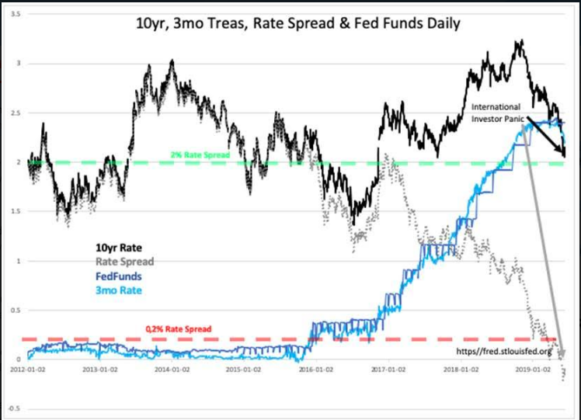

Panic has driven the 3-month/10-year Treasury spread to -0.18% (negative 18bps). The talk is about the Fed cutting rates, when and how much. Despite this becoming the dominant topic history indicates that the Fed follows 3mo Treasury rates(T-Bill rates) by lagging shifts in FFunds rates up to 30dys vs 3mo Treasury market rates.

Current market psychology has 3mo rates at 2.14% v FFunds at 2.4%. Based on recent Fed actions, we could see the Fed adjust FFunds lower by 0.25% shortly.

While a host of positive economic activity indicate continued expansion, i.e. no global slowdown as repeated daily in the media, the Fed, following its historical pattern, is likely to cut.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.