The media and financial talking heads continue to spout on the odds of a federal funds rate increase either in June, July or whenever. The poor employment report for May seems to have caused most analysts to rule out a June rate increase. The Federal Reserve FOMC members keep opening their mouths with conflicting statements on the economy, and FOMC Chair Yellen proclaiming "U.S. economy will continue to improve". Confused?

Follow up:

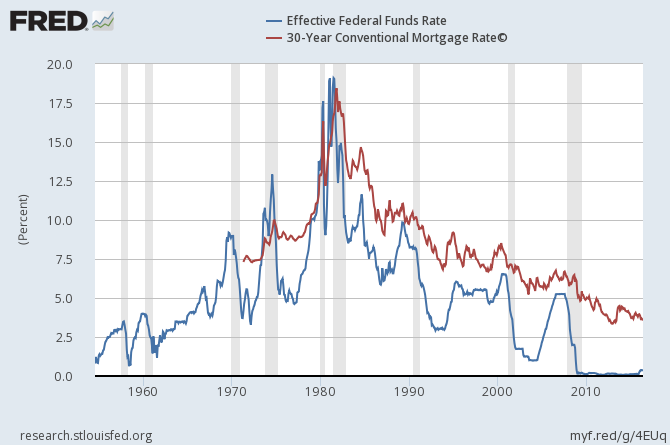

As I have posted previously, the Fed was negligent in not raising the federal funds rate earlier - when the economy was running on all cylinders in 2014. I have consistently forecast that beginning in 2015, the economy was slowing and that raising the federal funds rate coincident with a slowing economy is not logical on many levels.

The Fed loses credibility if they do not time actions relative to economic movement. The Fed wants us to believe they are on top of economic movements. Plainly, they are not. Unless you PERSONALLY sift through data daily without prejudicial lenses, you will be blinded by the chaotic headlines - and miss the backward revisions which have been generally downward.

All of us should want the future to be better than the present, but the Fed is in a Catch-22 situation as they believe presenting a negative economic forecast will be self-fulfilling. Better to say nothing than say the economy will worsen. How does that work with "forward guidance" and "transparency"?

And the economy continues to be heading downward. Some say a recession is possible. As always, I warn that when an economy is going slow - any bump can cause it to dip below the zero growth line. Still, there is little evidence that any dip into recession would be large - the USA snail economy is simply flirting with zero growth.

The Fedoholics are encouraged by 2Q2016 GDP forecasts from the Atlanta Fed and the New York Fed which are showing second quarter growth around 2.5%. This is a major improvement from first quarter growth currently less than 1 %. However, I reject GDP as an accurate metric of the economy - as it has too many elements which are not related to Main Street (and not to mention most of these elements are volatile).

There are flags which are showing the USA is close to zero growth:

- The Conference Board's Leading Economic Indicator (LEI) has historically dropped below zero in its six-month moving average anywhere between 2 to 15 months before a recession.

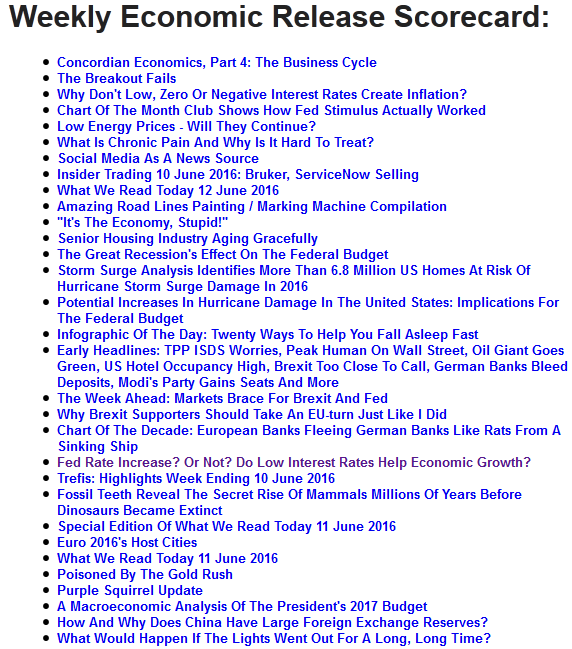

- Business Activity sub-index of ISM Non-Manufacturing - this index is barely over 55 (below 55 is a warning that a recession might occur, whilst below 50 is sometimes (but far from always) an indication a recession is underway).

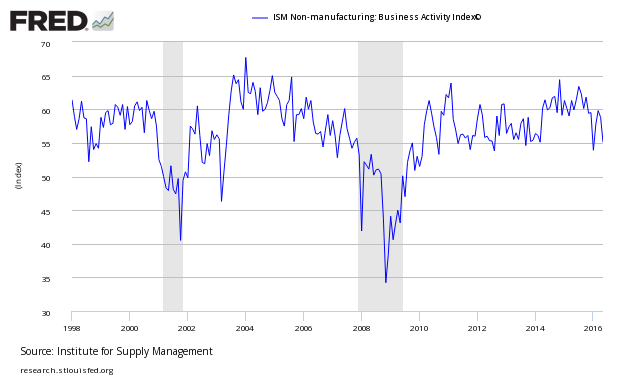

- Employment in the trucking sector is showing year-over-year growth approaching the zero growth line.

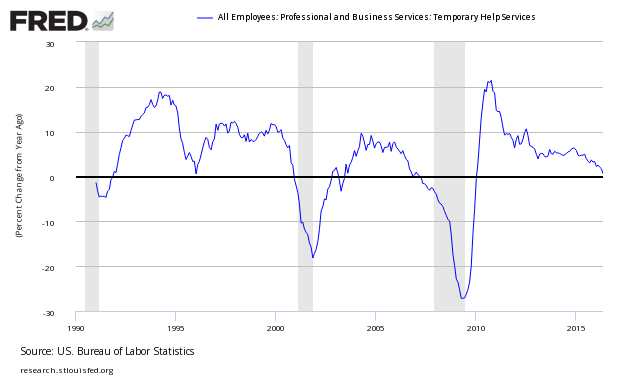

- Temporary help also is headed towards the zero growth line.

There are many more caution flags such as corporate debt, manufacturing, consumer credit, global trade, and transport counts. I see very few data sets with accelerating trendlines. Trends remain until they no longer remain - and are much more accurate in projecting the future than the smoke and mirrors non-analytical rosy economic projections from many economists.

The bottom line

Raising the federal funds rate anytime soon will make the actions and knowledge of the Federal Reserve look like the antics of the Three Stooges. Yet, I see little proof that the zero bound interest rates are beneficial (except in very short spurts). And there is some evidence (far from conclusive) that the zero bound rates are restraining economic growth.

Looking at Japan's adventure with the zero bound interest rates, I continue to worry that the zero bound is a dynamic contributing to weak economic growth. We know too little about the long term affects of the zero bound - and it is probable that baking extremely low interest rates into the economy will cause a withdrawal reaction when rates are normalized. The longer rates remain at the zero bound, the larger the withdrawal affects.

I would vote for the federal funds rate to be normalized and correlated to mortgage rates. A rise in the federal funds rate to 1.5% over a year may be positive for the economy. Continuing the zero bound is not driving economic growth.

Other Economic News this Week:

The Econintersect Economic Index for June 2016 marginally dropped into contraction. The index is at the lowest value since the end of the Great Recession. Note that an industrial output, non-monetary data set used to build the index has been swapped as the previous set became too volatile for accurate trending. Reflecting on the potential that a recession is underway (or soon to be underway) - I find the prospect unlikely (but not impossible). It is more likely the economic dynamics have slowed from "muddling along" to a "snails pace". The only group forecasting better economic growth is the self serving forecasts of the Federal Reserve - as well as the components of GDP which do not translate to a better world for those on Main Street. For the near future, one may need a microscope and a micrometer to measure any improvement, but further deterioration is needed to raise our assessment to probable that a recession has or soon will start.

Bankruptcies this Week: Hercules Offshore Inc (NASDAQ:HERO), Seventy Seven Energy

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: