Gilead Sciences, Inc. (NASDAQ:GILD) received a major boost when the FDA approved the company’s once-daily single tablet regimen (“STR”), Biktarvy (bictegravir 50mg/emtricitabine 200mg/tenofovir alafenamide 25mg, BIC/FTC/TAF) for HIV-1 infection.

The approval, which comes ahead of the PDUFA date of Feb 12, 2018, provides a major boost to Gilead’s HIV franchise.

Though the company topped both earnings and revenue estimates in the fourth quarter, the magnitude of the decline in HCV sales was wider-than-expected. The HCV franchise has been under pressure for a while due to lower patient starts and increased competition form AbbVie’s (NYSE:ABBV) .

The company’s guidance for 2018 also lacks lustre and we expect sales of the same to decline further.

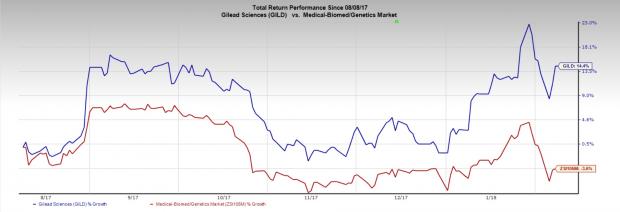

Amid such a scenario, the approval of this latest triple HIV therapy is likely to provide an impetus to the stock as Gilead is now banking on its HIV franchise and newer avenues like the CAR-T therapy post the Kite acquisition and promising NASH candidates for growth. Following the news of the approval, shares of the company moved up 3.8%. Gilead’s stock has gained 14.4% in the last six months as against the industry's decline of 3.6%.

Biktarvy, Gilead’s latest triple therapy, is approved as a complete regimen for the treatment of HIV-1 infection in adults who have no antiretroviral treatment history or to replace the current antiretroviral regimen in those who are virologically suppressed (HIV-1 RNA

Meanwhile, the HIV franchise continues to gain traction on the back of rapid adoption of TAF-based regimens in the United States and EU. The TAF-based regimens now represent 62% of total Gilead HIV prescription volume following the launch of Genvoya along with Odefsey and Descovy in 2016.

Biktarvy combines the novel, unboosted integrase strand transfer inhibitor (“INSTI”) bictegravir, with the demonstrated safety and efficacy profile of the Descovy, (FTC/TAF) dual nucleoside reverse transcriptase inhibitor (“NRTI”) backbone, and is the smallest INSTI-based triple-therapy STR available.

The approval of Biktarvy was supported by encouraging data from four ongoing studies: Studies 1489 and 1490 in treatment-naïve HIV-1 infected adults, and Studies 1844 and 1878 in virologically suppressed adults. Biktarvy met its primary objective of non-inferiority at 48 weeks across all four studies.

However, Biktarvy has a Boxed Warning in its product label regarding the risk of post treatment acute exacerbation of hepatitis B.

The approval of this new HIV therapy will pose stiff competition to GlaxoSmith’s (NYSE:GSK) existing therapies, Tivicay and Triumeq.

On the other hand, per a report from Reuters, ViiV Healthcare, a joint venture majority-owned by GlaxoSmith with Pfizer (NYSE:PFE) and Shionogi Ltd has filed a lawsuit against Gilead alleging patent infringement on ViiV's dolutegravir, a component of the venture's triple-drug HIV treatment Triumeq.

Zacks Rank

Gilead currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think.

See This Ticker Free >>

Pfizer, Inc. (PFE): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Original post