The Federal Reserve has increased rates by 75 bp and has signalled a willingness to maintain this pace of tightening at the July FOMC meeting. The Fed funds rate will end the year well above 3% with the dollar set to stay strong, but moving harder and faster comes at an economic cost. Rising recession risks mean rate cuts will be on the agenda for summer 2023

1.5-1.75% The Fed funds target range

75 bp hike with much more still to come

After implementing the first 50 bp hike in 22 years in May, the Fed has followed up with the first 75 bp increase since 1994 as the central banks tries to dampen inflation pressures with greater vigour. Markets had been moving in the direction since the release of the May inflation data and the jump in longer-term inflation expectations reported by the University of Michigan, gathering momentum on reports the Fed was “likely” to consider more substantial policy options than the 50 bp previously signaled. Only Esther George wanted to see 50 bp today. The Fed’s Quantitative Tightening plans remain unchanged.

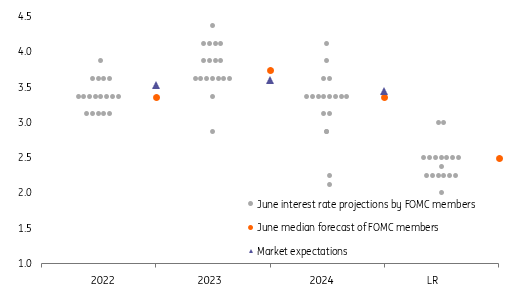

The Fed’s new forecasts sees them signal that the pace of policy tightening will remain intense over the next few months. The dot plot of individual forecasts now predicts the year-end Fed funds rate at 3.4% versus 1.9% in March and 2023 at 3.8% (2.8% previous) with 2024 at 3.4% (2.8% previous) and long run at 2.5% versus 2.4%. Even the least hawkish FOMC members have the Fed funds rate ending this year above 3%. The accompanying statement underscores the shift in the Fed view with the central bank "strongly committed" to getting inflation down to 2% target and being "highly attentive" to inflation risks.

Fed Dot Plot of individual forecasts for the Fed funds rate (%)

Source: Federal Reserve, ING

These hikes imply around 175 bp of rate increases from here, which suggests three 50 bp and a 25 bp in the four meetings in the second half of the year. This more aggressive stance comes at an economic cost with the Fed revising down 4Q year-on-year 2022 GDP growth to 1.7% from 2.8% and 1.7% YoY from 2.2%YoY for 4Q 2023. Despite this the core PCE deflator, the Fed’s favoured inflation measure, is not expected to get down to 2% before 2025 with the 4Q YoY rate for 2023 still expected to be 2.3%.

Another 75 bp in July with rates ending the year at 3.5-3.75%

We believe that the risks to the Fed’s rate hike projections are to the upside. To get inflation lower quickly we ideally need the supply side capacity of the economy to better balance with strong demand. However, the geopolitical backdrop, Covid containment measures in Asia and the lack of worker supply in the US suggests this isn’t going to happen soon. Consequently, inflation is likely to be slow and sticky on its descent, thereby putting the onus on the Fed to weaken demand via higher interest rates.

Between now and the July FOMC meeting we only have one round of data. The jobs report should be pretty good (hiring intentions surveys remain strong and there are 11.4 mn vacancies) while inflation is likely to remain elevated given food and energy prices – the YoY rate won't start to really drop on favourable base effects until late 1Q through 2Q 2023. Consequently we now favour the Fed to follow up today’s move with another 75bp hike in July – note Fed Chair Powell acknowledging this possibility in the press conference.

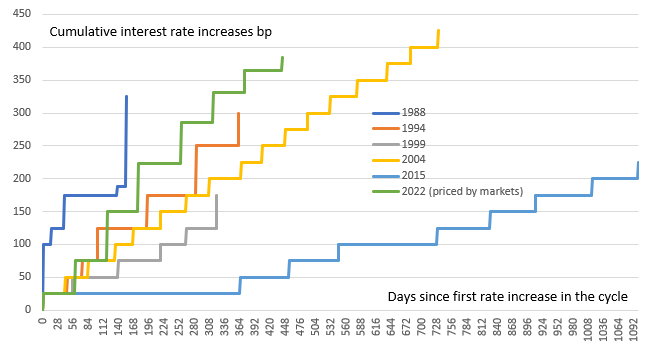

Cumulative hikes and the pace of tightening in Federal Reserve rate hiking cycles

Source: Macrobond, ING

We then expect 50 bp moves in September and November with a 25 bp hike in December. This is close to where the market is pricing, which would be the most aggressive Fed tightening path since 1988. The bank’s quantitative tightening plans will complement these actions.

The faster they rise... the quicker they will fall...

However, going faster and deeper into restrictive territory implies a greater risk of a hard landing. The move higher in the treasury yield curve looks set to ensure mortgage rates jump over the next couple of weeks with the typical 30Y fixed set to test the pre-Global Financial Crisis level of 6%. At the same time there is already evidence that hourly earnings growth is softening while the plunge in equity markets hurts both consumer and business sentiment with knock-on effects for spending and hiring. Consequently, the outlook for domestic demand is already weakening while the strength of the dollar is hurting international competitiveness and squeezing corporate profitability.

Our best guess is that inflation can drop quickly from late 1Q through 2Q 2023

Even if recession can be avoided we expect the Fed to reverse course and move policy to a more neutral footing once it is convinced inflation is moving lower. Our best guess is that inflation can drop quickly from late 1Q through 2Q 2023 as the big increases in food and fuel prices seen in 2022 drop out of the annual comparison. We also expect to see weaker demand translate into profit margin compression while the housing market, if it does soften as we expect, can also quickly contribute to depressing annual inflation via a moderation in housing rents.

As for those long-heralded supply side improvements, we remain hopeful that supply chain strains will ease over the next twelve months and energy prices with stabilize and move a little lower. We will also be closely looking to see if the plunging stock markets tempt some retired workers back to the workforce to boost the availability of labour.

If supply side factors do improve we could be talking US inflation below 2.5% in the second half of 2023 and this will certainly open the door for interest rate cuts. Moreover, over the last 50 years the average length of time between the last rate hike in a cycle and the first interest rate cut was only seven months. When inflation interest rates were more volatile in 1970-2000, as we would argue it is today, it was only three months. With the Fed being more aggressive on the upside, history suggests we should be open to the possibility of Fed rate cuts again in summer 2023.

Rates on repo, reverse repo and excess reserves also up by 75bp. But SOFR continues to lag…

The Fed may not like to admit it, but the issues that have plagued the front end of the market not only remain in place, but have intensified in an uncomfortable direction in the past few weeks. The volumes of cash going back to the Fed on the reverse repo facility is in the area of USD 2.25 trn, a huge number that reflects difficulty for market repo to match the 80bp on offer at the Fed. In fact Secured Overnight Financing Rate (SOFR) has just slipped to below 70bp, reflective of where market overnight repo has trended towards. The Fed has now hiked by 75bp, thus pushing the reverse repo rate to 1.55%. Based off where the repo market is currently trading, SOFR will likely have difficulty climbing above 1.5% in the coming days, as there has not been any material change in liquidity circumstances in the wake of the FOMC outcome.

Other key rates also reflect the full 75bp move in the Fed funds range to 1.5%–1.75%. The rate on the standing repo facility has been hiked to 1.75% (from 1.0%), a facility that tends not to get used currently, reflecting the bias towards an excess of liquidity, that instead pushes use of the reverse repo facility. The rate on excess reserves has been hiked to 1.65% (from 90bp). Cash getting compensated in this bucket has in fact been on the decline in recent months, as bank reserves have fallen from $4.3 trn to $3.3 trn, reflecting a tightening in conditions at the level of commercial banks. This process is likely to continue to the extent that banks underdeliver in terms of deposit hikes, relative to what the Fed has delivered (and will deliver).

The move of the 10-year Treasury yield from sub-2% to 3.5% since March has come practically entirely from higher real rates

An additional factor that should not be ignored is the significant rise in real (inflation adjusted) market rates in the past few weeks, and in fact in the past number of months. The move of the 10-year Treasury yield from sub-2% to 3.5% since March has come practically entirely from higher real rates, as has the more recent spike in market rates. Inflation expectations have in fact been steady-to-falling, even in the wake of Friday’s elevated inflation number. This ongoing rise in the real rate actually takes pressure away from the Fed for the perceived need to (over) hike. That said, it appears this has not impacted to decision today for the Fed to deliver 75 bp, even though they had a clear prior intention to deliver 50 bp, which they could have stuck to on a higher real rate rationale (but clearly didn’t).

FX: High volatility, but high short end rates to keep the dollar bid

After Monday’s press reports that 75 bp was possible, if not likely at today’s FOMC meeting, the Fed delivering 75 bp has been well priced. What is new for the markets is the fresh take on the Dot plots. Certainly, the short end of the US yield curve has been taking close notice of these since the Fed shifted policy in June 2021.

Today’s release showing a median dot plot of 3.8% for end-year 2022 was higher than the 3.65% being priced going into today’s meeting. Short-term US rates and the dollar have consequently pushed a little further ahead on this release, but are showing lots of volatility as Powell speaks too. However, it seems too early for the markets to price a clear slowing or pause from the Fed as it seeks to ride out the hump in the inflation cycle. This should allow the dollar to continue to trade near its high for the year. Yet with a terminal rate for the Fed already priced close to 3.90/4.00% for next year – and pricing of that terminal rate having been a key driver of the dollar bull trend – the dollar does not necessarily need to advance aggressively from these elevated levels.

The Fed upping the ante on the pace of rate hikes does raise the challenge for peer group central banks, however. We suspect the ECB was disappointed how the euro reacted to its hawkish June press conference as doubts emerge whether the eurozone economy can handle higher rates. The surge in European natural gas prices today and news of a record wide monthly trade deficit in April also serve as a reminder of the acute stagflationary risks in the eurozone and a reminder of our view that the fair value of the euro has fallen on the back of the energy shock. We expect EUR/USD to stay offered this summer, with potential to the 1.02/1.00 area over coming weeks and months.

We expect EUR/USD to stay offered this summer, with potential to the 1.02/1.00 area over coming weeks and months

Of even more interest – according to FX options markets – is Friday’s Bank of Japan (BoJ) meeting. The hawkish Fed suggests USD/JPY may well be going into that meeting pressing 135. The BoJ has placed itself between a rock and hard place here, where unchanged policy could see a disorderly move through 135 and elicit FX intervention from the BoJ. No wonder one month USD/JPY implied volatility is trading near 15% and could trade higher still.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more