Down, up, and down again – so go precious metal prices since the release yesterday of the Federal Open Market Committee’s latest verdict on the near-term direction of US monetary policy. The FOMC decided to prolong “Operation Twist” – sales of short-term Treasury securities, with the cash generated used to buy long-term Treasurys – but stopped shy of announcing QE3 or any other new moves to boost bank reserves. Stocks and commodities have reacted poorly to this news, while gold, silver, platinum and palladium have also slipped lower.

PIMCO’s Mohamed El-Erian has a withering verdict on the Fed’s latest move:

“What this continued Fed activism will do is to continue altering the functioning of markets, contaminate price discovery and distort capital allocation. Already, the viability of several segments – from money markets to insurance and from pension provision to suppliers of daily market liquidity, all of whom provide financial services to companies and individuals – has been undermined. The Fed has also conditioned many market participants to believe in a policy put for both equities and bonds. . . . And other government agencies are relieved to have the policy spotlight remain away from their damaging inactivity.”

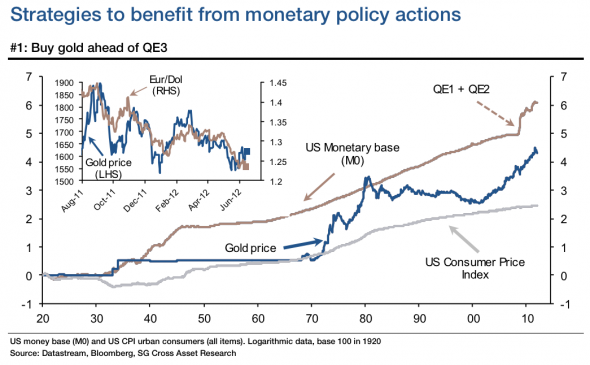

Figures out today from HSBC show that manufacturing activity in China contracted for the eighth consecutive month in May, while German composite PMI has also fallen over the last month, and is now at its lowest level in three years. With economies all over the world struggling, big inflationary policy responses from central bankers remain inevitable. As the chart below from Bloomberg indicates, owning gold remains a smart strategy for dealing with the fallout.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fed Playing Coy – For The Moment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.