a very volatile day of trading with the USD surging late in the day on the back of hawkish minutes from the FOMC. Some members stated that it would be appropriate to slow or end asset buying in 2013. Stopping QE is a necessary prerequisite to eventually raising interest rates. ADP Employment beat expectations in December +215k vs. +133k forecast. Looking ahead, December NonFarm Payrolls forecast at 150k vs. 146k previously.

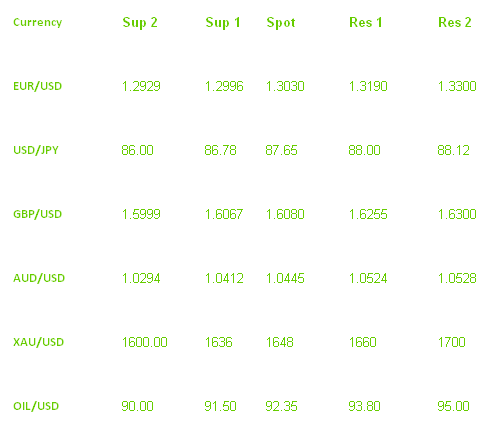

The Euro (EUR) the EUR/USD sell off, which began on the night before on U.S. debt ceiling worries has turned into a rout today with another heavy day of selling. Support at 1.3100 was broken and we closed at 1.3050 and in striking distance of 1.3000. The outlook is mixed with the recent post Greece/Spain Drama Rally struggling to get past 1.3300 and some analysts looking for USD strength in 2013. The Sterling (GBP) was weaker than the Euro and fell the most in one trading day since 2011. The main catalyst was the USD strength post-FOMC minutes but also a growing feeling in the market that a short-term top is in place for the EUR/USD and GBP/USD. Looking ahead, EU PMI Services forecast at 47.8 vs. 47.8 previously. Also December Inflation Flash forecast at 2.1% vs. 2.2% previously.

The Japanese Yen (JPY) gains against the USD/JPY where limited however with recent buying already putting the major in overbought territory. After the FOMC minutes yesterday we saw the 10-Year Yields on U.S. debt tick higher as investors believed we moved closer to normalization of interest rates. The USD/JPY immediately tracked this change in Yield and is a key factor for movement these days. Australian Dollar (AUD) the AUD/USD was mixed with a brief rally above 1.0500 before the FOMC sent the commodity currency back to 1.0450. The Aussie is getting support however from Iron Ore which has gain 70% since the China slowdown scare low.

Oil And Gold (XAU) Gold was crushed lower as the market responded to the hawkish change in FED tone and U.S. bond yields. Support at $1660 was broken in Asia and we have fallen back to $1645oz so far. Oil came off highs above $93 as USD strength countered optimism about global growth in 2013.

Pairs To watch

- EUR/USD Upside under threat? Market Caught Long?

- XAU/USD to retest $1700 as buyers gain control?