Dollar trades mildly firmer today as markets await FOMC rate decision. Nonetheless, that would likely be a non-event. Fed is widely expected to stand pat. And, December is the month for rate hike, not the current one. Also, traders mind are probably more on the path beyond December. And that heavily ties to who US President Donald Trump will nominate to succeed Janet Yellen as Fed chair after February. It's reported that Trump will announce to nominate Fed Governor Jerome Powell on Thursday. Meanwhile, House Republicans are delaying the rollout of the tax bill due to unresolved questions on some key elements. The announcement was originally scheduled for today but is now delayed by one day to Thursday. Economic data to be released today will also be closely watched including ADP employment and ISM manufacturing from US and PMI manufacturing from UK. We're expecting a lot of volatility for the rest of the week.

Sterling jumped as EU Barnier ready to speed up talks

Sterling jumped sharply yesterday on positive news on Brexit negotiations. EU's chief Brexit negotiator Michel Barnier said that he's ready to speed up the negotiations with UK. And the schedule for next round of talks would be see in the coming days. Meanwhile, UK Brexit Secretary David Davis told a House of Lords committee that "the withdrawal agreement, on balance, will probably favour the [European] Union in terms of things like money and so on. Whereas the future relationship will favour both sides and will be important to both of us." This is taken as an signal that the UK team is finally ready to clear out all the smokescreens to move on quickly with the talks. And that would likely raise the chance of making sufficient progress by EU summit in December to move on to trade talks afterwards.

Nonetheless, GBP/USD is staying in range of 1.3026/3337, lacking a clear direction. BoE rate decision will be one of the most critical factors in determining the pair's near term direction. BoE is widely expected to raise the Bank Rate by 25bps to 0.50%, first hike in a decade. In our view, this will be a one-off as the Bank Rate will be brought back to pre-Brexit referendum level. The vote split of the decision is the first key point to watch. The tighter the decision, the more unlikely for another hike in near term. In addition, BoE will release the quarterly inflation report. Revision in inflation projection there will tell us how policymakers general feel about the recent surge in inflation.

BoC Poloz: Canada economy at a crucial spot

BoC Governor Stephen Poloz sounded cautious yesterday as he told the parliament that Canada is at a "crucial spot in the economic cycle". He also warned that "significant uncertainties are clouding the way forward". Poloz also reiterated the central bank's statement that any future adjustments in rate will be "cautious". Recent economic data from Canada has been disappointing. GDP showed -0.1% mom in August, below expectation of 0.1% mom rise. That raised some concerns that BoC's two consecutive rate hikes this year are a little too quick.

Kiwi rebounds after strong job data

New Zealand Dollar rebounds notably today after solid job data. Employment rose 2.2% qoq in Q3, well above expectation of 0.8% qoq. Unemployment dropped to 4.6%, down from 4.8%, better than expectation of 4.7%. That's also the lowest level since 2008. Nonetheless, the support to Kiwi could be temporary as there shouldn't be any change in RBNZ's neutral stance. The central bank is far from hiking interest rate from the current 1.75% level.

Additionally, markets are concerned with the uncertainties from the new government's policies. Reform on RBNZ is expected after appointment of a new governor in March 2018. Finance Minister Grant Robertson confirmed earlier this week that the government will push for a broader mandate for RBNZ. Robertson expressed that RBNZ would not be tie to a specific target on employment. But " we want to be clear about the bank's role not only in managing inflation, which is extremely important, but also in terms of the overall health of the economy".

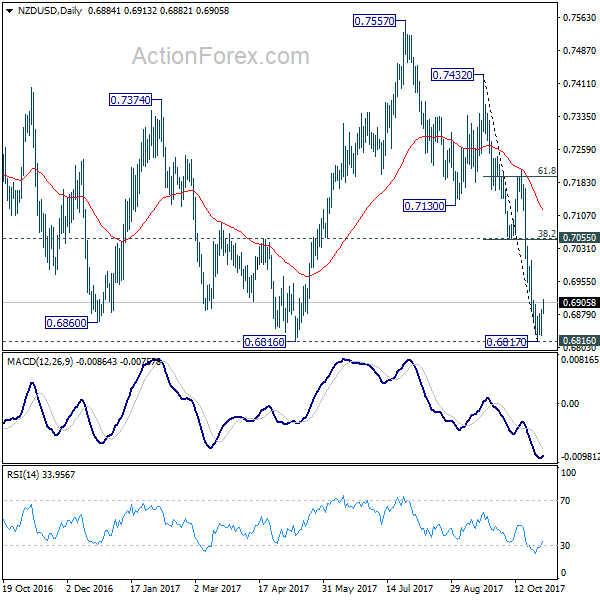

NZD/USD should have formed a short term bottom at 0.6817, after being supported by 0.6816 key support level. Some recovery should be seen in near term. But upside should be limited below 0.7055 cluster resistance (38.2% retracement of 0.7432 to 0.6817 at 0.7052) bring fall resumption. It should also be noted that decisive break of 0.6816 key support level will carry larger bearish implication and would pave the way to 0.6102 (2015) low.

Elsewhere

UK BRC shop price dropped -0.1% yoy in October. Japan PMI manufacturing was finalized at 52.8 in October. China Caixin PMI manufacturing was unchanged at 51.0 in October. Swiss and UK PMI manufacturing will be the main focus in European session. US will release ADP employment, ISM manufacturing and construction spending later in the day. Also, FOMC will announce November rate decision.