Fed Flop:

With this morning’s scheduled Federal Reserve announcement amounting to absolutely nothing, we continue to creep forward along the winding path leading to an expected December hike.

We did however get some unexpected headlines from the Fed, with Janet Yellen responding to a letter titled ‘An Open Letter To Chairwoman Yellen From the Savers of America‘. Yellen’s response explained that most Fed policymakers expect the pace of rate hikes to be gradual and that any early, aggressive interest rate moves would only have a short term benefit to savers as lack of demand could quickly have the Fed back at low rates in an attempt to provide stimulus once again.

Although Yellen’s responses were mainly cliché and not really containing substance for traders, I do have to applaud the response. She is working for the people after all.

The other major narrative overnight was the weakness experienced in commodity prices, most notably headlined by the continued rout in copper.

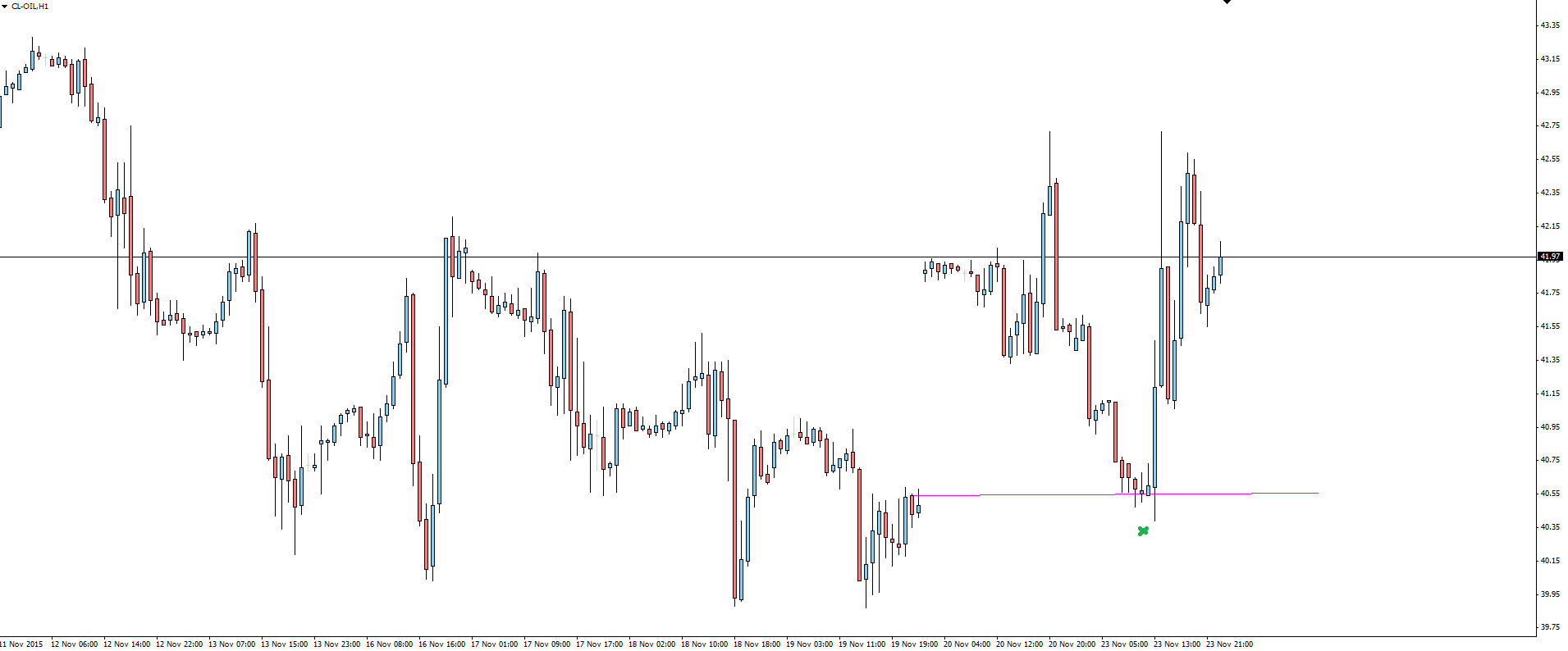

Oil Hourly:

Click on chart to see a larger view.

Through the headlines of doom, it is worth noting that OIL received a nice bounce of support, highlighted by this beautiful technical chart.

The bounce can be attributed to a pledge from Saudi Arabia to work with OPEC to stabilise global crude oil markets. Combine this headline to an already jumpy market who is obviously net overall short up to its eyeballs, and you are going to get these sorts of jumps to the upside as short covering tweaks fears of a rolling snowball effect that nobody wants to get caught standing in front of.

———

On the Calendar Tuesday:

EUR German Ifo Business Climate

AUD RBA Gov Stevens Speaks

GBP Inflation Report Hearings

USD Prelim GDP q/q

USD CB Consumer Confidence

Just be aware that RBA Governor Stevens is actually speaking during the European session at the annual Australian Business Economists dinner in Sydney. Seen plenty of traders caught out by a central banker speaking outside of their own market hours.

———-

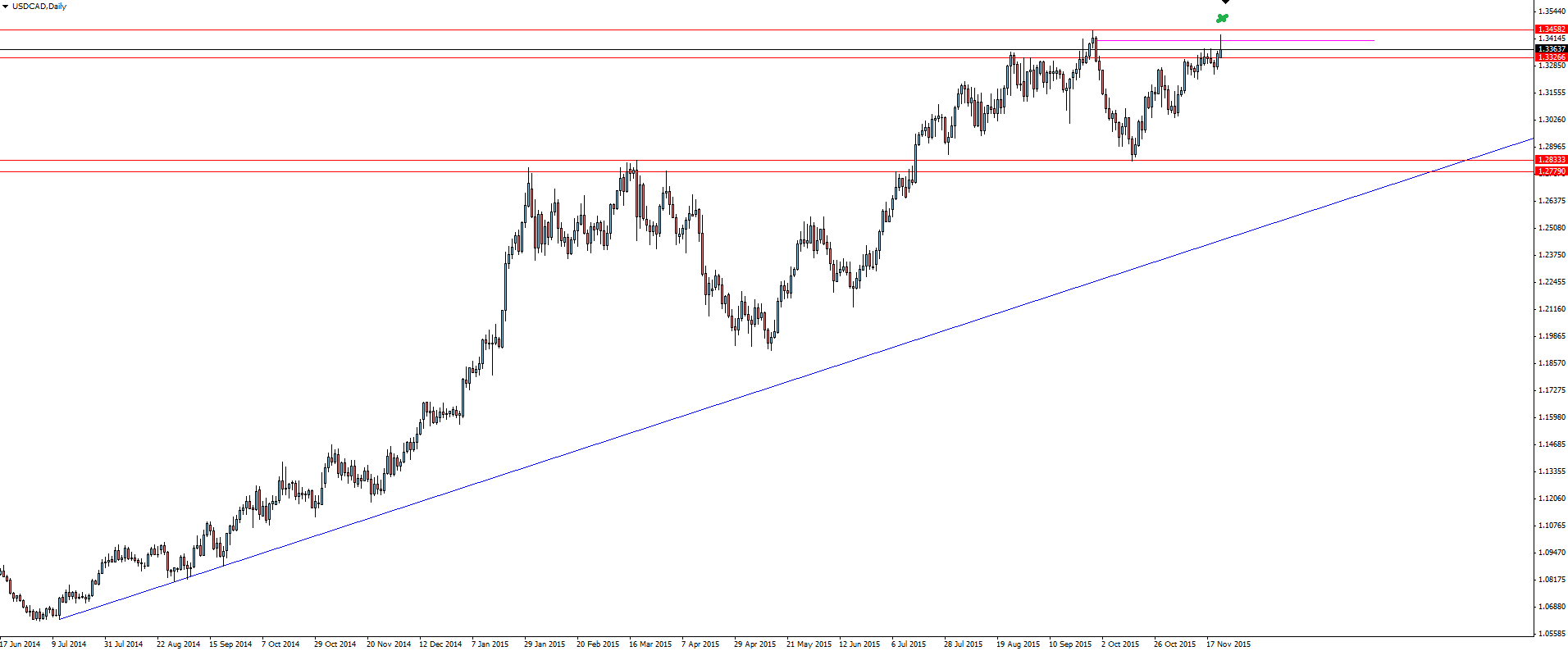

Chart of the Day:

Last Monday’s Daily Market Update featured USD/CAD as our chart of the day where we were looking for any signs of slowing momentum as price headed back toward swing highs:

“With the gap down helping to exaggerate the lack of momentum, any weak push back up could be viewed as an opportunity to sell weakness.”

USD/CAD Daily:

Click on chart to see a larger view.

As you can see from the live Vantage FX MT4 chart here, price has now pushed right into our marked resistance zone where it has immediately found sellers, highlighted by the long wick on the most recent daily candle.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, Forex news, research, analysis, prices, Smart Trader Tools or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.