Today’s AM fix was USD 1,568.50, EUR 1,189.34 and GBP 1,030.96 per ounce.

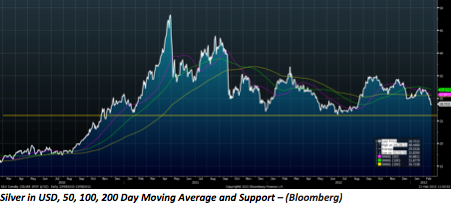

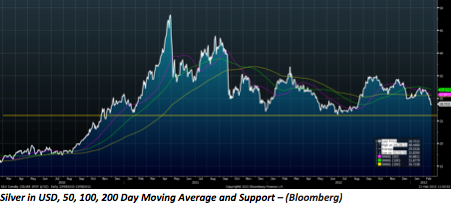

Yesterday’s AM fix was USD 1,602.00, EUR 1,195.34 and GBP 1,045.76 per ounce. Gold fell $40.30 or 2.51% yesterday in New York and closed at $1,564.30/oz. Silver slipped to a low of $28.28 and finished with a loss of 2.99%.

More speculative gold buyers appear to have been spooked by the FOMC minutes from the Fed’s January 30 meeting, which said, the central bank should be ready to vary the pace of their $85 billion in monthly bond purchases amid a debate over the risks and benefits of further quantitative easing.

Gold rebounded this morning from a seven-month low as physical buyers in Asia bought the dip and it is likely that central banks are also accumulating after this sharp correction.

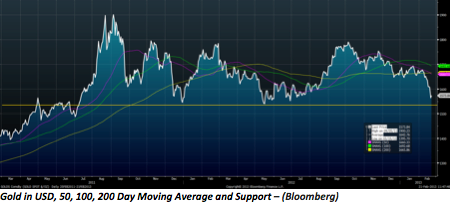

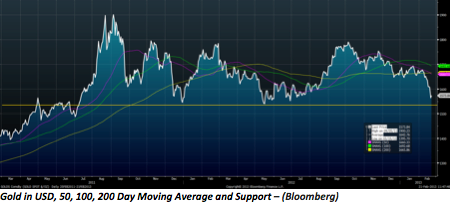

The RSI or relative strength index is near 20, which suggests that spot gold is deeply oversold and strong support is seen at the $1,500/oz level (see chart below).

Other indices like the S&P 500 index has climbed 6% year to date while gold has fallen 6% during the same period. The largest ETF, SPDR Gold Trust, has fell 1.57% from the prior session to 1,299.164 tonnes on Feb. 20, its lowest in over five months.

Gold has come under pressure from heavy liquidation by hedge funds and banks on the COMEX this week. The unusual and often 'not for profit' nature of the selling, at the same time every day this week, has again led to suspicions of market manipulation.

Short sellers, technical and momentum traders have the upper hand and are pressing their advantage with momentum and sentiment on their side. Nervous longs are being stopped out through stop loss orders and concerns regarding the clear downward short term trend.

Gold-market sentiment is the most negative that we have seen in recent years. The ratio of sell orders to buy orders was the highest it has ever been in recent days. Yesterday, for the first time ever we had all sell orders for gold and silver coins, bars and certificates and not one buy order.

This shows that many retail buyers are very nervous about the outlook for gold and concerned about the risk of further price falls.

There has been more selling from retail clients today and we are getting a sense of fear from clients that they have not had in the last ten years. Interestingly, long term buyers of gold and silver bullion, particularly high net worth individuals were evident this morning and flows from this demographic look set to continue.

Fear in the gold market and retail buyers selling their gold suggest that we are very likely to close to a bottom. Still it is important to always remember the old Wall Street adage to "never catch a falling knife."

More risk adverse buyers would be prudent to hold off buying the dip until we get a higher weekly or even monthly close. Alternatively, they should consider dollar, pound or euro cost averaging into a position at these levels.

Gold’s ‘plunge’ is now headline news which is bullish from a contrarian perspective. As is the fact that many of the same people who have been claiming gold is a bubble since it was $1,000/oz have again been covering gold after periods of silence.

Gold’s so called ‘death cross’ scare is simplistic, bogus nonsense that should be ignored by all. Gold experienced a ‘death cross’ in April 2012 (see gold chart above) and similar alarmist analysis was put forward about the death of the gold bull market and the likelihood of a 1980 style plunge.

This did not come to pass, nor will it come to pass now given the real world fundamentals driving the gold market.

Single technical indicators in and of themselves are completely useless. It is far more important to focus on the real fundamentals of a European and coming UK, U.S. and Japanese debt crises’, global currency wars and the real risk of recessions and a Depression.

It is far more important to focus on the hard facts and the hard data on money supply growth rather than mere words of central bankers. Currencies globally continue to be debased.

Less informed money is again selling gold or proclaiming the end of gold’s bull market. The smart money such as Marc Faber, Jim Rogers and those who predicted this crisis and have constantly advocated a long term allocation to gold bullion to hedge systemic and monetary risk, will accumulate again on this dip.

Yesterday’s AM fix was USD 1,602.00, EUR 1,195.34 and GBP 1,045.76 per ounce. Gold fell $40.30 or 2.51% yesterday in New York and closed at $1,564.30/oz. Silver slipped to a low of $28.28 and finished with a loss of 2.99%.

More speculative gold buyers appear to have been spooked by the FOMC minutes from the Fed’s January 30 meeting, which said, the central bank should be ready to vary the pace of their $85 billion in monthly bond purchases amid a debate over the risks and benefits of further quantitative easing.

Gold rebounded this morning from a seven-month low as physical buyers in Asia bought the dip and it is likely that central banks are also accumulating after this sharp correction.

The RSI or relative strength index is near 20, which suggests that spot gold is deeply oversold and strong support is seen at the $1,500/oz level (see chart below).

Other indices like the S&P 500 index has climbed 6% year to date while gold has fallen 6% during the same period. The largest ETF, SPDR Gold Trust, has fell 1.57% from the prior session to 1,299.164 tonnes on Feb. 20, its lowest in over five months.

Gold has come under pressure from heavy liquidation by hedge funds and banks on the COMEX this week. The unusual and often 'not for profit' nature of the selling, at the same time every day this week, has again led to suspicions of market manipulation.

Short sellers, technical and momentum traders have the upper hand and are pressing their advantage with momentum and sentiment on their side. Nervous longs are being stopped out through stop loss orders and concerns regarding the clear downward short term trend.

Gold-market sentiment is the most negative that we have seen in recent years. The ratio of sell orders to buy orders was the highest it has ever been in recent days. Yesterday, for the first time ever we had all sell orders for gold and silver coins, bars and certificates and not one buy order.

This shows that many retail buyers are very nervous about the outlook for gold and concerned about the risk of further price falls.

There has been more selling from retail clients today and we are getting a sense of fear from clients that they have not had in the last ten years. Interestingly, long term buyers of gold and silver bullion, particularly high net worth individuals were evident this morning and flows from this demographic look set to continue.

Fear in the gold market and retail buyers selling their gold suggest that we are very likely to close to a bottom. Still it is important to always remember the old Wall Street adage to "never catch a falling knife."

More risk adverse buyers would be prudent to hold off buying the dip until we get a higher weekly or even monthly close. Alternatively, they should consider dollar, pound or euro cost averaging into a position at these levels.

Gold’s ‘plunge’ is now headline news which is bullish from a contrarian perspective. As is the fact that many of the same people who have been claiming gold is a bubble since it was $1,000/oz have again been covering gold after periods of silence.

Gold’s so called ‘death cross’ scare is simplistic, bogus nonsense that should be ignored by all. Gold experienced a ‘death cross’ in April 2012 (see gold chart above) and similar alarmist analysis was put forward about the death of the gold bull market and the likelihood of a 1980 style plunge.

This did not come to pass, nor will it come to pass now given the real world fundamentals driving the gold market.

Single technical indicators in and of themselves are completely useless. It is far more important to focus on the real fundamentals of a European and coming UK, U.S. and Japanese debt crises’, global currency wars and the real risk of recessions and a Depression.

It is far more important to focus on the hard facts and the hard data on money supply growth rather than mere words of central bankers. Currencies globally continue to be debased.

Less informed money is again selling gold or proclaiming the end of gold’s bull market. The smart money such as Marc Faber, Jim Rogers and those who predicted this crisis and have constantly advocated a long term allocation to gold bullion to hedge systemic and monetary risk, will accumulate again on this dip.