Gold blasted higher this week after a major dovish surprise from the Federal Open Market Committee. Its statement added a qualifier lowering odds for more rate hikes. More importantly, top Fed officials cut their outlook for the federal-funds rate in 2024. That slammed the US dollar, igniting big gold-futures buying to spur gold. This major dovish pivot leaves gold looking more bullish, helping attract investment demand.

Since the Fed’s initial rate hike of this cycle in mid-March 2022, gold’s fortunes have been largely slaved to FOMC actions. This causal link is mostly indirect via the US dollar. When the Fed either hikes rates or teases more hikes coming, resulting higher dollar yields fuel buying from currency traders. The gold-futures speculators dominating gold’s short-term price action look to the US Dollar Index for their trading cues.

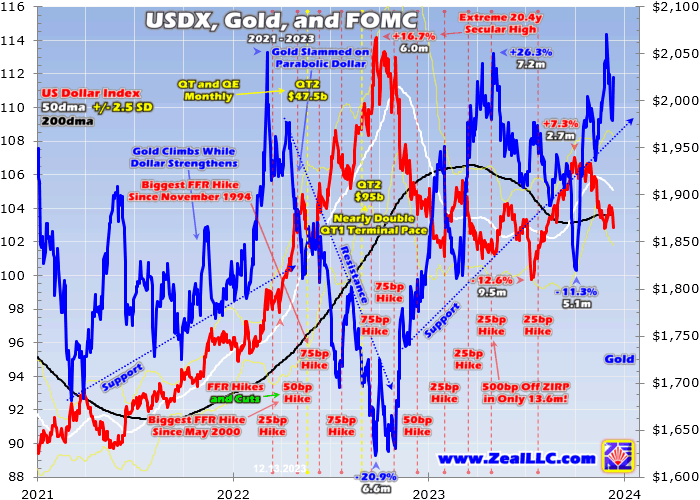

This rate-hike cycle was the most aggressive and extreme in the Fed’s century-plus history, with the brunt hitting in mid-2022. That included four monster 75-basis-point hikes in a row. Those helped catapult the USDX an extreme 16.7% higher in just 6.0 months, leaving it at an extreme 20.4-year secular high. That parabolic dollar spike bludgeoned gold a brutal 20.9% lower over 6.6 months into late September 2022.

But as I analyzed soon after, that extreme Fed dollar/gold shock was ending. Indeed despite the FOMC continuing to hike, that lofty euphoric exceedingly overbought USDX collapsed 12.6% over the next 9.5 months. That fueled enough gold-futures buying to catapult gold 26.3% higher in 7.2 months, reentering formal bull territory after being briefly hammered into an anomalous bear. But both moves proved overdone.

Gold peaked in early May, failing to achieve new record highs. Then it mostly consolidated high until mid-July, when the USDX bottomed. Short-term oversold, the US dollar started mean reverting higher from there. Technical momentum buying along with increased expectations for more Fed rate hikes ultimately extended that to a huge 7.3% bear rally in 2.7 months. That helped slam gold down 11.3% in 5.1 months.

That dollar rally was supercharged by the FOMC’s late-September meeting, despite the Fed pausing rate hikes after fully 11 totaling an enormous 525bp. Instead traders fixated on the accompanying Summary of Economic Projections, which are released quarterly with every-other FOMC meeting. That includes top Fed officials’ individual outlooks for FFR levels exiting coming years, which are known as the dot plot.

In the previous SEP in late June, those dots had projected the FFR leaving 2024 at 4.63%. That implied 100bp of rate cuts next year. But in their next late-September dots, Fed officials upped their 2024 target by 50bp to 5.13%. That slashed their projected rate cuts next year in half to just two quarter-pointers. Over the next couple weeks or so, the USDX rallied 1.1% and gold plunged 5.8% on that hawkish surprise.

This chart superimposes the FOMC’s monster rate-hike cycle and quantitative-tightening decisions over gold and USDX price action in recent years. Note the inverse sometimes-mirrored symmetry between the dollar and gold. Endlessly discouraging gold investors, the yellow metal’s performance since the Fed started hiking has been dominated by FOMC actions through the US dollar’s reactions. That’s still the case.

Ironically gold-futures speculators’ fear of Fed rate hikes is highly irrational based on historic precedent. Back in mid-February 2022 before the FOMC’s maiden hike, I published an essay analyzing how gold thrives in rate-hike cycles. I looked at all dozen of these in the modern monetary era since 1971. Gold’s average absolute return from the days before their first hikes to the days of their last hikes was excellent.

Gold actually averaged great 29.2% gains during the previous dozen Fed-rate-hike cycles. If this current one ended in late July which looks increasingly likely, gold rallied a modest 3.0% through its exact span despite a 2.0% USDX rally. But those gains are skewed low by an unusual event leading in, Russia invading Ukraine igniting a massive geopolitical gold spike. So gold entered this hiking cycle relatively high.

The FOMC warned rate hikes were coming in mid-March 2022 at its preceding meeting in late January. That was about a month before Russia launched its war. Gold’s total rate-hike-cycle advance from there was 10.2%. And despite odds of another rate hike waning the longer the FOMC pauses, Fed officials still want markets to believe more hikes are possible in this current cycle. It’s probably over, but might not be.

Gold’s total gains from late January 2022 to mid-week are running 13.1% despite the Fed’s most extreme hiking cycle in its entire history. That catapulted the FFR a shocking 500bp off zero in only 13.6 months. So I’ve never understood why gold-futures speculators sell so hard on Fed rate hikes or tidings of them. Gold has amassed an excellent half-century track record of rallying on balance despite Fed rate hikes.

Turning back to gold’s recent performance, traders’ expectations for 2024 FFR levels shifted dramatically dovishly last month. First early on in November the monthly US jobs report missed expectations. It came in at +150k, shy of the +170k forecasts. And -101k jobs in past-month revisions made that read look even weaker. Futures-implied Fed-rate-cut expectations for 2024 rocketed from 67bp to 110bp on that jobs miss.

Then in mid-November, the US CPI inflation print came in a tenth lighter than economists were looking for on all key measures. That prompted the Wall Street Journal’s closely-followed Fed whisperer to tweet that the Fed’s rate-hike cycle was probably finished. He is thought to have unique inside access to top Fed officials. Federal-funds-rate futures started pricing in two full rate cuts by July 2024, another dovish shift.

All that and some lesser Fed-dovish economic data slammed the US Dollar Index 2.9% lower last month. That in turn goosed gold 2.6% higher in November to $2,036. As December dawned, it surged again to $2,071 which was its first new nominal all-time-record-high close since August 2020. My essay last week on gold-record momentum dug into those dynamics and their very bullish implications for gold in depth.

But between then and this week’s FOMC meeting, gold pulled back fairly hard dropping 4.4% in seven trading days. A parallel 1.3% USDX bounce over a similar span certainly contributed. Traders came to believe top Fed officials had to really push back against November’s surge in rate-cut expectations for 2024. They were convinced this week’s latest dots and the Fed chair’s comments would prove hawkish.

Ever the contrarian, I figured it would play out differently. Every Tuesday I write a weekly newsletter for our paid subscribers, Zeal Speculator. In this week’s issue published after the close on FOMC eve, I warned “Since traders now expect to see such hawkish dots and a hawkish Fed chair tomorrow, anything perceived contrary to that ought to move markets big.” Fed officials didn’t have much room to up their dots.

I explained why, “The last dot plot in mid-September penciled in a 5.13% FFR exiting next year, up 50bp. With the current FFR at 5.38%, Fed officials could only add another 25bp before implying an exceedingly unlikely lone rate hike in 2024. ...honestly Fed officials don’t have much room to hawkishly surprise.” So I went into this week’s FOMC meeting expecting 2024’s dots to stay unchanged at worst, a contrary opinion.

Most of gold’s December weakness resulted from traders expecting either more hawkish dots or the Fed chair to wax hawkish in his post-FOMC press conference. On the latter I wrote in ZS, “Odds are Powell will say something in that span that will be interpreted as dovish, and traders will really latch on to that particular comment since they are so worried about hawkish Fedspeak right now.” That would reverse gold.

Gold had slumped to $1,980 on FOMC eve, leaving traders pretty bearish. That was sure evident in both silver and the leading GDX (NYSE:GDX) gold-stock ETF, which both act as gold sentiment gauges. During those seven trading days in early December where gold pulled back 4.4%, silver and GDX plunged 10.5% and 9.3%. Traders feared this latest FOMC statement, or the dot plot, or the Fed chair would prove hawkish.

But as often in the markets, that popular consensus proved wrong. The FOMC statement itself this week was slightly dovish, with top Fed officials adding the word “any” in their key sentence on further rate hikes. “In determining the extent of any additional policy firming that may be appropriate to return inflation to 2 percent over time...” That “any” made more rate hikes look less likely than the prior statement without it.

That alone would’ve moved markets some, but boy those 2024 dots even surprised me. There was a dramatic dovish shift in top fed officials’ federal-funds-rate outlook next year. There are only nineteen of those guys, and they moved from just five expecting 3+ 25bp rate cuts in 2024 a quarter earlier to fully eleven of them. Their median year-end-2024 FFR outlook fell 50bp from 5.13% in the prior dots to just 4.63%.

With the current FFR running 5.38%, that implies top Fed officials collectively expect 75bp of cuts next year. That was one more than the previous dot plot’s 50bp, a sizable shift. This really surprised traders because financial conditions had loosened dramatically in November. Weaker US jobs and a cooler US CPI left traders expecting more Fed rate cuts, which slammed both the USDX and US Treasury yields lower.

That left markets much more dovish than top Fed officials, pushing back against their FFR projections. So traders expected these guys to fight back in this week’s dots, emphasizing their higher-rates-for-longer narrative oft-expressed in their speeches. Yet they did the opposite, suddenly leaving the USDX’s early-December surge and gold’s slump looking silly. So traders rushed to rectify their mistaken FOMC views.

Gold entered US trading on FOMC day this Wednesday at $1,980, where it mostly ground along until that 2:00pm main event. Within minutes of traders marveling at those dovish 2024 dots, gold blasted back to $2,000. It kept on powering higher as the Fed chair spoke, who didn’t sound particularly hawkish either. By the US close, gold had soared 2.3% to $2,024. That erased half of December’s post-record-high selloff.

That proved gold’s biggest daily rally by far since mid-October, the day it looked like Israel was finally moving into Gaza to root out Hamas terrorists. And the USDX plunged 0.9% Wednesday on those latest dots, its worst down day since mid-November on that cooler-than-expected CPI. Gold was back up to early-December levels, while the US Dollar Index retreated to late-November ones. Reversals were underway.

Gold’s $45 rally that FOMC day really boosted sentiment, as evident in the big reactions in silver and GDX. They blasted 4.6% and 6.4% higher respectively, making for both of their best daily rallies since mid-March. That came right after a crisis weekend where Silicon Valley Bank imploded, which was the fastest bank run in history. Within hours, depositors yanked out a high percentage of their $173b in deposits.

So gold’s violent reversal this week on more rate cuts next year was a really big deal, seeing huge daily gains rivaling those in market and geopolitical crises. Odds are this upside is only beginning. Gold just achieved its first nominal record close in 3.3 years, and those really attract investors who love chasing upside momentum. The last gold upleg enjoying new record closes grew to monster size in mid-2020.

Gold’s records attracted American stock investors in droves, who aggressively flooded into the dominant GLD (NYSE:GLD) and IAU gold ETFs. In just 4.6 months, their differential gold-ETF-share buying was so great that it forced these behemoths to add 460.5 metric tons of gold bullion. That huge 35.3% GLD+IAU holdings build catapulted gold a mighty 40.0% higher in that short span. New records fuel outsized demand and gains.

Gold’s current young upleg has merely rallied 13.8% at best over 1.9 months into early December. All further gains from that $2,071 will push it deeper into nominal record territory. Gold has a long way to rally to adequately reflect the raging inflation in recent years. From the pandemic-lockdown stock panic in March 2020 to April 2022, the Fed ballooned its balance sheet an absurd 115.6% or $4,807b in 25.5 months.

That more than doubled the US monetary base in just a couple years, leaving far more dollars bidding up prices on way-slower-growing goods and services. Even today with the Fed trying to shrink its bloated balance sheet since, it is still 86.1% or $3,579b higher than pre-pandemic levels. Gold prices really ought to proportionally reflect these vastly higher US dollar supplies, which would require it climbing near $2,950.

And that’s not considering the world’s other major central banks that also greatly expanded their money supplies in recent years. Much higher gold prices seem inevitable with so much more fiat currencies force-fed into the global economy. The biggest beneficiaries of a major secular gold bull will be the gold miners’ stocks. Their profits really leverage higher gold prices, leading to outsized gains as gold powers higher.

During gold’s last new-record-driven upleg in mid-2020, the GDX gold-stock ETF soared 134.1% higher in 4.8 months. That made for an awesome 3.4x upside leverage to gold, better than the major gold stocks’ usual 2x-to-3x range. And smaller mid-tier and junior gold miners with superior fundamentals tend to amplify gold’s uplegs even more.

Our newsletter trading books are currently full of great smaller gold stocks poised to see massive gains as gold prices normalize to ballooned money supplies. Despite gold’s dovish-2024-dots surge this week, most are still cheap and great buys. Mid-tiers and juniors remain deeply undervalued fundamentally and battered technically, despite recently reporting one of their best quarters of earnings ever before gold surged.

The bottom line is top Fed officials’ latest rate outlook really spurred gold. These policymakers just did a major dovish pivot, projecting a 50-basis-point-lower federal-funds rate in 2024. They now think they’re done hiking rates, and expect three 25bp cuts next year. That all but guarantees this monster rate-hike cycle is over, which slammed the US dollar and ignited big gold-futures buying blasting gold sharply higher.

With gold prices still low relative to recent years’ ballooned money supplies, this young upleg likely has a long ways to run yet. Investors love chasing upside momentum, and new record highs excite them like nothing else. Gold enjoyed a monster upleg the last time it forged into record territory several years ago. The gold stocks really leveraged those gains as their earnings soared, rapidly multiplying investors’ wealth.