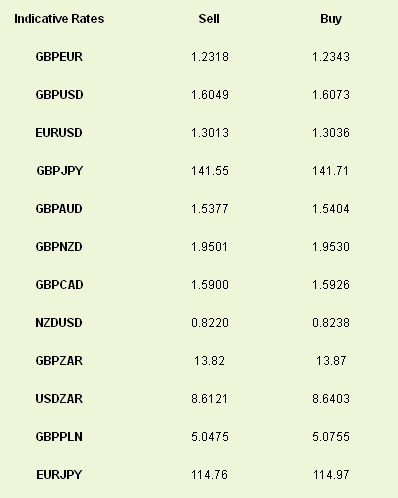

The post-Fiscal Cliff postponement decline continued yesterday with currency pairs back to trading below levels seen pre-Christmas. EUR/USD has scythed lower towards 1.30 whilst GBP/USD is homing in on the 1.60 level like a missile falling from the sky. High yielders such as the AUD, CAD or NZD have once again kicked on higher as investors continued to hunt for yield. Chinese data has been a big driver of this with the services PMI for the country showing an increase to 56.1 from 55.6.

Service numbers come out over the course of the day from basically everywhere across the globe and will dictate market sentiment for the large part of the day before the key number of the session. Key PMIs are from Italy (08.45), France (08.50), Germany (08.55), UK (09.30) and the U.S. (15.00).

Today’s key announcement is the Non-Farm Payroll number from the U.S., due at 13.30 GMT. Following yesterday’s ADP private sector reading that showed an increase in employment of 210k vs 140k, banks have been quick to revise their expectations for the official government figure higher. The market now estimates that 153k jobs were added in the U.S. in December. We expect to see a bigger number promote dollar strength and a weaker number dollar weakness following a slight degradation of the relationship in the dollar and risk in recent sessions.

Our thinking is that given the association the Fed now has between the unemployment rate and its own monetary policy, ie that higher employment will lead to a quicker tightening of policy and a stronger dollar, that the opposite also holds true.

The latest Fed minutes published overnight seem to support this, with “several” members thinking “that it would probably be appropriate to slow or stop purchases well before the end of 2013, citing concerns about financial stability or the size of the balance sheet.”

While this looks and smells like hawkishness, we don’t think that we will see a sudden switch to tighter policy but instead just not increasing the flow of purchases.

Even so, it does suggest and lead us towards market pricing that will likely see a breakdown of the risk-on / risk-off market behaviour that has been so prevalent in the past two-to-three years and lead to an increased reliance on the individual performance of each respective economy. That is likely to increase volatility and the unpredictability of currency markets going forward.

While most people seem to be trying to stay off the booze in January, the JPY is getting hammered harder than Ollie Read stuck in the Guinness factory at the moment. There seems to be little respite forthcoming either and dips in XJPY will be bought hard.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fed Not As Dovish As Thought As ADP Shows Good Job Gains

Published 01/04/2013, 05:46 AM

Updated 07/09/2023, 06:31 AM

Fed Not As Dovish As Thought As ADP Shows Good Job Gains

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.