The pound has proved to be one of the most reliable of short positions in the past number of months. Driving the prodigious fall from grace is an overwhelming and palpable fear over the economic health of the UK, especially as the Brexit referendum looms. Predictably, in the face of uncertainty and fear we can see the CHF come to the forefront to soak up the capital fleeing the UK.

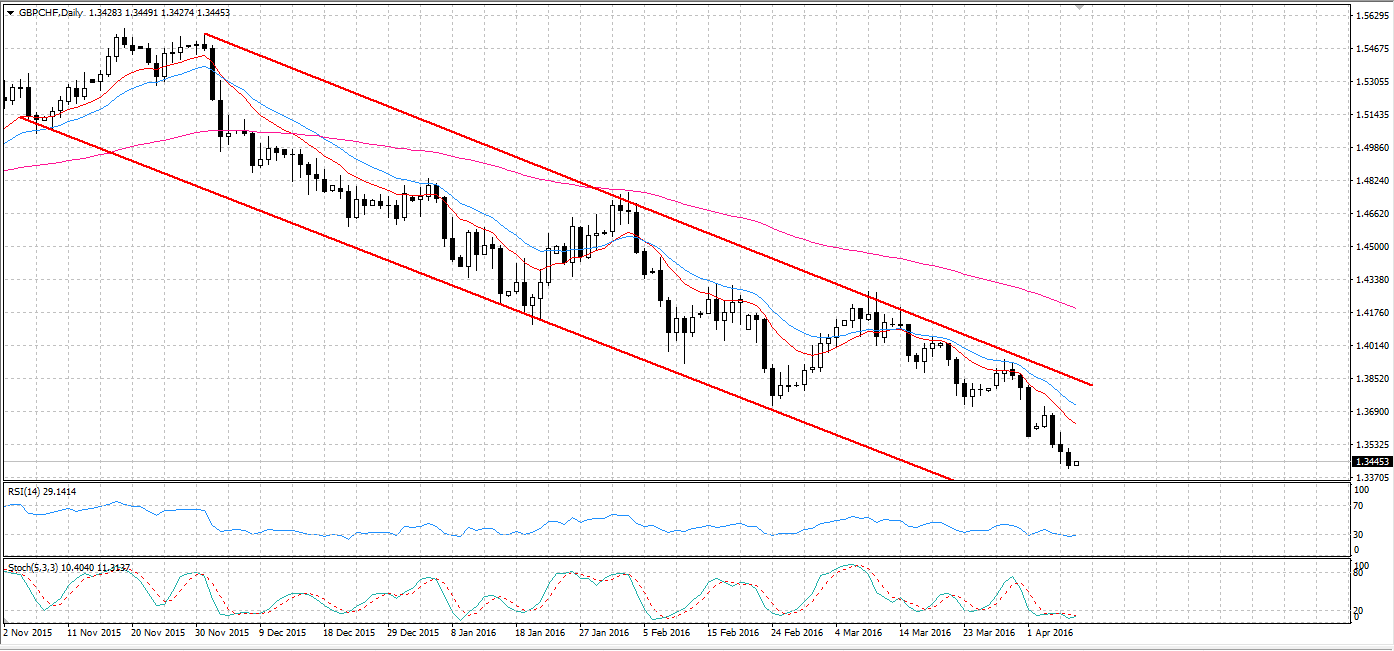

Firstly, it doesn’t take much imagination to visualise the bearish channel that has constrained the GBP/CHF over the past months. The pair has reliably moved between the constraints of the channel and ultimately looks to be unable to breakout. As a result, it comes as little surprise that the markets continue to funnel capital into the franc whilst the pattern is so clear. Subsequently, the bears barely stirred over the pair’s recent foray into oversold territory.

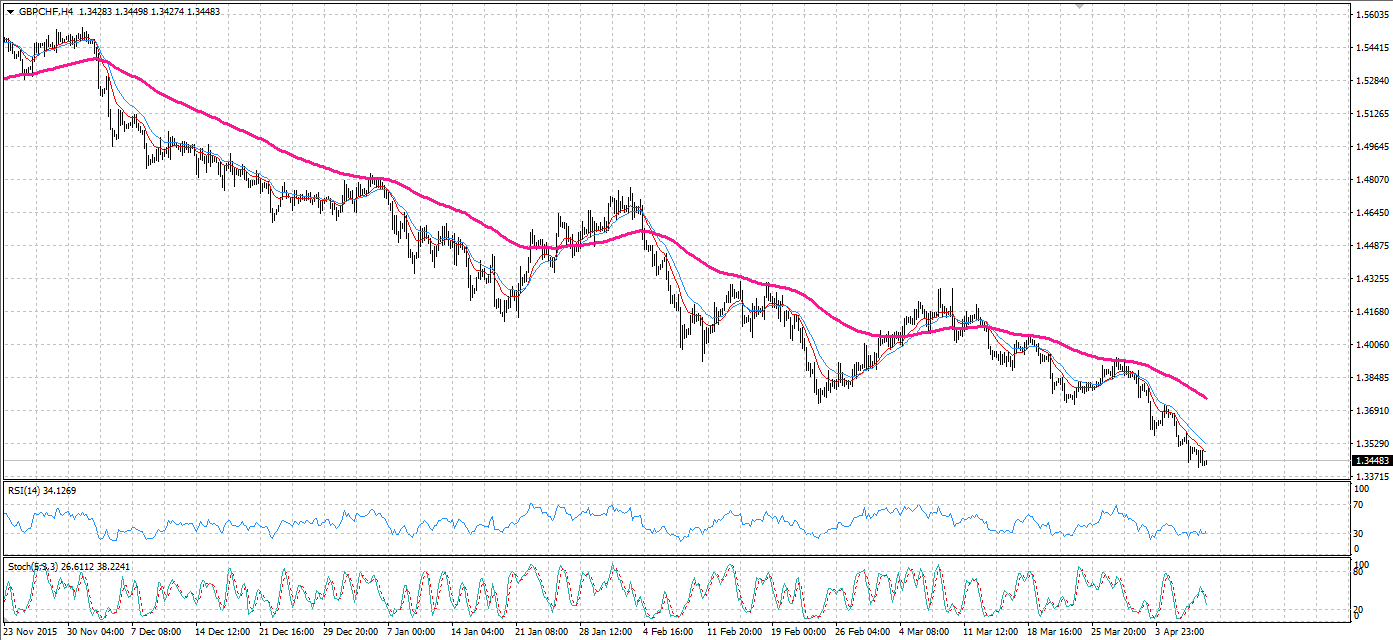

Furthermore, the channel constraints are not all that is providing firm resistance for the pair moving ahead. As seen in the H4 chart, the 100 period EMA is proving to be an excellent source of dynamic resistance as the pound continues to fall. As a result, even the RSI and Stochastic readings will likely only be able to move the pair back to the 100 period EMA before it has to turn back to test the downside of the channel.

Fundamentally, the pair is destined to fall as a result of the ongoing influence of sentiment trading. The impending Brexit referendum has already managed to drum up significant fear around the UK economy and its future moving forward. Additionally, the near constant stream of poor indicator results being posted by the UK scarcely requires the fear of the Brexit to cause the markets to shy away from the pound.

If the combination of the Brexit referendum and the sickly UK economy wasn’t enough to drive the pair lower, the jawboning by Lagarde should really be putting the thumb screws on the pound now. As revealed by her recent statement, the head of the IMF listed the UK referendum as one of the key threats to global economic recovery. Consequentially, the traditional safe haven of the CHF has become a consistent beneficiary of the embattled pound and could see more gains moving forward. Whether pushing the pound lower is Lagarde’s intent, is certainly appears to be a potential outcome.

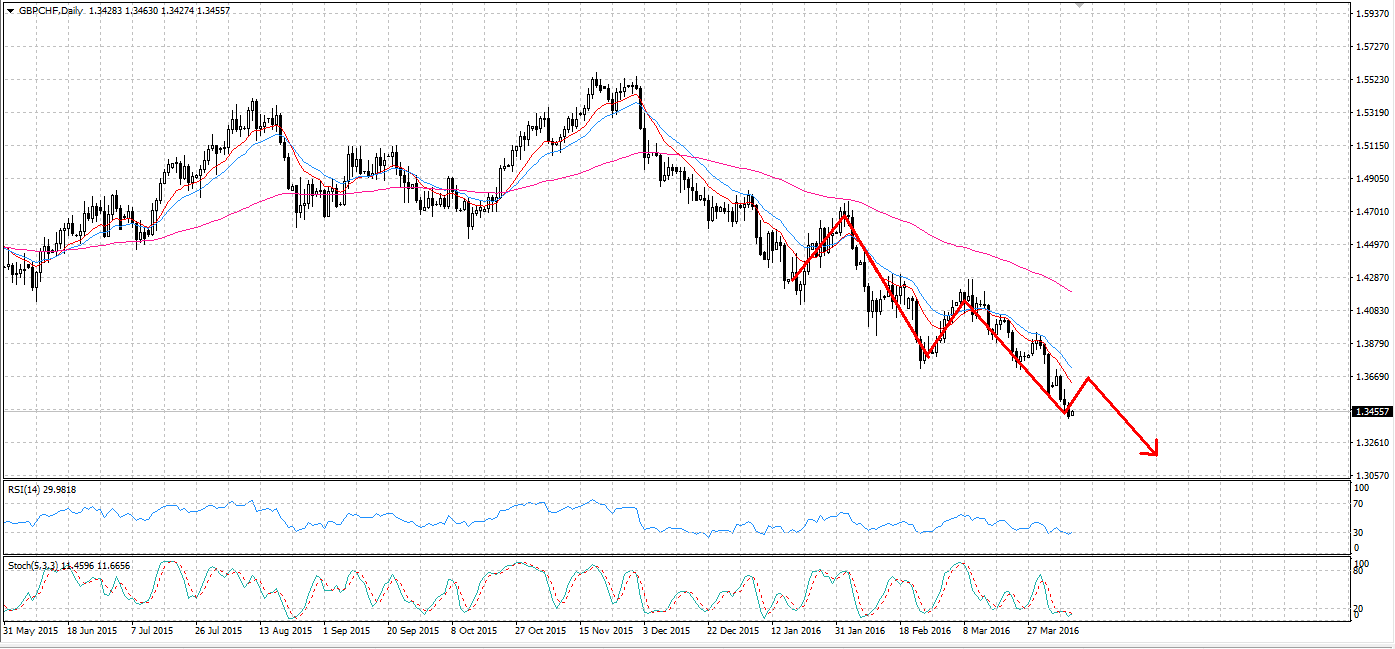

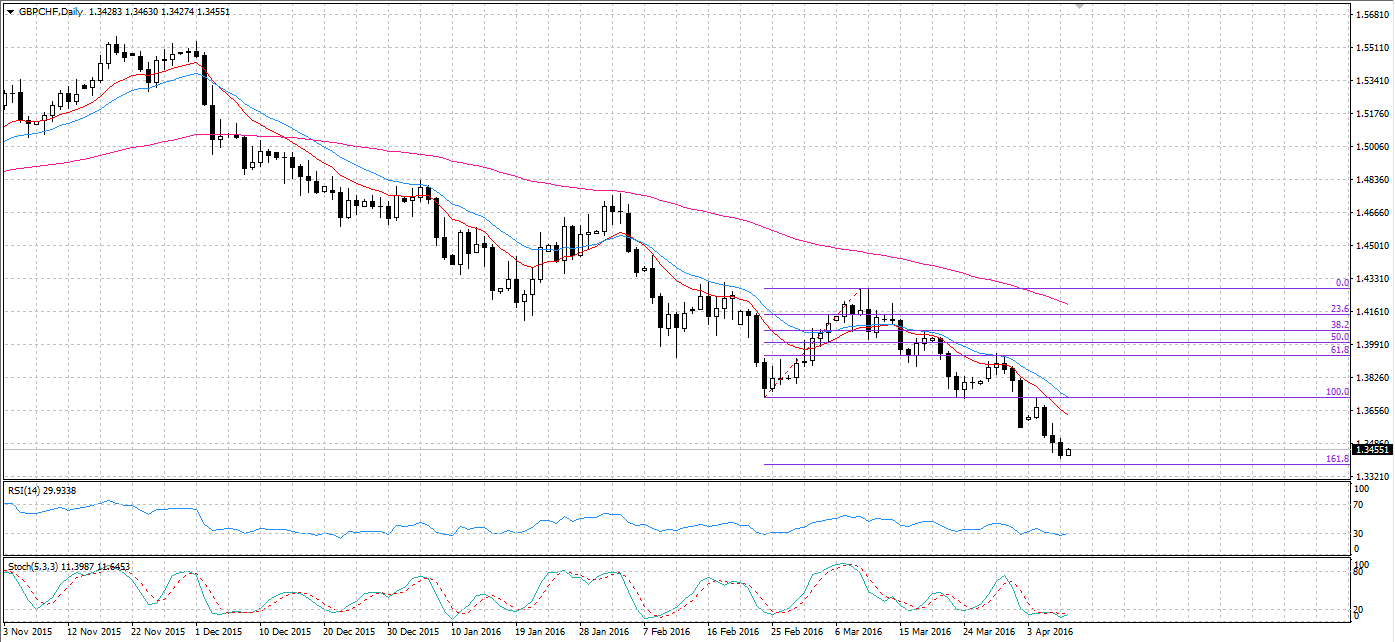

Going forward, it wouldn’t be surprising to see a completion of an impulse wave pattern in the coming weeks. Specifically, the current move towards the upper channel constraint could be a retracement before the next leg of the pattern. As it completes, the pattern should pull back to around the 100.00% or possibly the 61.8% retracement levels before making the move to break support at 1.3450. Ultimately, the downside of the channel will stall the tumble and force a corrective movement.

In the end, the GBP/CHF is a pair likely to see more and more bottoms being tested as the bears capitalise on sentiment. As a result, the bearish channel is likely to remain intact unless some major improvement occurs in the UK economy. Furthermore, comments from the likes of Lagarde will continue to suppress the upside potential of this pair and reinforce the downwards momentum.

by Matthew Ashley