U.S. markets were mixed overnight after surging the day before. There was volatility after the FOMC minutes, from last month, showed they were considering quickening the pace of the taper for their QE. Also, the ADP payrolls which are consider the precursor to the NFP came in better than expected. The ADP report showed 238,000 new jobs for December.

Comments made by Fed officials were a little more bullish than what we had expected. They seem to have more confidence in the economic recovery and we could see another scale back of their QE at next week’s FOMC meeting. The markets were prepared for the last one, this one, maybe not as much. We will see how they react to tomorrow’s NFP.

This morning, China’s inflation number rattled investors. Inflation in the world’s second largest economy slowed to 2.5 percent in December. The number came in at 3 percent in November and we expected a print of 2.7 percent. Producer prices all fell and came in at 1.4 percent.

STOCKS

Overnight the DJIA lost 68.20 points to finish at 16,462.74. The S&P 500 was virtually flat finishing the day at 1,837.49. Telecommunication was the worst performing sector of the 10 that make up the S&P. The tech heavy Nasdaq Composite rose 12.43 points on the day. The composite closed the day out at 4,165.61.

This is a red day in the Asian and Pacific Rim markets as inflation data and concerns the Fed will taper again this month are hitting nerves hard.

The Nikkei is currently down 1.74 percent and has set a new weekly low. The benchmark had rallied yesterday by 2 percent and we have lost most of those gains today. This is a mix of profit taking and a stronger yen rattling investors. The USD/JPY is falling from the 105 area as the yen gains strength. Exporters do not like a strong yen. We should also note a correlation between the yen and the Nikkei. If the yen weakens, the Nikkei rises and vice versa.

The Shanghai Composite is bucking today’s downtrend and is up slightly by 0.3 percent. Gains here are capped as the People’s Bank of China (PBOC) missed open market operations for the fifth straight day. The Australian ASX 200 was unable to make any headway today despite a better than expected sales data release. It showed a 0.7 percent gain, but investors ignored.

CURRENCIES

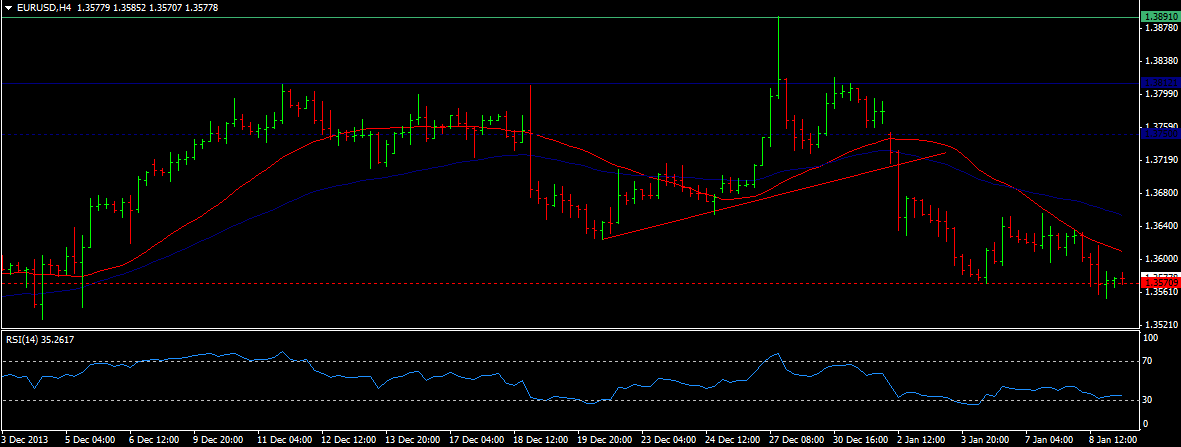

EUR/USD (1.3578) since falling from a major congestion area near 1.3650/90 the pair has been bearish and we are currently testing support now. See below chart. A move below this level will speed up losses. Only a move back above 1.3720 will relieve selling pressure.

USD/JPY (104.856) is still above 104 keeping us strong towards 109. We see weakness only below 103.50. That breaks we can dip to 102.50. We see resistance at 105 and then at 105.20 today. GBP/USD (1.6446) is testing resistance at the current level. Support at 1.63 is holding well indicating another rally could occur. In that case we could move towards 1.6740. If the resistance at 1.6448 holds we could dip again to 1.63 or 1.62.

COMMODITIES

Gold is lower on fears of another imminent taper. This is to be expected.

Gold (1226.10) is weaker again and moving lower. While we are below 1245, expect sellers to dominate. We are now testing 1225, if we hold here, then there is hope for a rise to 1250. Silver (19.63) is also moving lower after failing at 19.70. We have an important support zone at 19.50 through 19.20. If this area holds we will bounce higher. We will wait and see. Copper (3.35) is trading steady and testing resistance now. While below 3.35 we are range bound from 3.30. If 3.35 breaks we could target 3.40.

TODAY’S OUTLOOK

A busy day before tomorrow’s all-important NFP.

0830 EST Weekly jobless claims and chain store sales

1330 EST Minneapolis Fed President Narayana Kocherlakota will give remarks.

2030 EST Fed President Ester George speaks

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fed Could Quicken Taper, China’s Inflation Concerns Investors

Published 01/09/2014, 03:15 AM

Updated 05/14/2017, 06:45 AM

Fed Could Quicken Taper, China’s Inflation Concerns Investors

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.