For all the market worries about a UK housing bubble and US financial stability, the only market shock yesterday was the MIA Central Bank 'hawk.' Despite expressing "surprise" that the market had not been pricing in higher rates for 2014, the BoE's MPC minutes revealed that board members had voted unanimously (9-0) to keep benchmark lending rates unchanged.

For the Fed chair, Yellen, and her crew, only two things ended up mattering, whether it was intentional or not – first, yesterday's FOMC meet delivered a sharp downgrade to 2014 US GDP (+2.8%-2.1%), and second, Ms. Yellen's comments about the equity market being "fairly valued" and policy not being shaped by financial stability concerns. In truth, Wednesday's outcome was hardly the "hawkish" tilt that many had been expecting, especially in the wake of stronger data like US employment and inflation. By day's end and in translation – markets are to adhere to 'lower rates for longer' and this despite record high asset prices and improving economic data.

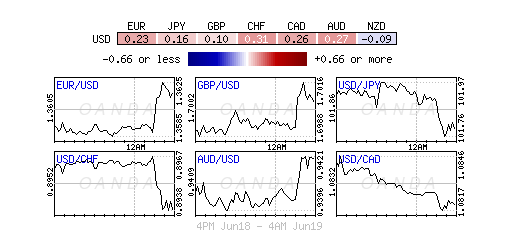

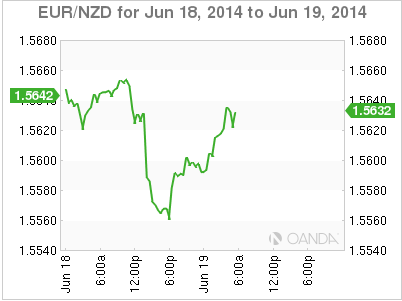

A major implication for the "steady as she goes" Fed policy is the theme of subdued US yields and the various asset classes' ultra low volatility looking unlikely to change in the near term. With the Fed disappointing investors by not shifting to a 'tighter monetary policy', it has led to business "as usual," again supporting the "carry trade" currencies. The market should expect developed currencies like the kiwi and Aussie to continue to benefit, while in the EM pairs category, both the ZAR and TRY should be coveted.

Yesterday's actual FOMC policy statement contained few surprises, maintaining its -$10b/month pace of taper, giving partial acknowledgement of "further improvement" in the US labor market and a rebound in fixed investment. Despite the much higher CPI data on Tuesday, FOMC members repeated that inflation is running below the longer-run objective, deferring to the release of its preferred PCE (Personal Consumption Expenditures) measure. Most importantly, FOMC staff projections cut 2014 GDP to +2.2% midpoint from +2.9% due to a softer Q1, and affirmed growth numbers for 2015 and 2016. Unemployment targets for 2014 and 2015 were also lowered slightly but PCE projections were maintained for the next three-years.

In hindsight, the Fed's rate path forecast were also little changed, despite the better than expected run of employment and higher inflation data - vast majority of the policy members see the Fed Funds rate no higher than +1.25% in 2015. During the post press conference, Ms. Yellen stuck to her script and in the level of transparency, she delivered a "measured press conference" stating that there is no mechanical formula for what is "considerable time" between the end of taper and the first rate hike. In effect, Yellen was able to avoid the pothole trap of last time when "quantifying the lag as a six- month period."

What do you give a market that has everything? You give them more of the same. Global equity bourses continue to eek out record highs on 'cheaper' cash. Global bond yield will remain under pressure, flattening many G10 yield curves.

Lower US yields do not make owning US dollars that exciting, but it does support commodity prices somewhat (Gold through key resistance $1,282oz). The mighty dollar is taking it on the chin as investors head stateside.

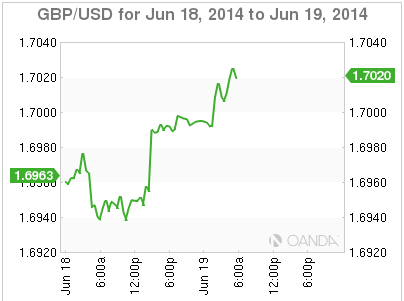

Sterling has managed to hit a fresh five-year high, rising above £1.7020 (highest level since July 2009). The key resistance in the pair remains at £1.7030-50. The USD/JPY continues to hover below the psychological ¥102 handle, despite improved market risk appetite. The less-hawkish-than-expected Fed statement has driven one-month volatility to a record low at less than 5%.

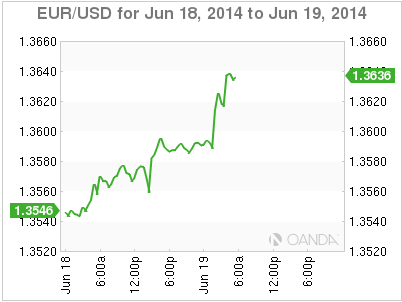

Today's disappointingly weaker UK retail sales report spurs further squeezes of this week's main EUR/GBP shorts. May UK retail sales fell -0.5%, while April was also revised down -0.3%. Yesterday's initial EUR/GBP squeeze higher was being supported by the MPC 9-0 bank rate vote. Owning the pound was in vogue on the back of a surprisingly hawkish Carney at the UK mansion house last week. However, this higher EUR cross is managing to drag the EUR outright higher (€1.3632). The EUR/GBP first line of resistance is €0.8033 while EUR outright is €1.3645-50.

The market should expect more of the same, with a few surprises thrown in- just likeWorld Cup results!