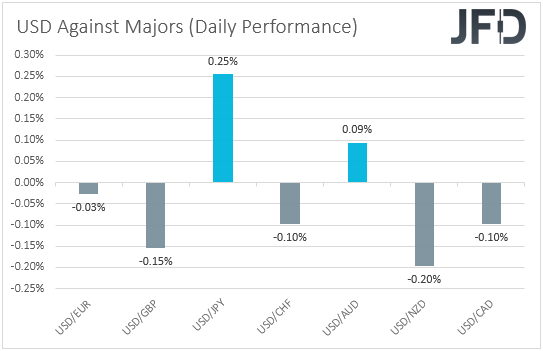

The US dollar was found lower against most of the other major currencies this morning. It gained only versus JPY and AUD, while it was found nearly unchanged against EUR. The greenback lost ground versus NZD, GBP, CHF and CAD.

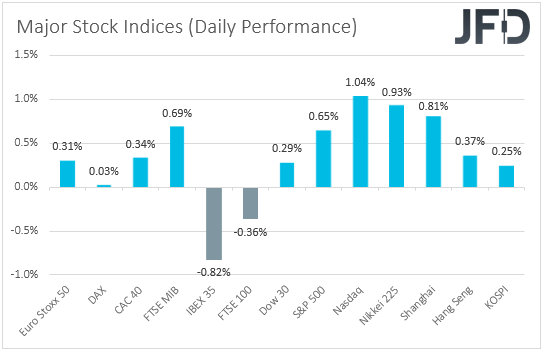

The performance in the FX sphere does not paint a clear picture with regards to the broader market sentiment. Therefore, in order to get an idea of investors’ morale, we prefer to turn our gaze to the equity world. There, EU indices were mixed, but Wall Street edged north, with all three of its main averages hitting fresh record highs again. Appetite remained supported during the Asian session today as well.

Yesterday, the main event on the agenda was the FOMC decision, with the Committee announcing the beginning of its QE tapering process as was widely anticipated, at a pace of USD 15bn per month. They committed on another $15bn tapering for December, but they added they stay prepared to adjust the pace beyond that if warranted.

In the statementtaccompanying the decision, they said that “inflation is elevated, largely reflecting factors that are expected to be transitory”. Remember that the previous part was “inflation is elevated, largely reflecting transitory factors”. This means, that although they kept the “transitory” language in the statement, they are not so adamant on that view now. With regards to interest rates, Chair Powell said that it’s not the time to raise them and added that they can be patient.

The dollar slid initially, perhaps due to the fact that officials maintained the “transitory” language in the statement, as well as due to Powell’s patient approach. However, we don’t believe that this could be the start for a trend reversal in the US dollar. The fact that they change the language on inflation, as well as the fact that Powell did leave the door open for interest rates to start rising at some point next year, may keep the slide short-lived.

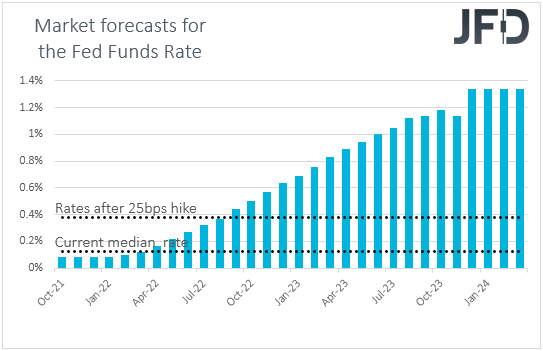

Even market participants may share that view. According to the Fed funds futures, they brought forth their hike expectations after yesterday’s outcome, from September 2022 ahead of the meeting, to August 2022. In our view, any future remarks or hints suggesting that interest rates could indeed start rising after the tapering is over may allow traders to buy more dollars.

For now, we prefer to exploit any USD gains mostly against JPY. Although the greenback slid on the Fed decision, it was found higher against its Japanese counterpart this morning, and this may be due to the BoJ’s policy to keep a lid on its government bond yields. In our view, US Treasury yields may stay supported in the aftermath of the Fed decision, and thus, due to yield differentials, USD/JPY could keep drifting north.

USD/JPY – Technical Outlook

USD/JPY traded higher yesterday, but stayed within the sideways range that’s been in place since Oct.11, between the 113.20 and 114.70 barriers. Although the prevailing longer-term trend is to the upside, we prefer to stay neutral for now and wait for a break above the range’s upper end before we start examining a trend continuation.

A clear and decisive break above 114.70 will confirm a forthcoming higher high on the daily chart and take the rate into territories last tested in March 2017. The next stop may be the peak of Mar. 10 of that year, at around 115.50, the break of which could allow extensions towards the 116.00 area.

In order to start examining whether the bears have gained the upper hand, we would like to see a break below the 113.00 barrier, marked by the low of Oct. 12. This would confirm a forthcoming lower low and may set the stage for declines towards the low of the day before, at around 112.17. If that level is broken as well, then we could see a test at 111.80, the break of which could aim for the 111.20 zone, which provided support on Oct. 6 and 7.

Will The Bank Of England Hit The Hike Button Today?

Today, the central bank torch will be passed to the Bank of England. Back in September, this Bank kept all its policy settings unchanged, but in the statement accompanying the decision, it appeared very confident on interest rate increases. Officials noted that some developments have strengthened the case of some modest tightening over the forecast period, and added that this should come in the form of a rate hike, even if that becomes appropriate before the QE end.

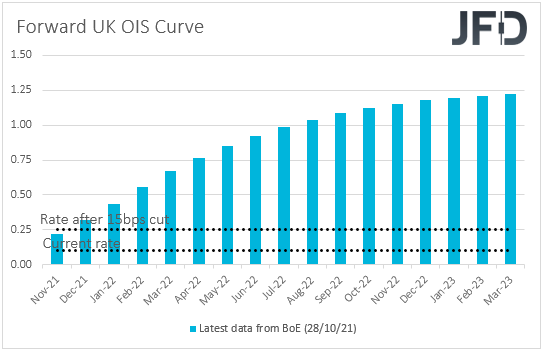

Recent data showed that inflation in the UK slowed more than anticipated in September, but both the headline and core rates stayed well above the BoE’s objective of 2%. This, combined with the fact that Governor Andrew Bailey and MPC member Michael Saunders have expressed willingness to push the hike button very soon, prompted market participants to assign an 80% chance for a 15bps hike to take place at this gathering, according to the UK OIS forward yield curve.

Therefore, a 15bps hike by itself is unlikely to move the pound much. We believe that if indeed the Bank lifts rates, market participants will quickly turn their attention to the statement, the meeting minutes, the Bank’s updated economic projections, but also on the voting over a hike. If the decision is a close call, and the language and projections point to a slower rate path than the OIS curve suggests, then the pound could pull back.

There is also a chance that, due to the recent supply shortages in the UK that appeared to have left their mark on the economy, officials refrain from hitting the hike button now and perhaps wait until next month, a decision that could result in a stronger selloff in the pound. In our view, for the pound to rebound, the BoE may have to appear more optimistic than the current market pricing suggests. In other words, it has to deliver a hike and signal that more are on the cards in the months to come. So, overall, we see the risks surrounding the pound’s reaction to the meeting as tilted to the downside.

GBP/CAD – Technical Outlook

GBP/CAD traded higher yesterday, but hit resistance at 1.6990 and retreated again. Overall, the pair stays within the sideways range between the 1.6870 and 1.7095, zones, and this has been the case since Oct. 8. Thus, for now, we will hold a flat stance.

In order to star examining the bearish case again, we would like to see a dip below 1.6870. This will confirm a forthcoming lower low and could pave the way towards the 1.6770 barrier, marked by the low of Dec. 11, 2020. If the bears are not willing to stop there, then we could experience extensions towards the low of Mar. 23, 2020, at around 1.6615.

The outlook could change to positive upon a break above the upper bound of the aforementioned range, which is at around 1.7095. The bulls may then get encouraged to climb towards the peak of Oct. 5, at 1.7170, the break of which could see scope for more extensions, perhaps towards the inside swing low of Sept. 27, at 1.7245. Another break, above that hurdle, could allow advances towards the peak of that same day, at around 1.7368.

As For The Rest Of Today's Events

Besides the BoE decision, we get the final Markit services and composite PMIs for October from the Eurozone, as well as the UK’s construction PMI for the month. Later in the day, from the US, as every Thursday, we have the initial jobless claims for last week.

With regards to the energy market, we have the OPEC+ group gathering, but the official outcome may not become public until tomorrow. Although the group is under pressure from the US to increase supply, several members appear unwilling to do so, with one of the latest headlines pointing to Algeria saying that output should not exceed the current agreement of 400k bpd because of market uncertainty and risks.

Therefore, the base-case scenario is for no change, which is unlikely to affect oil prices much. For oil prices to slide notably, the group may need to surprise the markets by announcing an increase in its quotas. There is also chatter that they may double production in November but keep it unchanged in December. However, we don’t see this as a material change and we would expect the effect, if any, on oil prices to be temporary.

As for the speakers, besides BoE Governor Andrew Bailey, who will present the Inflation Report after his Bank’s decision, we will get to hear from ECB President Christine Lagarde, and ECB Executive Board members Frank Elderson and Isabel Schnabel.