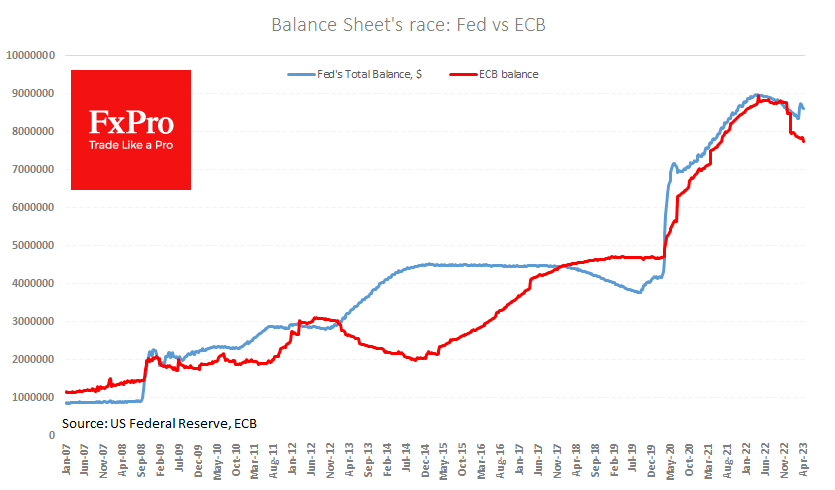

The Fed’s balance sheet shrank by 17.6 bn last week to 8,615 bn. Down 119bn over three weeks, the balance sheet is still 275bn higher than at the start of March.

Pumping liquidity into the financial system helps to support demand for risky assets, as it reduces stress in the financial system and creates more optimistic expectations for the banking sector and the market.

A shrinking balance sheet is only good news for the dollar in theory. In practice, the ECB is more disciplined in reducing its balance sheet. Moreover, comments from European officials are shaping expectations that the next ECB rate hike will also be a 50bp hike. Markets are currently pricing in a 69% probability of the Fed’s 25bp hike and a 31% probability of no hike.

The situation with US banks in March highlighted the Fed’s flexibility and willingness to change course as circumstances dictate. This is good news for the economy, commodities, and equity markets but also a negative agenda for the dollar. The US is clearly in the lead regarding policy tightening, while the ECB is raising interest rates and selling assets from its balance sheet more actively.

We expect this to continue, putting moderate pressure on the USD against its major rivals. On the macro monetary policy, 2022 is similar to 2002, when the EURUSD began a strong recovery, and the pair rose by more than 50% in less than three years.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fed Shrinks Balance Sheet at Slower Pace Than ECB

Published 04/14/2023, 05:35 AM

Updated 03/21/2024, 07:45 AM

Fed Shrinks Balance Sheet at Slower Pace Than ECB

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.