On June 14th, the US Federal Reserve (Fed) increased its policy rate for the second time this year as was widely anticipated. Less certain, however, was the path of future policy tightening in light of recent weakness in inflation. In what came as a surprise to some, the Fed maintained its projection for a third hike in 2017 and outlined the process for a gradual reduction of its balance sheet for the first time, which is expected to begin this year.Markets have responded apprehensively, as US yields have fallen on account of being more sensitive to weaker inflation than the more hawkish Fed policy. We explore these issues in this week’s piece.Our view is that the Fed will follow through on its commitment to raise rates once more and enact balance sheet reduction in 2017.

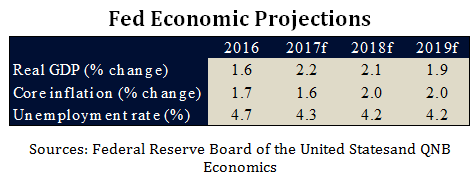

Do the economic conditions warrant a third rate hike?The Fed’s latest summary of economic projections, released alongside its latest rate decision, reveals a mixed picture. The Fed expects a material strengthening of the labour market but a slight moderation in inflation. The unemployment rate is projected to fall from 4.7% in 2016 to 4.3% in 2017 while core inflation is forecast to dip from 1.7% in 2016 to 1.6% in 2017. Based on these estimates, the Fed’s standard rule used to link unemployment and inflation to interest rate decisions (the so-called Taylor Rule) actually suggests that two rate hikes would be appropriate in 2017.

So why then is the Fed eager to increase rates a third time? The answer lies in the Fed’s view of inflation. Core inflation has dipped in recent months from its average pace of 1.7% over October 2016-February 2017 to 1.6% in March and April. Temporary factors largely explain the deterioration and are expected to keep core inflation from rising until these effects fall out of the calculation in 2018. The weakness reflects a methodological change which reduced how cell phone costs are calculated in the consumer price index and a sharp one-time drop in prescription drug prices.Together these effects have shaved off an estimated 0.1-0.2 percentage points of core inflation. Hence, in anticipating another rate hike, the Fed is likely looking through these idiosyncratic factors. Moreover, this is corroborated by amending the Taylor Rule. Incorporating a core inflation estimate that strips out the impact of these temporary factors into the rule then reveals that three rate hikes would be appropriate for the year.

Fed Economic Projections

Sources: Federal Reserve Board of the United Statesand QNB Economics

But, why does the Fed want to tighten even further, by starting to reduce its balance sheet? The Fed announced a strategy to reduce the size of its balance sheet by allowing long-dated government and government-backed securities purchased through its multiple quantitative easing programmes to mature and their proceeds not be reinvested. In principle, this would lift the downward pressure on yields and provide the Fed with another tool through which to tighten monetary policy. While there remains considerable uncertainty over how much this will raise yields, the pace and magnitude of the proposed unwinding suggests the impact will be relatively small in 2017. Officials announced that at first,the balance sheet will be reduced at a pace of at most USD10bn per month, with the cap rising gradually each quarter until it reaches USD50bn per month.The Fed balance sheet sits at around USD4.5tn and authorities conveyed the intent to reduce assets below current levels but not to pre-crisis levels, implying a lengthy and gradual reduction to mitigate concerns of rapid tightening.

In conclusion, the Fed appears set on tightening policy through both higher rates and reducing the size of its balance sheet. We expect the Fed to follow through on its commitments. Considering the transitory nature of the inflation weakness, the projected economic conditions warrant an additional hike and the impact of unwinding the balance sheet is unlikely to be materially felt until 2018 and beyond. Additionally, after years of failed promises to hike, we expect the Fed to be more careful in following through on its proposed action to preserve its credibility.