- A quote from a Zerohedge source who trades bonds for a big bank, in reference to the fact that professional bond traders are expecting a possible severe sell-off in the bond market.

Having been an institutional bond trader for nine years, I know what it's like to be sitting on big positions ahead of seeing a big sell-off coming and before the entire market sees it coming. You can't protect yourself from what you see by the time the market sees it because by then it's too late to do anything about it. When I read the first couple of sentences of the quote above, I knew exactly what that person was talking about. I can guarantee you that the smart "inside" money sees something really ugly coming and that's why bond yields have been moving higher quickly over the last month, despite the fact that the Fed has been buying over 50% of all new issuance and now owns 30% of the entire Treasury bond market.

Speaking of the bond market, today the Treasury auctioned 2-yr Notes. The only problem is that it wasn't really an "auction" in the true sense of the word because the Fed-backed primary dealers of Wall Street were forced to buy 65.4% of the bonds issued, otherwise it would have taken substantially higher rates to induce outside buyers. Make no mistake about it, there will be severe "collateral" damage that will occur systemically as a result of the unprecedented Fed intervention in the bond market via QE - that is exactly what the last sentence in the quote above alludes to...

On Friday, the Government reported durable goods orders for April. They were reported to be up 3.3% vs. March. Please note that this is a "seasonally adjusted, annualized" rate that is calculated using some computer model voo doo not open to public inspection. The decline from Feb to Mar was revised higher from -5.7% to -5.9%.

The reason I bring this up is that if you go through the individual categories that comprise the Government's durable goods report under the "not seasonally adjusted" category, you'll see that nearly every single line item in both new orders and shipments declined, some substantially, from March to April. Clearly I'm not making any of this up because the truth is right there in black and white - in the Government's own report.

The point here is that what gets reported in the headlines in the mainstream media is often completely different from the actual facts. I don't care about "perception" and "expectations management" and all that other nonsense, because eventually over time markets become self-correcting based on facts and truth. History as spoken many times - and many times loudly - on this matter. Unfortunately, history is likely on the verge of giving our country a "lesson" in facts vs. fiction that will be extraordinarily painful for most people. Again, I defer to the quote at the top.

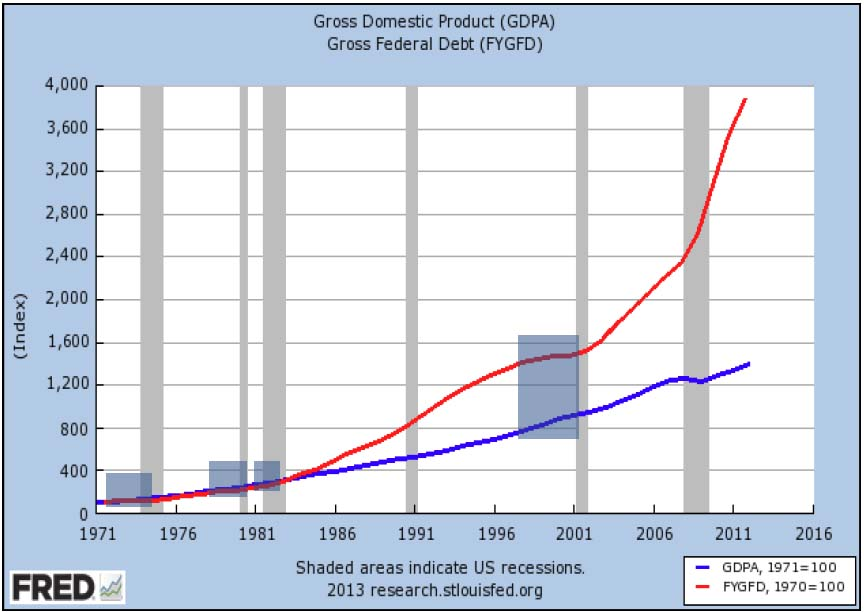

Meanwhile, I thought I would greet everyone to summer with another lesson in truth with one chart - there's really not anything that can be said about this chart that is not conveyed by the chart by the chart itself (I think I sourced this from Zerohedge):

Again, if you need any commentary on this chart, re-read the opening quote at the top...

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fed Intervention In Bond Market: Collateral Damage To Come?

Published 05/29/2013, 04:09 AM

Updated 08/21/2024, 03:35 AM

Fed Intervention In Bond Market: Collateral Damage To Come?

There are forces developing over the next few months that may push the BOJ and the Fed to take some extraordinary actions. That these two big CBs are facing the same potential outcome, at the same time, is troubling for me. I see this evolving story as a possible turning point. The key CB's will have gone from Offense to Defense. For five-years the CBs have enjoyed being on the offense. They have successfully controlled things so far. But I can't imagine how they can continue to be "successful" when they are forced to defend (versus lead) the bond markets.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.