Next week's FOMC meeting is the last big event of the year. The recent string of strong data has prompted more talk about the Fed tapering. While this is the main focus of course, the FOMC will also update its forecasts.

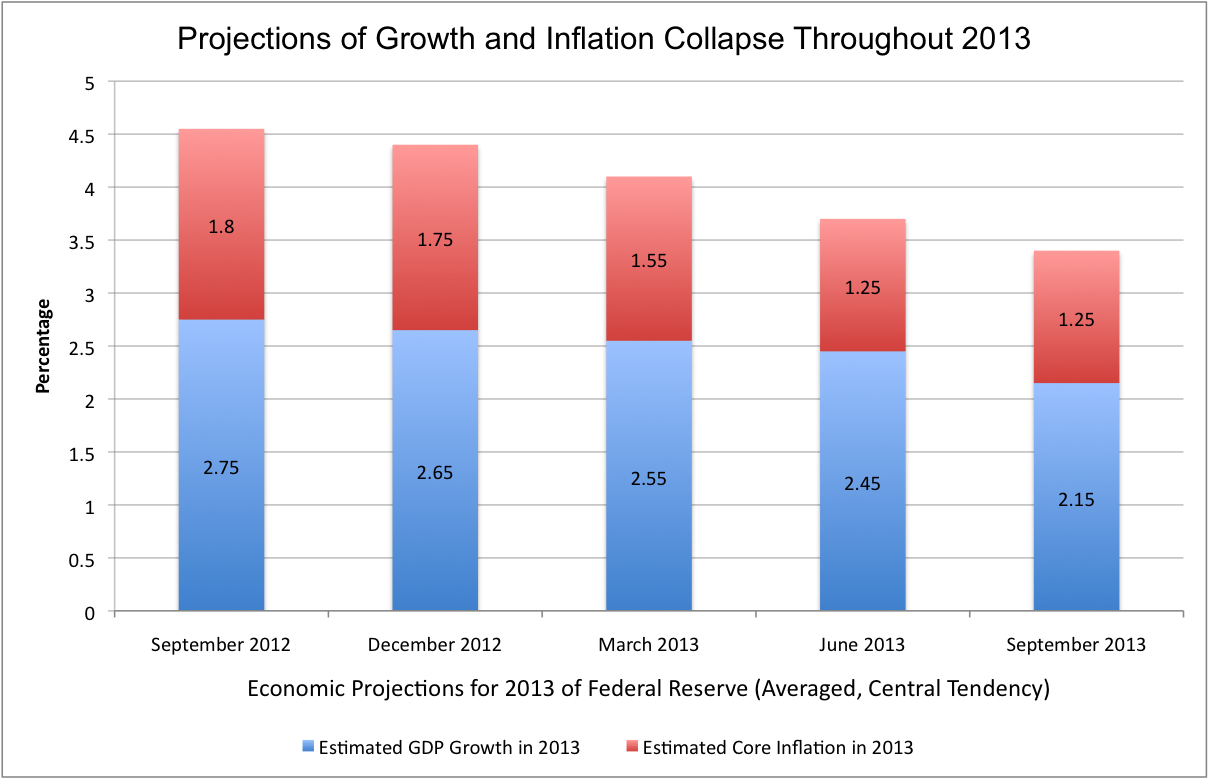

This Great Graphic that tracks the Fed's central tendency forecasts for growth and inflation was compiled by Mike Konczal and reprinted in the Atlantic. In every quarterly update since last December, the FOMC has shaved its growth forecasts. It also brought down its inflation forecasts, except for the last update provided this past September.

One of the reasons we did not expect the Fed to taper in September was that we anticipated the FOMC to lower its growth forecasts. To be sure, there were other reasons too (low inflation, fiscal uncertainties, softer job growth, and changes at the Fed). At next week's meeting, it is possible that the Fed cuts its forecasts yet again. In Q3, had grown 1.8% from a year ago and this, of course, is with the benefit of one of the largest quarterly increases in inventories on record. It seems like an anomaly.

Although this week's data underscores a rebound in consumption from multi-year lows in Q3, and the inventories have yet to be drawn upon, Q4 growth is now seen near 2% or a little above. The FOMC may lower its GDP forecast once again.

The core PCE deflator was up 1.1% from a year ago in October. The base effects warn of weaker readings in the final two months of the year as last Nov and Dec's 0.8% and 0.5% increases drop out and are replaced with 0.1% or 0.2% readings. This point has yet to be acknowledged by most observers, and especially by those who are thinking that the recent economic data (jobs/ retail sales) and the budget agreement will lead to Fed tapering next week. The FOMC may shave its inflation forecasts, which will be more of an accounting function (taking in to account current information) than much of a projection. And while policy must be forward looking, cutting growth and inflation forecasts at the same meeting as tapering could complicate the communication process unnecessarily.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.