Forex News and Events

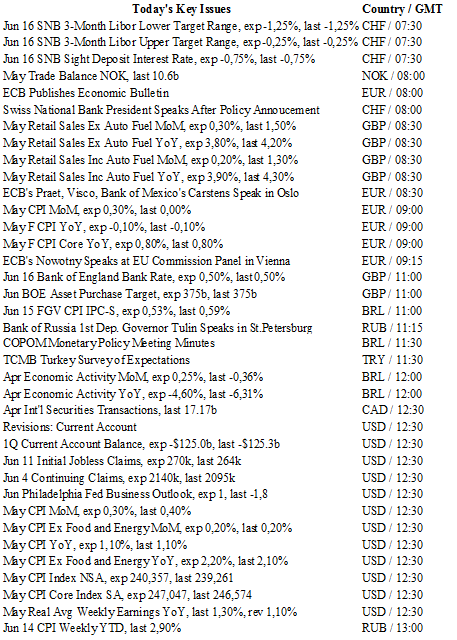

Unsurprisingly SNB keeps rate unchanged

Ahead of the Brexit and a day after the FOMC meeting which has seen the US rates being unchanged as widely expected by financial markets, the SNB announced its deposit rate decision. The Swiss institution has decided to keep it on hold at -0.75%. It is clear that the SNB is waiting for the Brexit Referendum result before to do any more action. It cannot disrupt the stability of the country as Switzerland is way too small toq be a leader in the monetary policy. It cannot drive financial markets. It can only be reactive to what is happening globally. Domestically the situation is still manageable. Indeed the Swiss inflation is slightly picking with the last four monthly figures printed positive, last May data showed a slight increase at 0.1% m/m. Nonetheless consumer spending remains fragile.

The main and widely tools used by the SNB is the verbal intervention. Over the past few years, the central bank has a history of intervening out of usual SNB meeting and its intervention are likely surprised in order to be as efficient as possible. This is why the SNB is not admitting that it is doing FX intervention even though the SNB balance sheet is expanding significantly. On top of that deeper negative rates are clearly not off the table.

If a Brexit leave vote wins, the inflow of money which is already very important towards the CHF will continue growing. At the moment, the EUR/CHF is getting weaker and is trading around 1.0800 for the first time in the last six months.

Cautious Fed lowers rate path

The Fed released its interest rate decision yesterday evening. The tone of the statement and the press conference were roughly in line with expectations, meaning that the Fed maintained its optimistic view on the US economic outlook, while referencing the weak jobs data for May and the Brexit situation as sources of risk. During the press conference, Fed chairwoman Yellen made clear that more positive signs are required before lifting rates, stating: “We do need to make sure that there's sufficient momentum”.

The Fed also updated its forecast, with growth projections being revised lower to 2% in 2016 from 2.2% at the March meeting. The unemployment rate is still expected to stay at 4.7% by year-end, while inflation forecasts were revised lower. Personal expenditure is expected to reach 1.4% by the end of 2016, while the Fed’s preferred measure of inflation, the core PCE, is expected to reach 1.7% this year compared to 1.6% at the March meeting.

Looking at the dots, only two Fed members are expecting more than two rate hikes compared to seven in March. Even though the median forecast is still on two hikes for this year, most members lowered their projections for this year as they realised that economic conditions do not allow an aggressive path. We maintain our bearish view that the Fed will not be able to lift rates more than once this year and this is our more optimistic scenario.

Gold - 18-Month High

The Risk Today

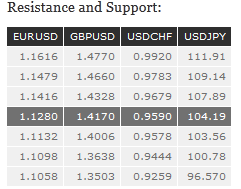

EUR/USD is now moving sideways. Hourly resistance can be found at 1.1303 (13/06/2016 high) while hourly support can be found at 1.1189 (14/06/2016 low). Expected to further weaken. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is trading mixed Resistance is given at 1.4328 (13/06/2016 high) and stronger one is located at 1.4660 (07/06/2016 high). The pair is heading towards support at 1.4006 (06/04/2016 low). Expected to confirm deeper selling pressures. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY's selling pressures continue. Supports at 106.25 (04/05/2016 low) and at 105.55 (03/05/2016 low) have been broken while hourly resistance is given at 107.89 (07/06/2016 high). The medium term momentum is clearly oriented downwards. Expected to further weaken. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) has been broken. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Expected to monitor support at 103.56 (03/02/2014).

USD/CHF is weakening below hourly resistance at 0.9679 (13/06/2016 high). Support at 0.9578 (09/06/2016 low) has been broken. Expected to show a continued bearish move. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.