The US Federal Reserve (Fed)has been in the spotlight recently.There have been questions about how the Fed would respond to President Trump’s economic policies, especially his projected fiscal stimulus. There has been a debate about the timing of the next rate hike in light of strong data recently. And there has been a focus on the Fed’s balance sheet and the strategy to reduce it, triggered by comments from a number of Fed officials. We address these issues in this piece. We reiterate our view that we expect two rate hikes from the Fed in 2017, starting in the first half of the year. The Fed is unlikely to start reducing its balance sheet before mid-2018.

How many Fed rate hikes are expected in 2017? We believe that macroeconomic conditions warrant two. The US economy is expected to grow by 2.0% in 2017. This should reduce the unemployment rate by 0.2% to 4.5% at end-2017 compared to a year earlier and core inflation is expected to rise by 0.1% to 1.8% over the same period. Using the Fed’s standard rule linking interest rate decisions to inflation and unemployment (the so-called Taylor Rule), the magnitude of improvement in economic conditions suggest two rate hikes. Financial markets are in line with this logic, as they are also currently pricing in two rate hikes.

When is the Fed expected to raise rates next? Encouraged by recent strong data on retail sales and consumer price inflation, markets have revised up the probability of a rate hike in the next meeting in March to 80%, up from 24% three weeks ago. However, the Fed may decide to wait until May or June, as this would give them time to get more clarity on Trump’s economic policies and how they might impact the economy. Whether the actual hike would happen in March or three months later in June would not matter a great deal, especially if the total number of rate hikes is left unchanged.

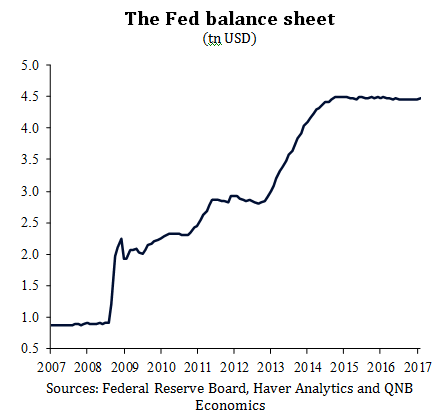

(tn USD) Sources: Federal Reserve Board, Haver Analytics and QNB Economics

More importantly, and potentially more disruptive for financial markets, is the third question about the Fed’s balance sheet. After the Fed pushed short-term interest rates close to zero in late 2008, its main tool for tackling the recession became reducing long-term interest rates through multiple quantitative easing (QE) operations. These involved purchasing large quantities of government bonds and government-backed securities, which resulted in the Fed’s balance sheet ballooning from around USD900bn to about USD4.5tn currently. QE was exceptional in its scope and size and was always expected to be unwound at some point.

Some have called for the unwinding process to start soon. Reversing QE would increase long-term interest rates, which could provide an alternative method of monetary tightening compared to controlling short-term rates. This should prove particularly attractive as the US dollar is less sensitive to long-term rates than short-term ones, which means that reversing QE could provide the required tightening in lending rates without the associated appreciation of the dollar which hurts exports. In addition, the size and the expansion of the Fed’s balance sheet have attracted political criticism and reversing QE could help fend off these attacks.

But there are also arguments against unwinding QE too soon. First, despite the Fed’s best intention to use “reverse QE” as an alternative to interest rates, markets might interpret the rush to reverse QE as an indication that interest rates would rise at a faster pace than expected. This would lead to a stronger dollar and trigger capital flight out of emerging markets, exactly the same dynamics that unfolded in 2013 with the “taper tantrum”. Second, the impact of both QE and its reversal are less well-understood than that of short-term interest rates. The Fed might want to build up sufficient space to allow it to reduce interest rates meaningfully should reversing QE have negative consequences. Hence, the Fed’s insistence that unwinding its balance sheet will not begin until the tightening of interest rates is “well under way”. Third, despite political criticism, there is little evidence showing that a large central bank balance sheet is harmful for the economy. Central banks in the UK, Japan and Switzerland all maintain larger balance sheets than the Fed relative to the size of their economies.Yet there are few if any negatives associated with maintaining large balance sheets in these countries.

In light of these arguments, we do not think the Fed will rush to reverse QE and reduce its balance sheet. As a result, we do not expect this process to begin until sometime in 2018. In the meantime, the Fed will continue raising short-term interest rates in a gradual manner. This means two rate hikes for the whole of 2017.