The Federal Reserve left interest rates unchanged yesterday, which Janet Yellen insisted wasn’t because the central bank is downgrading its outlook on the economy. Quite the contrary, Fed Chair Janet Yellen advised. “Our decision does not reflect a lack of confidence in the economy,” she said in a press conference on Wednesday. Economic growth is holding steady at a “moderate pace,” by her reckoning. But the Treasury market isn’t wholly convinced. Maybe that’s because the Fed’s economic forecasts were flat to slightly lower vs. the June projections.

The muddled message was echoed in the official statement from the Fed. “The Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives,” the Federal Open Market Committee explained.

Meantime, there was a mild downside bias in the Fed’s revised economic forecasts. GDP growth for all of 2016 is projected to rise 1.8%, down from June’s 2.0% estimate. The GDP projections for 2016 and 2018 held steady at 2.0% vs. the previous numbers, but the longer-run GDP predictions dipped to an annualized 1.8% gain from 2.0% in June.

Note, too, that the official forward-looking Fed funds rate estimate ticked lower across the board. The outlook for 2017, for instance, calls for a Fed funds rate of 1.1%. Although that’s up substantially from the current 0.25%-to-0.50% rate, next year’s forecast fell 50 basis points from the Committee’s June projection—a slide that raises questions about Yellen’s upbeat outlook.

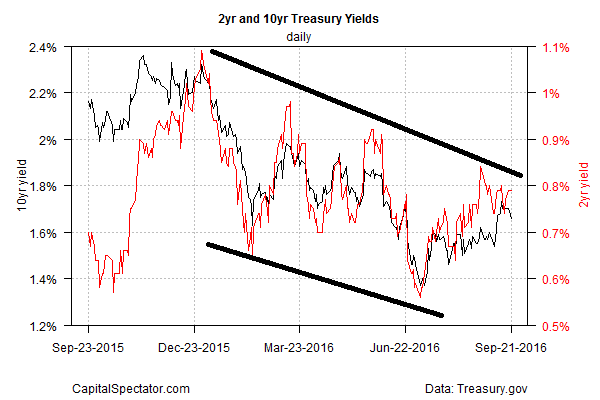

Overall, the Fed’s newly minted numbers suggest that the macro trend may be slowing, if only slightly. Treasury yields appear to be in line with that outlook. Although the policy sensitive 2-year yield remained unchanged yesterday at 0.79%, the benchmark 10-year yield slipped to 1.66%–the lowest since Sep. 8, based on daily data via Treasury.gov.

The bottom line: the downside bias in Treasury yields that’s been in play for much of this year for 2- and 10-year yields remains intact. Perhaps Yellen’s upbeat spin on economic activity will eventually persuade the bond market to climb on board with the official view.

By some accounts, tighter monetary policy for later in the year is in fact still a possibility. “The Fed is clearly positioning the market to tighten in December,” Jack McIntyre, a portfolio manager at Brandywine Global, tells MarketWatch.

The hawks say that the recent weakness in economic growth is only temporary. The surprising decline in retail spending and industrial output in August, for instance, will soon give way to firmer numbers.

In fact, that’s the message in the Atlanta Fed’s GDPNow model, which is currently projecting a substantially stronger growth rate for third-quarter GDP: +2.9% vs. the roughly +1% pace in each of the previous three quarters (seasonally adjusted annual rate).

Maybe so, but the Treasury market remains skeptical. What might bring the bond market on board with the Yellen’s relatively brighter outlook? Hard data, of course. The main event, as usual, is the payrolls report—the next update is the September release, scheduled for Oct. 7.

Meantime, yields will likely remain in a holding pattern as the market digests Yellen’s upbeat analysis that’s neither completely wrong nor convincingly right.