by Chaim Siegel of Elazar Advisors, LLC

Many may not have noticed the amazing move the stock and bond markets made yesterday. “What move? I didn’t see any major moves,” you may ask. That’s just it. The Fed news yesterday could have easily hit markets. Markets doing nothing was an incredible move when compared to the news.

Bad news, good “action” is bullish. We’ll explain.

What Did The Fed Say Yesterday?

The Fed, in yesterday’s FOMC minutes released at 2PM Eastern, gave painstaking detail for the first time ever about how they are going to wind down their $4+ trillion balance sheet. The Fed has been in there buying for almost a decade. That’s been supporting the market which is one main reason why rates are so low.

Removing this major buyer is a major bond and stock market risk.

Yesterday they said:

“It likely would be appropriate to begin reducing the Federal Reserve’s securities holdings this year.”

Prior to the minutes there had been questions if they would do it this year or announce it this year but start some time next year. Yesterday they clarified it would be this year.

And they gave details on how they are going to constantly lower their bond buying by reducing the amount they can buy every three months.

Why Could That Have Hit Bonds?

Back in 2013 the Fed announced a pulling back of bond buying which caused the famous “taper tantrum.”

Bonds were killed in the days to follow.

And yesterday? No Tantrum.

Above, the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT). No tantrum here. After the 2 PM release of the minutes, bonds spiked higher and kept going.

Maybe Bonds Held Up Because Of Rate Hike Expectations? Nope

Those Fed minutes reports are long. Maybe traders didn’t have time to read all 12 pages before the market’s close. Maybe they missed the Fed calling off rate hikes, or something. Nope.

Yes, the minutes are long but the key measure we look for if the Fed is ready to hike is their view on Fed Funds Futures.

The Fed wants to take Fed Funds rates to 3% from the current sub-1% over the next couple of years. They want to do it when the markets are ready.

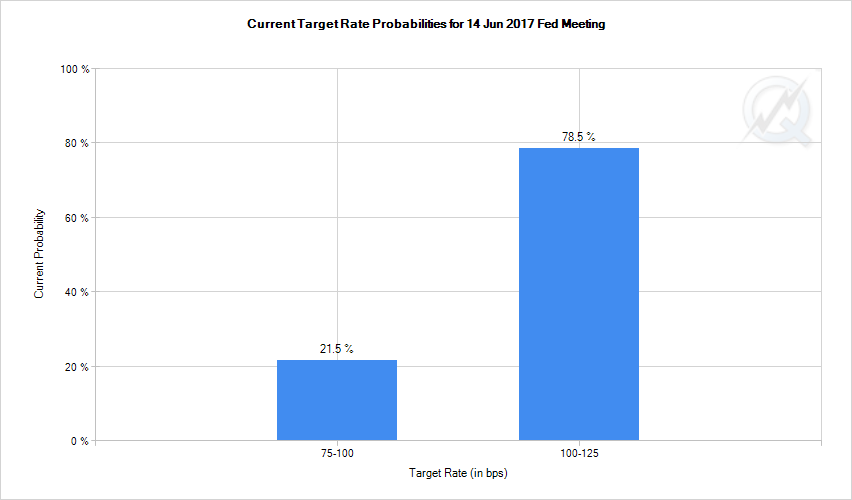

The markets are ready expecting an almost 80% chance of a hike in June.

In fact the Fed made mention that the market’s expectations are high. The Fed said markets, “saw a substantial probability of an increase at the June FOMC meeting.”

That’s code that the Fed knows we’re ready for a rate hike in June and so they’ll deliver on it.

Fed taper, and a rate hike, and still no taper tantrum yesterday. Bonds lift. Stocks lift. Amazing.

Great, Great Action

If you’ve been following our calls you know that we very much care about the art of “action.” Action is the trading mechanism to compare what should happen to what does happen. Therein you find major clues about markets.

Bonds should have been creamed yesterday at 2 PM. That could have hit stocks. But nope, nothing happened.

That was the amazing move the markets made yesterday. No move at all.

Let’s look at the Dow.

Anybody see any bad news in this chart? Nope, nothing here. “Bad news, great great action.” This is bullish.

What A Difference A Week Makes!

If you recall, our market call last week was knee deep in fear. Here’s the Dow chart we showed last Friday of what the market was going through the day before.

Couldn’t have been. Never happened. Fake news.

The Dow couldn’t have been at 20609 a week ago. It was. Go look.

In that report we said:

“As long as our three main fundamental indicators, earnings, jobs and GDP, are moving up, we’d use volatility as buying opportunities.”

Now, just a week later we have blue skies, blooming flowers and up-markets. It’s a beautiful view.

Conclusion

It’s a new world. Taper tantrums are now things of a distant past in a land far far away. Yesterday’s “action” is a bull market’s dream. Bulls enjoy.

Disclaimer: Securities reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium members and could differ from the above report.

Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.