Yesterday’s gold market action was disappointing, but from a technical perspective, the recoil from the $2790 cash market highs was expected and normal.

Gold, silver, and mine stock investors should be prepared for more discomfort, as this week features the Fed meeting tomorrow, the US GDP report on Thursday, the PCE inflation report on Friday, and the Indian budget on Saturday. It’s a big week!

These events often bring downside pressure to the price. Gold could easily trade well under Monday’s low but there is some potential news of significance in play.

News that could be the most significant since US citizens had their gold confiscated by their diabolical “Gmen” in 1933.

Is it real? The post appears to be valid, and if so, I’ll dare to ask all gold, silver, and mine stock investors to rise… and give new Treasury Secretary Scott Bessent the most thunderous standing ovation in the history of America! Even if the X post isn’t Scott himself, the actions mentioned are exactly what America needs.

The next golden age begins, and in time an ounce of gold could have more purchasing power than a Bitcoin has now, but investors still need to use Grade A tactics… to prosper with professionalism.

The daily gold chart. Stochastics (14,7,7 series) is overbought. It can stay overbought, but eventually, it will dip.

For gold, a pullback to the demand line or the apex of the continuation triangle is likely as this week progresses. From there, a huge rally should see gold surge to the triangle target, which is at least $3000!

The US Dollar's technical action is in sync with gold, meaning some short-term strength for the dollar is likely as this week’s events play out… but from there, it likely takes a major hit.

What about rates? The US rates chart also looks toppy. A small H&S top is in play and the neckline is being tested. In the long term, government tariff taxes and ramped-up deportations are going to put upward pressure on US domestic prices and wages. Trump’s agenda involves a lot of new spending and the cuts in government size are unlikely to be enough to reduce the debt very much.

That means Scott Bessent is probably going to make some kind of gold revaluation a priority.

Mainstream media focuses on Scott’s pro-bitcoin stance, but during his confirmation, he mentioned nothing about it and then the glorious X post on gold appeared.

The bottom line: Bitcoin is like a toy piggy bank. It’s a math equation reward and an exciting way to store wealth (until “beyond quantum” computers render it worthless?) but transactions are far too slow for it to work as actual money. No customer or business will wait for 10 to 60 minutes for proof of a transaction, which is how long they must wait with Bitcoin.

Scott understands the superiority of gold as money and the key role it can play in restoring sanity to the American government.

In the East, all gold bugs own gold. In the West, some only own silver or mining stocks, based on a scheme to “outperform gold” and make “big fiat profits”. Silver and the miners do outperform gold at times, and often quite significantly, but the main plan of action should be to use them to accumulate more and more supreme money gold rather than more failed fiat.

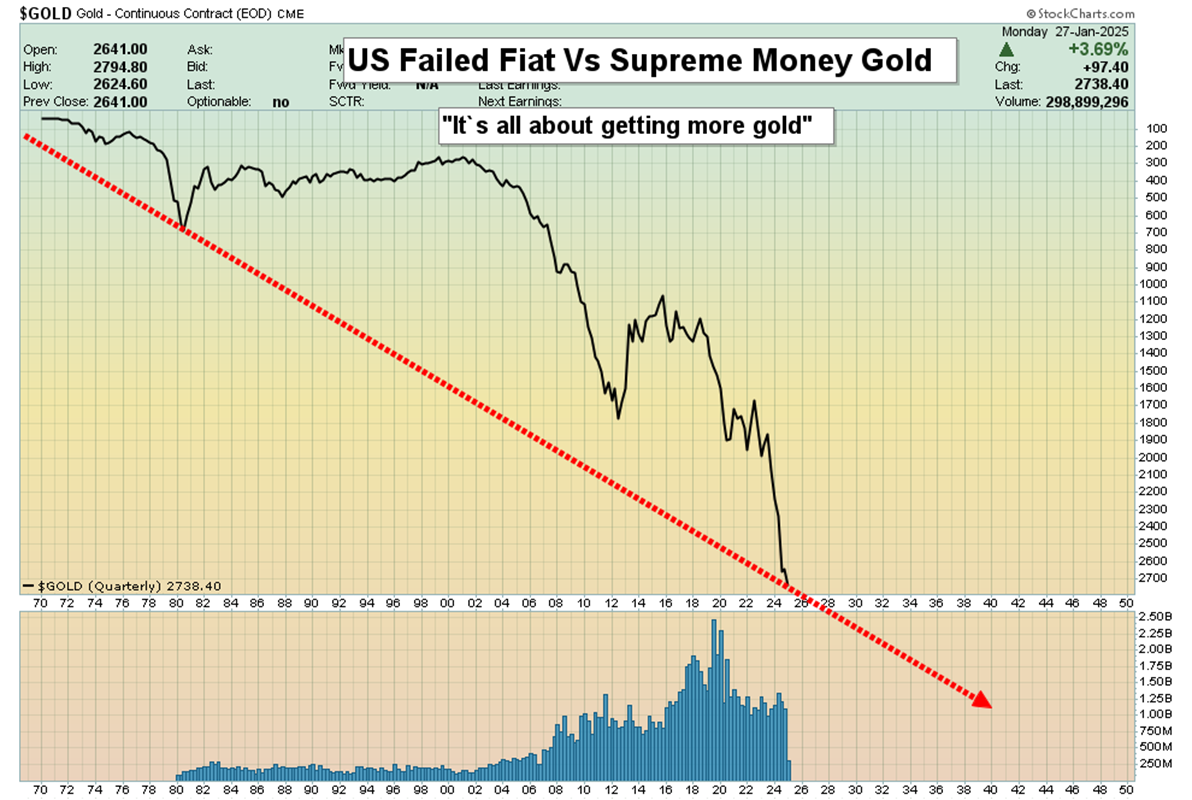

A big-picture view of gold versus fiat, what is likely the most important chart in the world. As the sign says, “It’s all about getting more gold."

The weekly chart. Gamblers can buy the $2740-$2700 range, and investors could buy the $2600-$2550 zone. That’s about a 5% price sale from the $2800 area high.

A look at silver, the enticing daily chart. As noted, there’s a nice bull wedge in play and within it, an inverse H&S pattern is developing

What about the miners?

Like gold, Stochastics is overbought and likely to pull back.

If that happens, the pullback would create the right shoulder of a significant inverse H&S pattern. That pattern could unleash a rally that targets the $43 area highs. Gamblers (and investors with no miners) should buy any potential right shoulder low.

As noted, Trump’s tariffs and mass deportations will put significant upside pressure on US product prices. Until “Tman” Scott ushers in the next golden age with his revaluation play, the rising US government debt and Mainstreet inflation will cause interest rates to also rise quite significantly.

That rise will essentially annihilate the US stock market, which is probably already in the final throes of a massive Elliott “Super Wave Five”. It would also create an institutional tidal wave into gold and silver mining stocks… a tidal wave that is likely to make the 1970s bull run look like a warm-up act.

It’s arguably the most glorious of all market charts at the current time. There’s a massive C&H pattern with a bull wedge as the handle, and within that, there is inverse H&S action. Stochastics (14,5,5 series) is flashing a thunderous buy signal. The bottom line: It’s a glorious time for gold, silver, and mine stock investors of the world. In China, it’s the year of the snake, and this awesome chart shows GDX (NYSE:GDX) coiled… and ready to launch a strike at the $60-$65 area all-time highs!