- The Fed faces a finely-balanced decision between raising interest rates 25bps and holding steady amidst banking turmoil.

- Markets and economists are leaning toward a 25bps rate hike.

- The Summary of Economic Projections and Chairman Powell’s press conference could lead to more volatility than the monetary policy decision itself.

When is the March FOMC meeting?

The Federal Reserve’s FOMC will conclude its 2-day meeting with the release of its monetary policy statement and Summary of Economic Projections (SEP) at 2:00pm ET on Wednesday March 22. Fed Chairman Powell will follow up with a press conference at 2:30pm ET.

What are the expectations for the March FOMC meeting?

After an outbreak of stress in the banking system has thrown a potential wrench in the Fed’s plan to keep raising interest rates throughout the first half of the year.

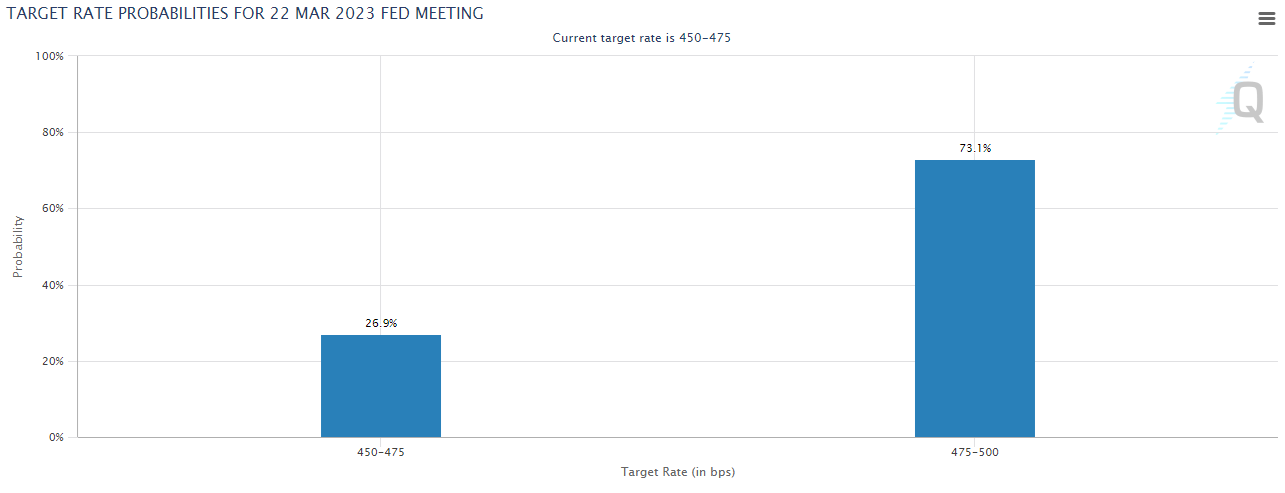

Despite those concerns, most economists are still expecting a 25bps interest rate hike up to the 4.75%-5.00% range. Traders generally agree, with the CME’s FedWatch tool showing that the Fed Funds futures market is pricing in about a 75% probability of a 25bps rate hike and a roughly one-in-four odds of no change to interest rates:

Source: CME FedWatch

March FOMC meeting preview

With inflation still far from the Fed’s 2% target (Core PCE recently printed at 5.4% year-over-year, up from last month’s 5.3% reading), we agree with the market’s expectation that Jerome Powell and company are likely to deliver a 25bps interest rate hike this month, though we certainly wouldn’t be shocked to see the central bank hold fire for now.

Much like the BOE did last year, the Fed is in a position to emphasize that its ongoing fight against inflation remains its top priority with an interest rate hike, while separating its efforts to support financial stability, which may be better addressed through macroprudential policies and/or slowing the rate of quantitative tightening to provide ballast to banks. Either way, we wouldn’t expect the statement or Chairman Powell to provide any sort of direct comment on the likelihood of another rate increase in May.

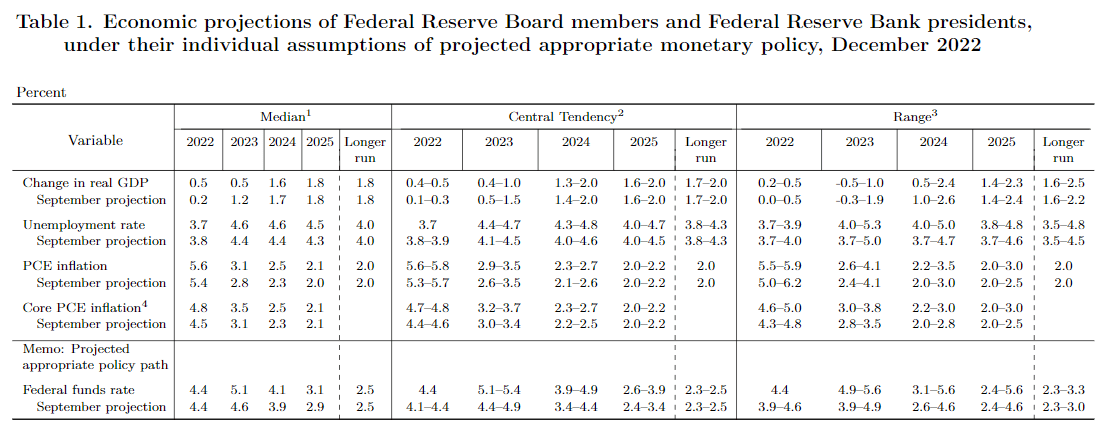

Outside of any immediate changes to interest rates or its balance sheet strategy, the Fed will also provide its quarterly economic projections, including the always-interesting “dot plot” of projected interest rates. With markets pricing in a full -50bps in rate cuts from the current level by the end of the year, traders will be keen to see if the Fed shows signs of wavering on its higher-for-longer outlook for interest rates.

At a minimum, it seems unlikely that the Fed would raise its median projection for interest rates to top out at 5.1% at the end of the year.

Source: Federal Reserve

Finally, Chairman’s Powell may provide the meat of the day’s volatility. Mr. Powell always seeks to provide additional insight into the FOMC’s outlook and decision criteria, and of late, that has often led to market reversals as he injects an element of nuance into the forward outlook. For this meeting, we would expect Powell to open the door toward a pause in the hiking cycle and re-emphasize the central bank’s data dependence.

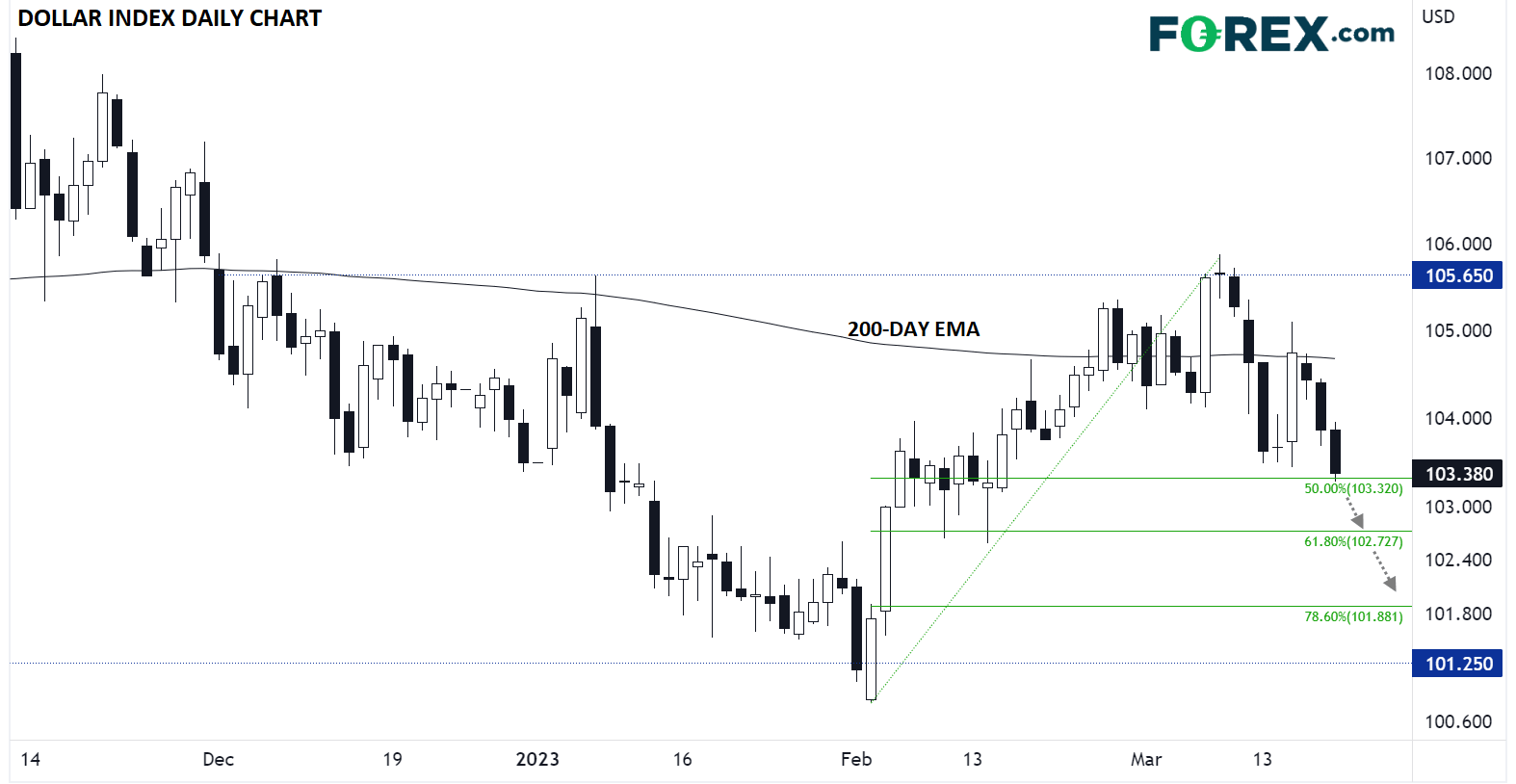

US dollar technical analysis – Dollar Index at 1-month lows

As of writing, the US dollar is testing its lowest level in over a month in the mid-103.00s after topping out near the yearly highs in the mid-105.00s a couple weeks back. The medium-term trend continues to point lower, so if Chairman Powell and Company do not deliver a rate hike, the greenback is poised for a quick drop toward 102.70 (the 61.8% Fibonacci retracement of this year’s rally) or 101.90 (78.6% Fib) next.

Meanwhile, the dollar index may still remain capped even if the Fed raises interest rates, with resistance likely to come in around the 200-day EMA in the 104.70 area as traders remain convinced that interest rates cuts are still coming this year.

Source: StoneX, TradingView