The Fed is fast approaching its worst nightmare.

Stag-flation.

Stagflation is when inflation is rising at the same time that the economy is weakening, if not contracting.

The Fed has always argued that low levels of inflation (2%) were acceptable provided the economy was also growing. Indeed, this is the very gimmick the Fed has utilized to mask the fact that quality of life has been falling in the US since the early ‘70s (by understating inflation, the Fed has overstated economic/ income growth).

All of the negative effects of inflation (wealth inequality, higher costs of living, increased debt required to maintain living standards) are “masked” by the Fed’s argument, “look how well the economy is doing! If we weren’t running things everything would be much worse. A little inflation isn’t a bad thing after all!”

Not with stagflation.

With stagflation you’ve got the economy shrinking, meaning people are losing their jobs and incomes are falling at the SAME time that the cost of living is exploding higher and thing are getting more expensive.

Cue Wednesday's Fed FOMC statement in which the Fed REMOVED its claim that the “economy outlook has strengthened.”

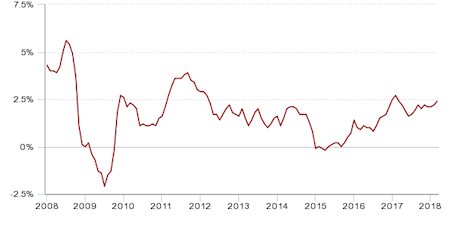

So the Fed has noticed that the economy is slowing and no longer has a great outlook. And this is happening at a time when the Fed’s official inflation measure, the CPI, is clocking in at 2.36% year over year (which incidentally the Fed is trying to ignore).

Put simply: stagflation is here.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm.

We are making just 100 copies available to the public.