“The Federal Reserve is poised to spray trillions of dollars into the U.S. economy once a massive aid package to fight the coronavirus and its aftershocks is signed into law. These actions are unprecedented, going beyond anything it did during the 2008 financial crisis in a sign of the extraordinary challenge facing the nation.” – Bloomberg

Currently, the Federal Reserve is in a fight to offset an economic shock bigger than the financial crisis, and it is engaging every possible monetary tool within its arsenal to achieve that goal. The Fed is no longer just a “last resort” for the financial institutions, but now the lender for the broader economy.

There is just one problem.

The Fed continues to try and stave off an event that is a necessary part of the economic cycle, a debt revulsion.

John Maynard Keynes contended that:

“A general glut would occur when aggregate demand for goods was insufficient, leading to an economic downturn resulting in losses of potential output due to unnecessarily high unemployment, which results from the defensive (or reactive) decisions of the producers.”

In other words, when there is a lack of demand from consumers due to high unemployment, then the contraction in demand would force producers to take defensive actions to reduce output. Such a confluence of actions would lead to a recession.

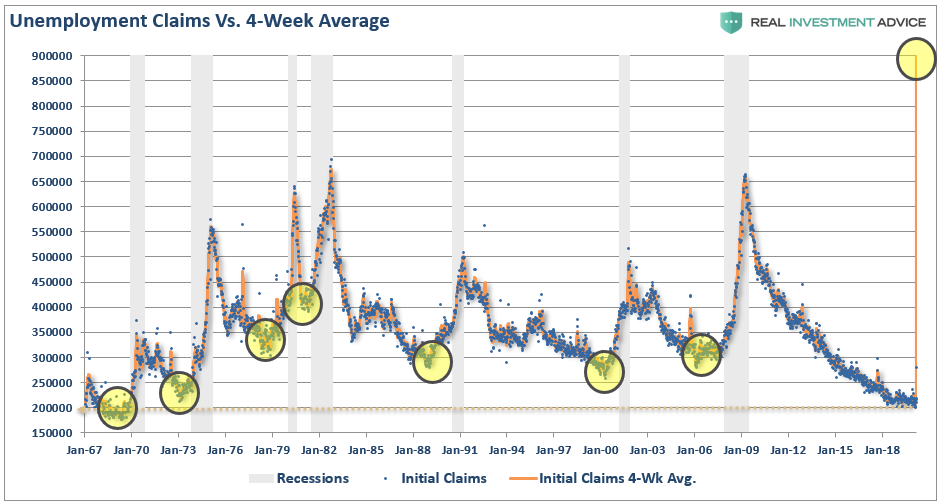

On Thursday, initial jobless claims jumped by 3.3 million. This was the single largest jump in claims ever on record. The chart below shows the 4-week average to give a better scale.

This number will be much worse next week as many individuals are slow to file claims, don’t know how, and states are slow to report them.

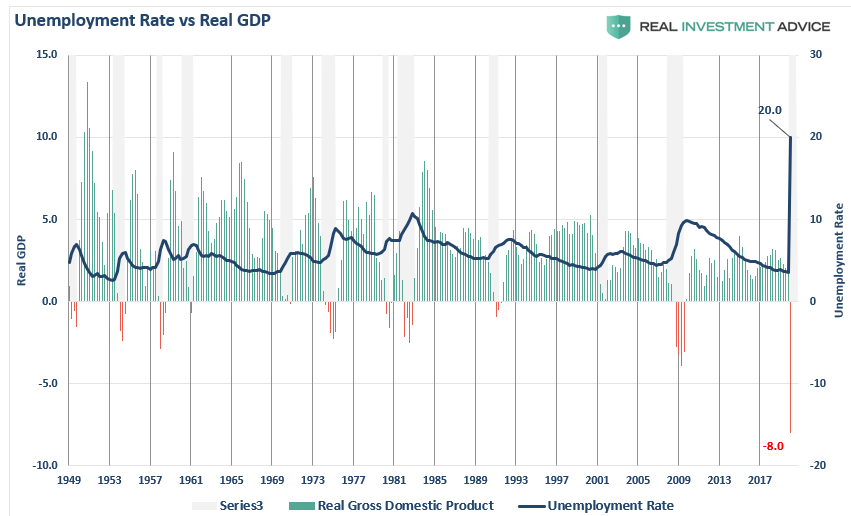

The importance is that unemployment rates in the U.S. are about to spike to levels not seen since the “Great Depression.” Based on the number of claims being filed, we can estimate that unemployment will jump to 20%, or more, over the next quarter as economic growth slides 8%, or more. (I am probably overly optimistic.)

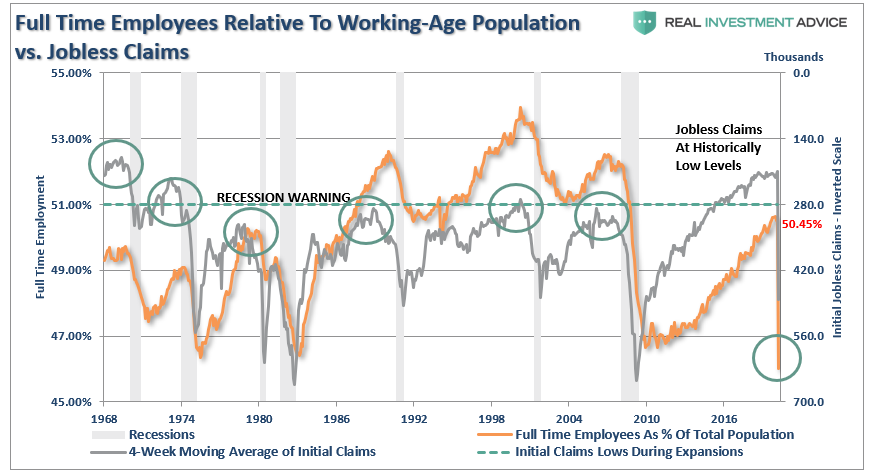

More importantly, since the economy is 70% driven by consumption, we can approximate the loss in full-time employment by the surge in claims. (As consumption slows, and the recession takes hold, more full-time employees will be terminated.)

This erosion will lead to a sharp deceleration in economic confidence. Confidence is the primary factor of consumptive behaviors, which is why the Federal Reserve acted so quickly to inject liquidity into the financial markets. While the Fed’s actions may prop up financial markets in the short-term, it does little to affect the most significant factor weighing on consumers – their job.

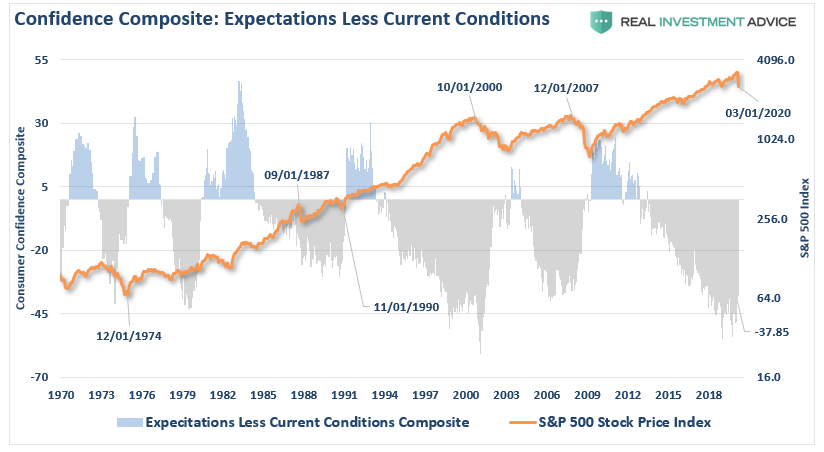

Another way to analyze confidence data is to look at the consumer expectations index minus the current situation index in the consumer confidence report.

This measure also says a recession is here. The differential between expectations and the current situation, as you can see below, is worse than the last cycle, and only slightly higher than prior to the “dot.com” crash. Recessions start after this indicator bottoms, which has already occurred.

Importantly, bear markets end when the negative deviation reverses back to positive. Currently, we have only just started that reversion process.

While the virus was “the catalyst,” we have discussed previously that a reversion in employment, and a recessionary onset, was inevitable. To wit:

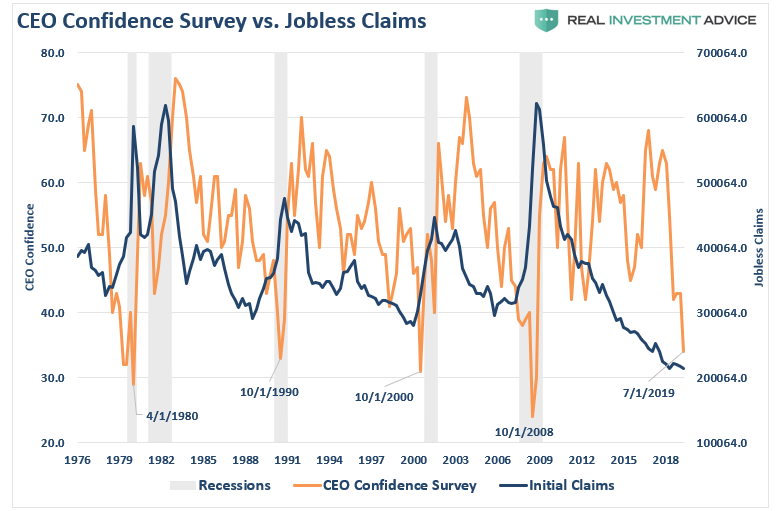

“Notice that CEO confidence leads consumer confidence by a wide margin. This lures bullish investors, and the media, into believing that CEOs really don’t know what they are doing. Unfortunately, consumer confidence tends to crash as it catches up with what CEO’s were already telling them.

What were CEO’s telling consumers that crushed their confidence?

“I’m sorry, we think you are really great, but I have to let you go.”

Confidence was high because employment was high, and consumers operate in a microcosm of their own environment.

“[Who is a better measure of economic strength?] Is it the consumer cranking out work hours, raising a family and trying to make ends meet? Or the CEO of a company who is watching sales, prices, managing inventory, dealing with collections, paying bills, and managing changes to the economic landscape on a daily basis? A quick look at history shows this level of disparity (between consumer and CEO confidence) is not unusual. It happens every time prior to the onset of a recession.