A week after the Fed decision to hold rates, markets are still looking for evidence of the rate path that will be followed this year. Yesterday, Chicago Fed President Charles Evans said that the Fed’s “dot plot”, in which members lay out their growth and interest-rate expectations, was too aggressive. Yet, the Fed still expects to raise rates twice this year despite financial markets pricing in one single rate hike. Regarding the U.S. outlook, Evans seemed pretty confident that inflation will reach the Fed’s target of 2%. In his view, the growth rate should print above 2% by year-end while the unemployment rate is likely to fall to 4.75%. In other words from Charles Evans’ standpoint, everything is on track.

From our side, we believe that the health of the U.S. economy is largely over-estimated. Debt is massive, unemployment is still declining but labour participation rates are as well. We believe job insecurity, hardly counted in the statistics, is on the rise. Massive intervention from the central bank has only created artificial growth. However, Evans’ optimistic comments underpin the dollar's strength helping to keep commodities (including gold and silver) at a lower price. Many countries, such as Russia and China, are going for gold right now, so does the Fed as it has growing concern that these countries could be selling more and more U.S. treasuries. Raising rates is not only about the true state of an economy, but also about the geopolitical map. For the time being, the dollar will remain strong against emerging countries, in particular vs. AUD and CAD. Today, Fed’s Patrick Harker and James Bullard will speak also. We definitely expect them to appear dovish but less so than financial markets.

South African inflation surprised to the upside (by Arnaud Masset)

Last week, the South African Reserve Bank increased its repurchase rate by 25bps to 7% in anticipation of mounting inflationary pressure. However, it was a close call as a few MPC members expressed concerns about the negative effects of high interest rate on the growth outlook. In the end it was a smart decision from the SARB as the CPI for February, released earlier this morning, came in well above median forecast, printing at 7% from 6.2% in January, while the market was expecting consumer prices to have risen 6.8%. In our opinion, it is crucial for the South African central bank to preserve its credibility by showing tenacity in its fight against rampant inflation. However, at some point, Governor Kganyago will have to let the economy breath as unsustainably high interest rates will seriously dampen domestic consumption, deteriorating the inflation outlook. The rand’s reaction to the CPI read was roughly muted, thanks to last week's rate hike. USD/ZAR is trading sideways between 15.20 and 15.30. On the medium-term the pair should trade between 15.00 and 16.30 as long as the political crisis remains.

EUR/GBP - Monitoring Resistance At 0.7928

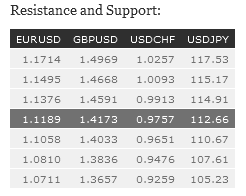

EUR/USD is decreasing slowly. Yet, hourly resistance still lies at 1.1376 (11/02/2016 high). Hourly support is given at 1.1181 (intraday low) while stronger support is located a 1.1058 (16/03/2016 low). Expected to show continued weakness. In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deterioration implies a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is weakening despite remaining in short-term bullish momentum. Yet, the medium-term technical structure is clearly bearish. Hourly resistance is given at 1.4514 (18/03/2016 high) while hourly support can be found around 1.4140 (uptrend channel). A break of strong resistance at 1.4668 (04/02/2016) is needed to show a reverse in the short-term momentum. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY's medium term momentum is clearly negative. Yet, on the short-term, the pair keeps on strengthening. Hourly resistance is given at 112.96 (17/03/2016 high). Stronger resistance is given at 114.91 (16/02/2016 high). Hourly support is given at 110.67 (17/03/2016 low). Expected to show continued increase in the short-term. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF's very short-term bullish momentum is increasing. Hourly support can be found at 0.9651 (11/02/2016 low). Hourly resistance is located at 0.9913 (16/03/2016 high). Expected to show further consolidation towards 0.9800. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.